“We are starting the year with sluggish activity across both presale and resale markets. Elevated inventory and measured buyer behaviour are reinforcing purchaser negotiating power, though overall market sentiment remains soft. On the rental side, January completions were light, but supply is expected to build through February and March. Even so, absorption remains healthy when projects are priced appropriately for today’s competitive landscape.” — Melissa Nestoruk, Product Development Specialist, MLA Canada

MARKET INSIGHTS - FEBRUARY 2026

The year has begun with measured activity across presale, rental, and resale markets. While the winter season typically brings a slowdown, current conditions reflect broader caution from both buyers and developers. Elevated inventory and ongoing affordability pressures continue to shape behaviour, with purchasers taking their time and prioritizing value. Across all asset classes, engagement remains selective rather than absent. Well-positioned projects are still finding traction, but momentum is far from broad-based. Market sentiment remains steady yet subdued as participants wait for clearer economic direction.

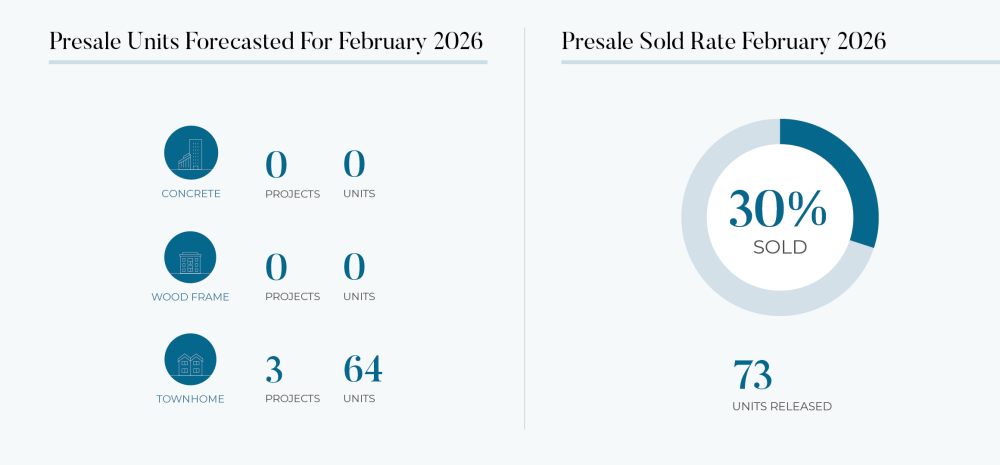

PRESALE SUMMARY

Presale activity remains below historical norms, with developers continuing to exercise restraint. Launch timing, unit mix, and pricing strategies are being carefully evaluated before projects move forward. Higher-density product remains limited, while townhome and family-oriented offerings continue to see relatively stronger interest. Buyers are highly discerning, focusing on location, livability, and long-term value. When pricing aligns with expectations and the product meets practical needs, absorption can still be healthy. However, overall activity reflects a market that is cautious rather than accelerating.

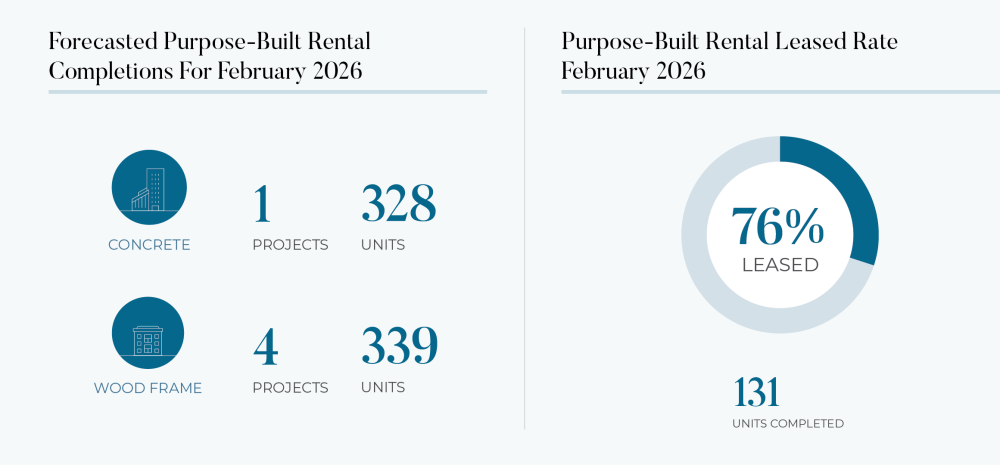

PURPOSE-BUILT RENTAL SUMMARY

Rental supply is beginning to build after a lighter start to the year, though tenant leverage remains evident. Renters are actively comparing projects, weighing incentives, amenities, and total monthly costs before committing. Leasing performance continues to depend heavily on competitive positioning. Projects that are priced appropriately for today’s environment are achieving steady absorption, while others are adjusting through incentives and extended pre-leasing periods. The rental landscape remains active but highly competitive.

RESALE SUMMARY

Resale markets across Greater Vancouver and the Fraser Valley continue to reflect cautious buyer sentiment. Sales activity remains below long-term averages, while inventory levels sit above typical historical ranges. This imbalance is reinforcing negotiating power for purchasers. Sellers remain motivated, but competition is increasing as listings accumulate. Pricing has softened modestly in some areas, though broader stability persists. Overall, the resale market mirrors presale conditions: measured activity, elevated choice, and buyers moving carefully rather than quickly.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, presale, rental and resale market video report in the February edition of the Presale Pulse.