"This is setting up to be one of the most uncertain Spring markets in the last decade. Of the limited new projects coming online, the ones attracting buyer attention are sharp on price and positioning. Given today’s landscape, existing projects that have started construction will outperform new launches as they can be more flexible on negotiations and have the benefit of being in the ground.” - Garde MacDonald, Director of Advisory

SLOW BLOOM FOR THE SPRING MARKET

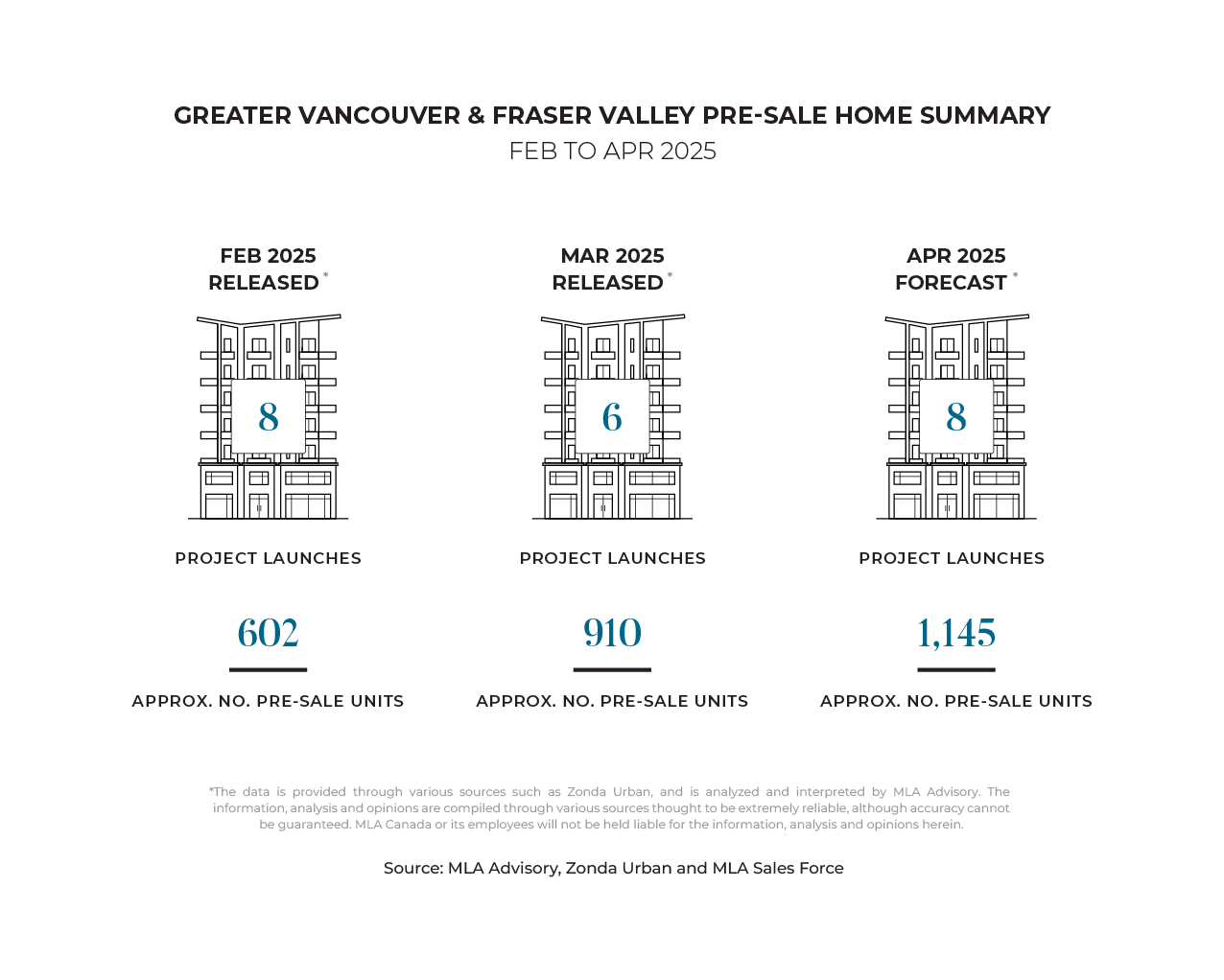

The Spring market got off to a slower than usual start in terms of new projects to enter the market. In March, six projects launched, introducing 910 new units. This is below the five-year average of 10 launches and over 1,300 units for the month. Year-over-year, project launches are down by nearly 50%, and total unit volume is 60% of last March's levels. While many developers had initially planned to bring delayed 2024 projects to market in early 2025, ongoing uncertainty in market conditions is prompting further delays.

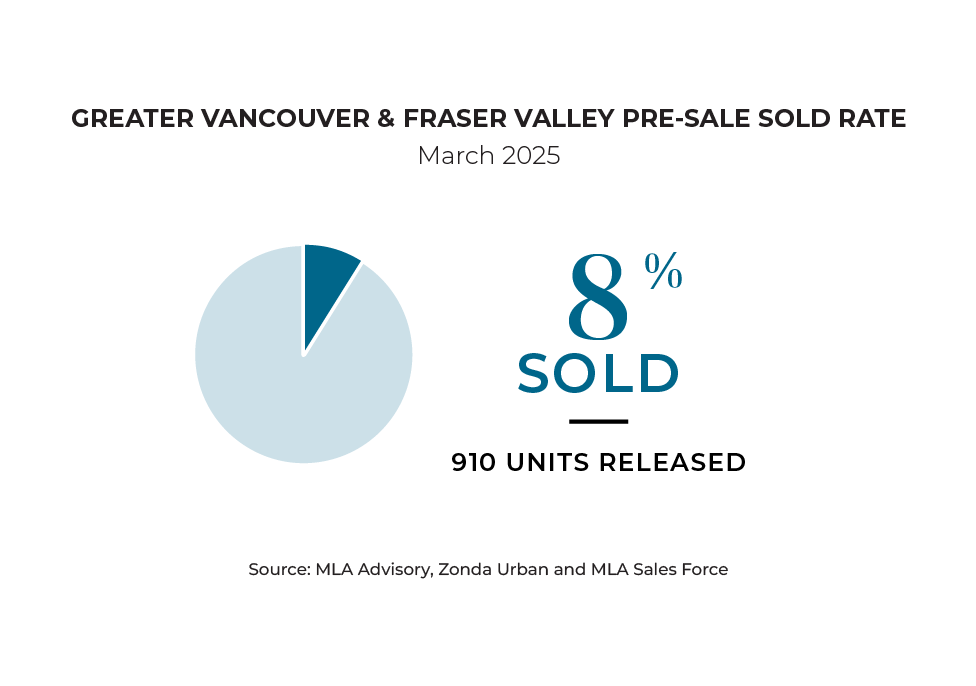

While fewer projects entering the market in March, it’s the decline in same-month absorption that is largely causing developers to hold back on new launches. Of the 910 units released in March, only about 8% sold within the month, well below the 27% seen in March 2024 and the five-year average of approximately 41%. Typically, a period of growing momentum, this spring has seen buyers hesitate, influenced not only by ongoing discussions around tariffs but also by the uncertainty surrounding the upcoming federal election at the end of April.

CONSUMER CONFIDENCE COOLS

Inflation rose to 2.6% in February, up from 1.9% in January – the first time it’s exceeded 2% since October. This increase came despite the GST holiday tax break still being in place for part of the month; without it, inflation would’ve been closer to 3%. While GDP grew by 0.4% in January, some of that may be temporary, driven by exporters rushing goods to the U.S. ahead of March tariffs and boosted consumer demand. Early estimates suggest flat growth for February, raising concerns about economic momentum.

At the same time, consumer confidence fell to a record low in March, with nearly 34% of Canadians expecting their financial situation to worsen—the highest level of pessimism since 2020. The uncertainty surrounding tariffs and the potential for job losses (estimated at 160,000 in Q2) are major factors. Despite interest rates beginning to ease, confidence hasn’t recovered since it started declining in March 2022, largely due to ongoing economic volatility, which continues to impact consumer spending.

DEALS IN THE DOWNTIME

TIn April, launch activity is expected to persist similar to March, with eight projects anticipated to come to market, releasing approximately 1,145 units. The higher number of released units is largely driven by the inclusion of a concrete high-rise in Burnaby and several townhome projects, each contributing around 100 units. Notably, townhomes account for half of the upcoming launches. This aligns with current buyer trends, as end users continue to drive demand in the presale market. Townhome offerings remain attractive due to their quicker completion timelines aligning with declining interest rates, and the competitive incentives currently being offered by developers.

The spring resale market also got off to a slow start, with Metro Vancouver recording 2,091 sales, down 13% from last year and 37% below the 10-year average. Similarly, the Fraser Valley saw 1,036 sales, nearly 50% below the historic average. Inventory levels continue to rise, with Metro Vancouver up 38% from March 2024 to 14,546 active listings, and the Fraser Valley reaching a decade-high of 9,219 listings, nearly 60% above the seasonal average. Despite ongoing economic and political uncertainties, both regions offer buyers prime opportunities not seen in recent years, including a large selection of inventory to choose from, the ability to secure a favourable deal, and the advantage of reduced mortgage rates.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, presale, and resale market video report, Presale Pulse.

Subscribe to the MLA Canada YouTube Channel or find the Pre-Sale Pulse on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio.