“We are still living through an incredibly slow time in the presale market. Tempo programs are struggling to attract steady traffic and active buyers are feeling empowered to negotiate, which is prolonging buying decisions further. Condo developers see nothing but short-term headwinds that all but eliminate the chances of new project launches. As such, much of our active focus has shifted to the rental market and the implications of skyrocketing rental completions.” — Garde MacDonald, Director of Advisory, MLA Canada

A Frosty Presale Market, Rentals Time To Shine

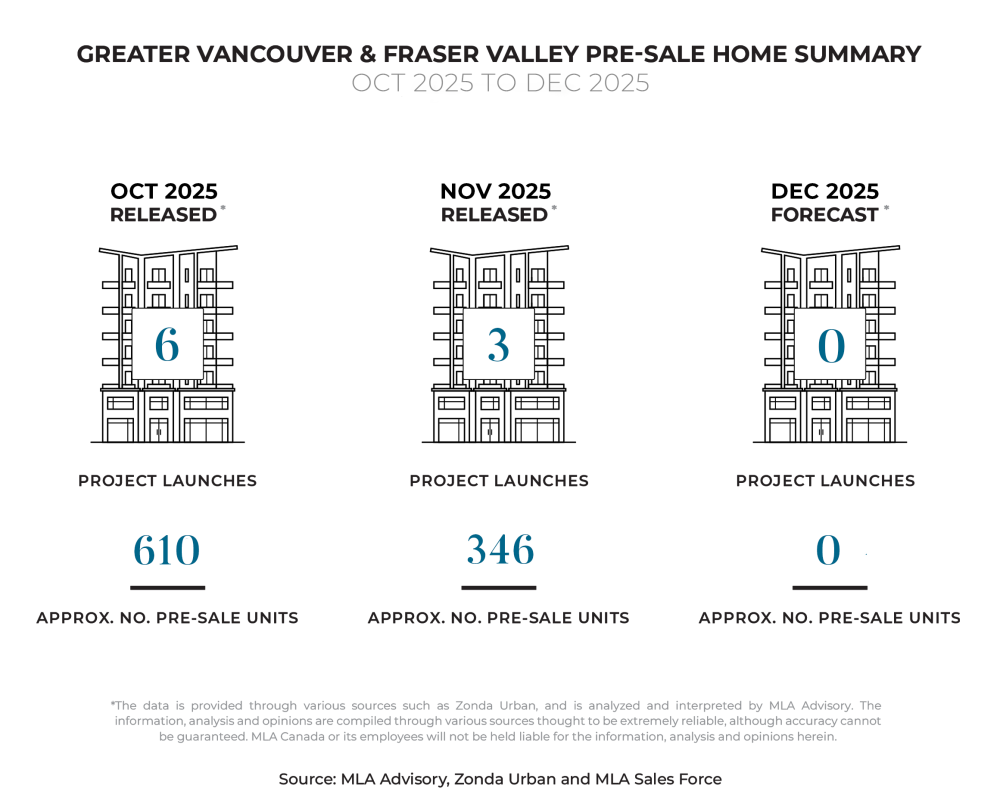

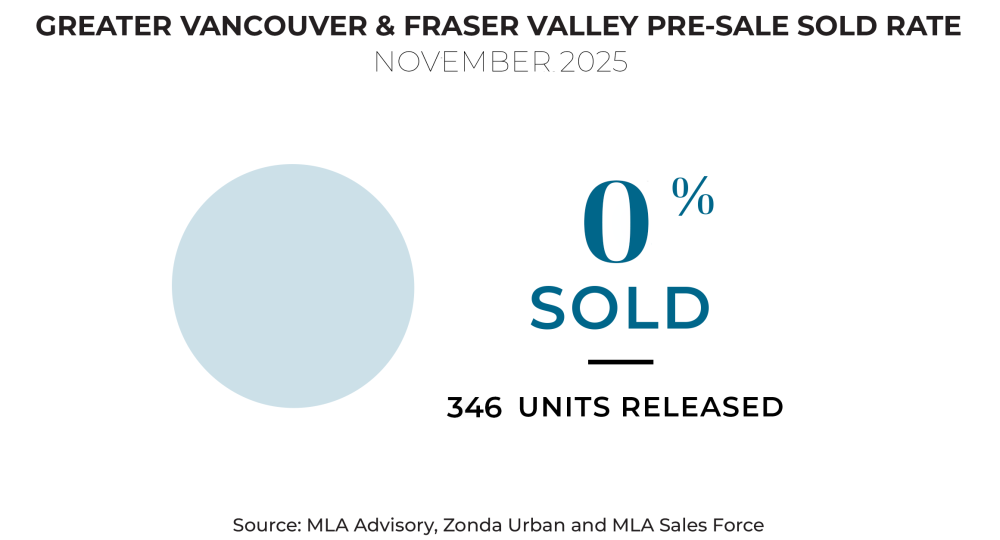

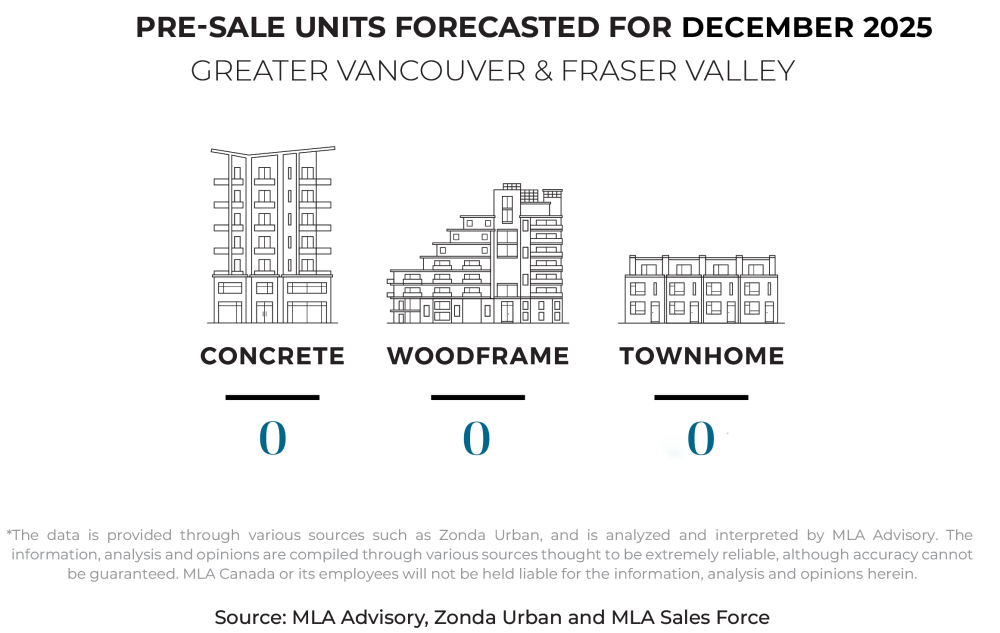

November brought three presale launches totaling 346 units, but no recorded absorptions, and no new launches are anticipated for December. The projects that entered the market this month will likely wait until the New Year or Lunar New Year before sharing sales updates, reflecting the continued slowdown in presale activity. Meanwhile, rental development remains strong with 45 rental projects completing in 2025, a 20 percent increase over 2024. About 62 percent of these were low rise, 16 percent midrise, and 22 percent high rise, with nearly 40 percent of units absorbed so far. Wood frame low rises dominate the rental supply, while concrete high rises remain concentrated in transit-rich or amenity-heavy areas or where larger suites are in demand.

Winter Woes For The Economy And Mortgages

Canada’s Q3 GDP grew 2.6 percent, beating expectations but driven largely by a reduction in imports rather than meaningful improvements in exports, business investment, or consumer spending, suggesting ongoing caution from both households and businesses. Mortgage delinquency rates remain low at 0.22 percent, but pressure is building with around 2 million mortgages set to renew in 2025 and 2026. Vancouver’s significant 2021 buyer cohort — many of whom purchased at peak prices — will be especially important as most renewals land in 2026. While many homeowners appear prepared for higher payments, foreclosures are gradually increasing and may rise further if economic conditions remain weak, particularly for those who bought at peak pricing and could face financial strain if unexpected expenses erode savings.

Holiday Hiatus

Home sales in Greater Vancouver and the Fraser Valley declined in November, dropping more than 15 percent year over year, with December likely to remain quiet as the holiday season slows activity. Total sales for 2025 are on track to be the lowest in 25 years at just over 22,200, nearly 45 percent below the 2021 peak. Elevated listing levels — over 15,000 in Greater Vancouver and 9,200 in the Fraser Valley — are giving buyers more leverage, while prices have eased 2 to 4 percent and days on market have lengthened by about a week. Sales-to-listings ratios of 12.6 percent and 10 percent respectively confirm a buyer-friendly environment. Despite recent rate cuts, demand has yet to noticeably rebound, and ongoing economic uncertainty suggests the market will stay subdued in the short term, though buyers who act now could be well-positioned as conditions stabilize over time.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, presale, and resale market video report in the December edition of the Presale Pulse.