Traditionally, the MLA Intel Report has included a breakdown of the presale activity over the past year as well as forecasting for the year ahead. However, as MLA Canada looks to find new ways to best serve our clients, our content and focus have continued to evolve. This year, a new source of information and analysis was added: the Residential Developer Survey.

The findings of the survey represent the views of leading professionals within the development industry who are active in markets across the Lower Mainland, BC, and Canada. The resulting analysis sets out the key trends shaping the market, as well as a temperature check on what developers expect in 2024. Our Advisory Manager, Nicholas Frappell, is sharing his insights into the results.

Annual Survey Insights: Tracking Developer Perspectives Over Time

In recent years, BC developers have navigated bottlenecks and red tape exceptionally well, contributing much-needed housing to Metro Vancouver’s market. As the environment becomes more complex and the market more competitive, the Residential Developer Survey engages with developers directly, aiming to understand how they’re adapting their approach to meet these demands while shedding light on the obstacles they’ve encountered in the process.

“The drive to create the survey was a recognition that, as an organization, we sit within a privileged position in the industry,” commented Frappell. “As one of Western Canada’s largest presale service providers, we can cast a wide net and have insightful discussions with decision makers across markets and product forms.”

MLA plans to reissue the survey annually, delivering information specific to the current time horizon. This recurring timeline will also allow the team to track changes in developers' opinions and sentiments over time. When developers weigh opportunities and threats, they are projecting their impact over spans of five, 10, or even 15 years, contributing to a more accurate forecast of trends and better market predictions.

Surveyed developers prefer sites that have not undergone rezoning

Nearly half of the surveyed developers expressed a preference for acquiring sites that have not undergone rezoning. "Although development-permit-ready sites can shorten timelines and reduce risks, the allure of potential cost reductions and greater flexibility of properties not yet rezoned remains strong," explained Frappell.

“There is also the fact that sites with existing zoning are unlikely to reflect the new government and city policies that are set to support increased density on sites near transit. Not wanting to leave added density on the table, many developers are waiting for the dust to settle before submitting formal applications. “

A reinforced need for innovative financing

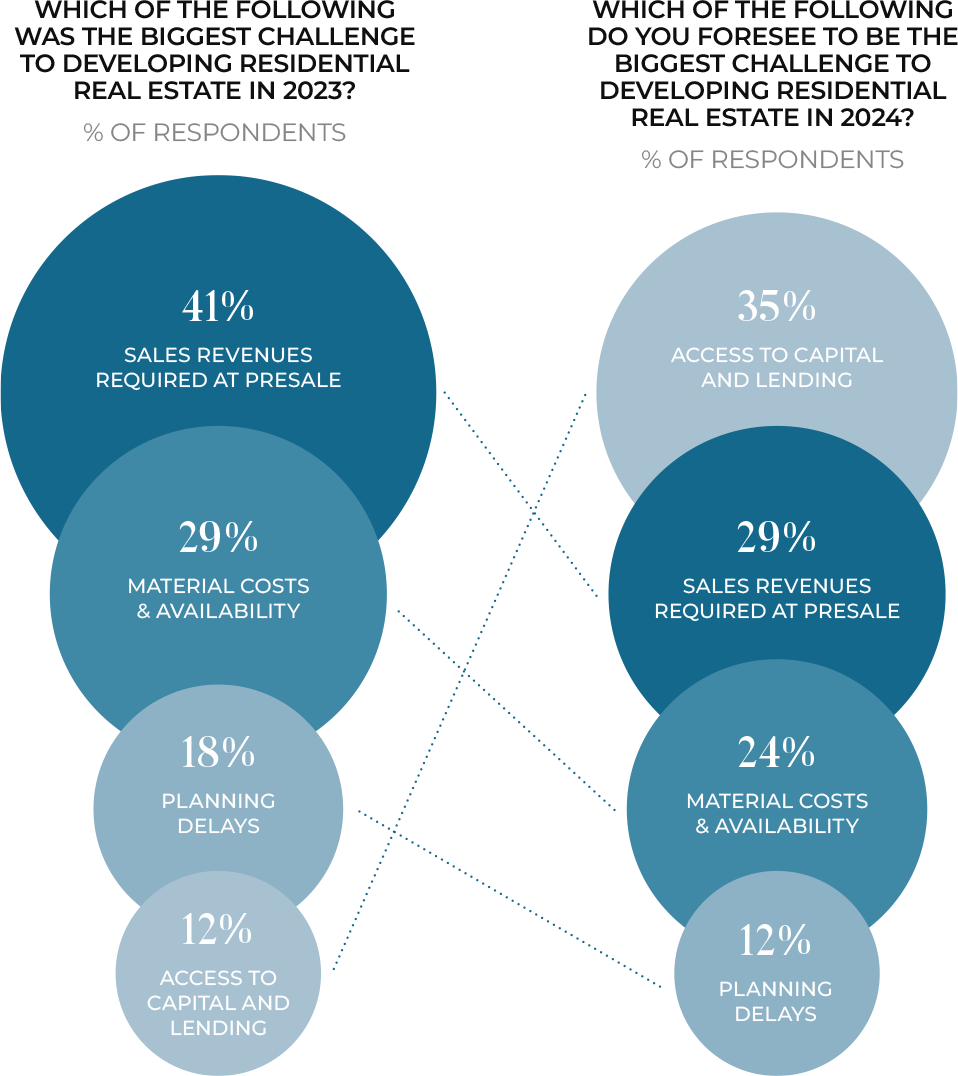

An overwhelming majority of developers acknowledge the effects escalating costs are having on their operations. In the past year, 94% of surveyed developers reported that the increase in building costs significantly affected their business, with expectations of continuing challenges into this year. Additionally, respondents anticipate that their main challenge in 2024 will be gaining access to capital and lending, a concern expressed by more than double the number of participants who considered it a challenge in 2023. This underscores the necessity for developers to employ innovative financing strategies. For many, this will include thoroughly examining their capital stack and exploring diverse funding options, including a mix of preferred equity and mezzanine financing to meet their financial needs effectively.

Policy changes impacting development equally

“When asked which recent policy change would have the greatest impact on Metro Vancouver’s residential real estate market, developers were fairly split across the available responses,” shared Frappell. “While their responses may be swayed by their portfolio and what stage their developments are in, it also in my opinion shows an element of uncertainty from respondents.” This is especially relevant regarding the changes to Metro Vancouver's Development Cost Charges (DCCs) and the BC Building Code. Metro Vancouver’s DCCs are expected to rise by 235% for condominiums and 256% for townhomes by 2027.

The changes to the BC Building Code, which are expected to be implemented in March, aim to enhance the accessibility of units and will require at least one room to not exceed 26 C. This will have a knock-on effect on prices as dwellings will need to be 5-15% larger to meet clearance requirements and will likely have to have some form of air conditioning in every home. "While I recognize the necessity of these changes, I believe policymakers must acknowledge that the ripple effects of these policies will have long-term consequences on affordability, the full extent of which remains uncertain."

For a more detailed analysis of the developer survey and the general forecast for the year ahead, read the MLA Intel Report 2024.