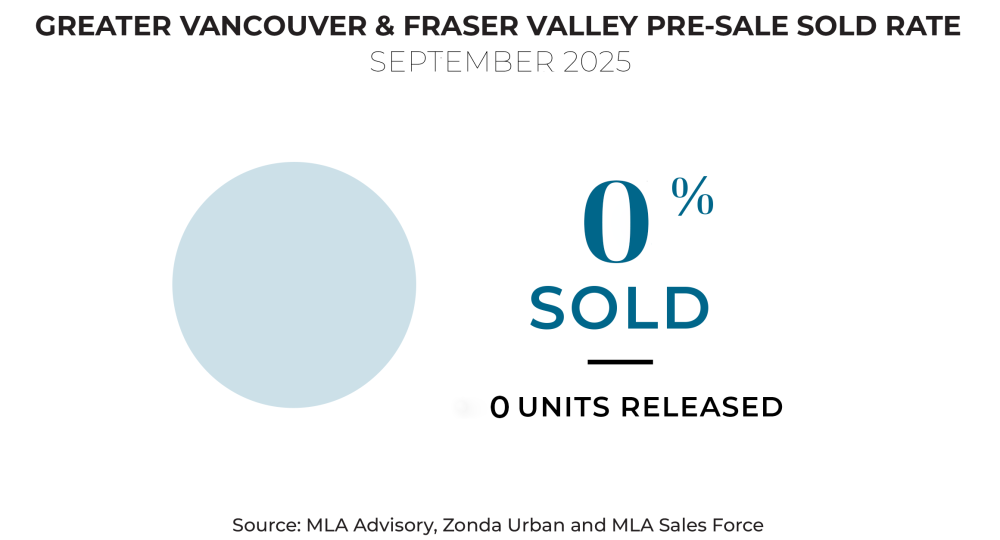

“September saw zero new launches as upcoming projects took the time for extended previews to garner interest and adjust pricing. The 0.25% rate cut we saw in September has yet to spur a noticeable change in buyer habits across tempo sites. We anticipate a busier presale market in October, with a variety of new projects coming online, across multiple geographies and product types.” — Garde MacDonald, Director of Advisory, MLA Canada

Silent September

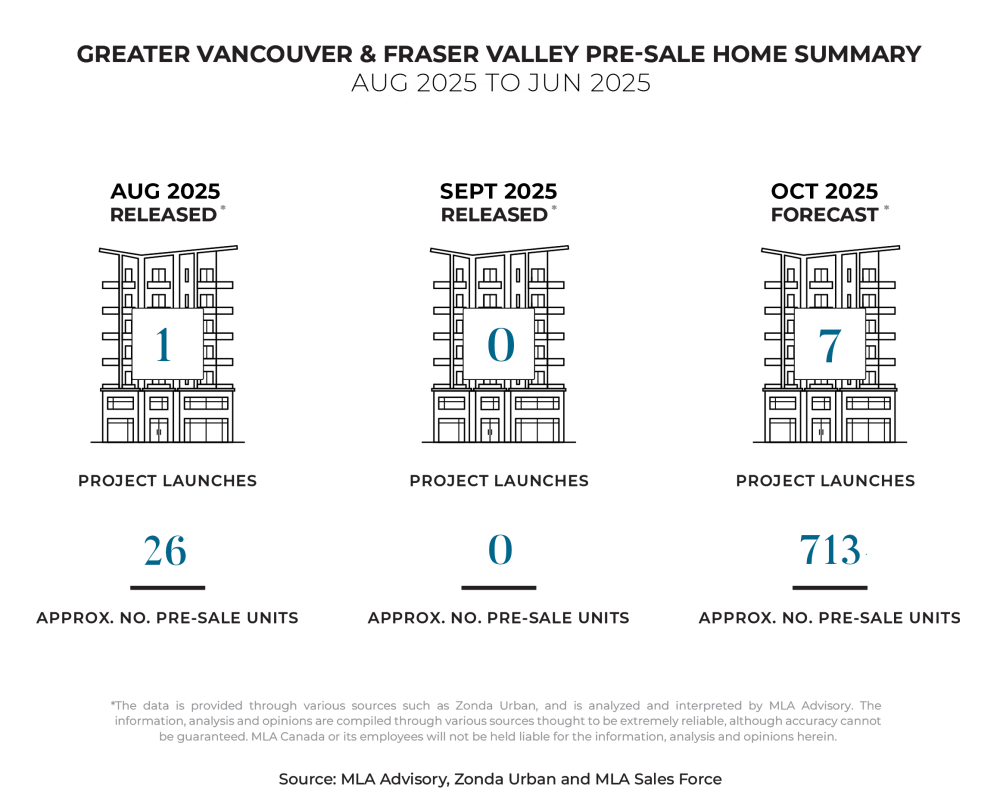

September mirrored August with no new project launches, a break from the five-year average of eight projects and 350 sales. The one anticipated launch delayed sales to October. Despite a 25-basis-point rate cut, presale demand remains muted as affordability pressures, weak confidence, and income concerns keep buyers sidelined. Developers are holding launches, refining product strategies, and pushing some projects into 2025.

Canada Avoids Recession, But Confidence Continues To Slip

The Bank of Canada cut rates from 2.75% to 2.5%, reflecting ongoing economic concerns. GDP showed 0.2% growth in July but flat forecasts for August, leaving Q3 growth at just 0.5%—an improvement over Q2’s contraction but still weak. Consumer confidence continues to decline. Unemployment rose to 7.1%, the highest in nearly a decade outside the pandemic, with core working-age Canadians hardest hit. Participation rates have fallen, and businesses remain cautious, limiting job growth.

Haunted By Hesitation

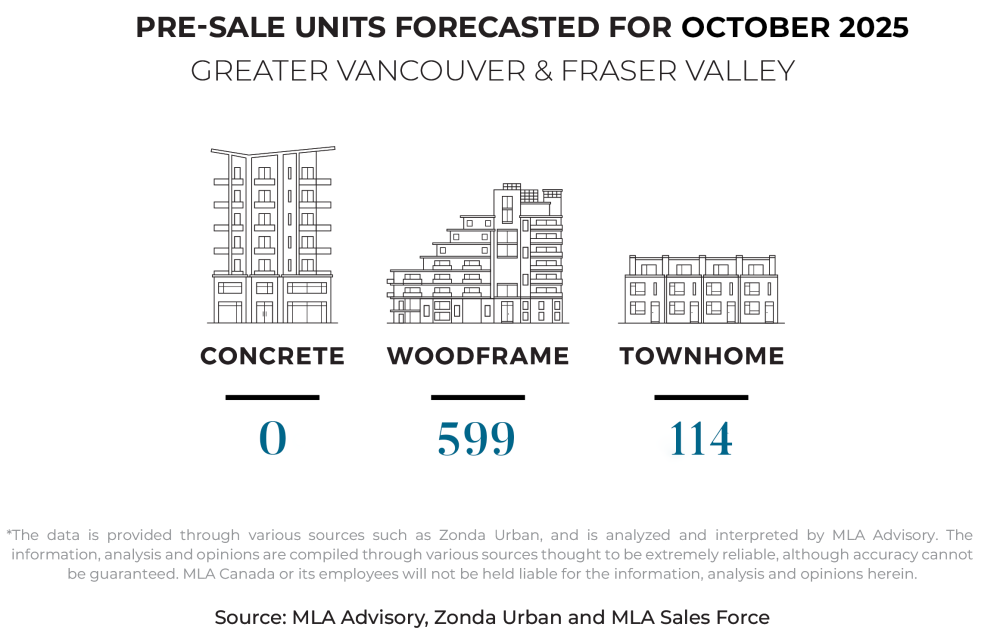

October is expected to bring more activity with seven projects and 713 units—mainly wood frame and townhomes, with no concrete high-rises. Greater Vancouver will see the majority of launches. Developers are extending previews and timelines to test demand. September resale activity remained soft: Greater Vancouver saw 1,875 sales and the Fraser Valley 962, both within 5% of last year but still 20–28% below long-term averages. Inventory climbed to decade-high levels, driving both regions firmly into buyer’s market territory. Prices are down year-over-year by 3.2% in Greater Vancouver and 5.4% in the Fraser Valley.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, presale, and resale market video report in the October edition of the Presale Pulse.