A Look at Real Estate Rules Across the Globe

In the last few months, pressure on the provincial government has started to heat up again regarding taxing wealthy offshore investors at a higher rate than local residents buying investment properties in Metro Vancouver. The debate centres on whether or not a foreign ownership tax would curb price acceleration in the housing market.

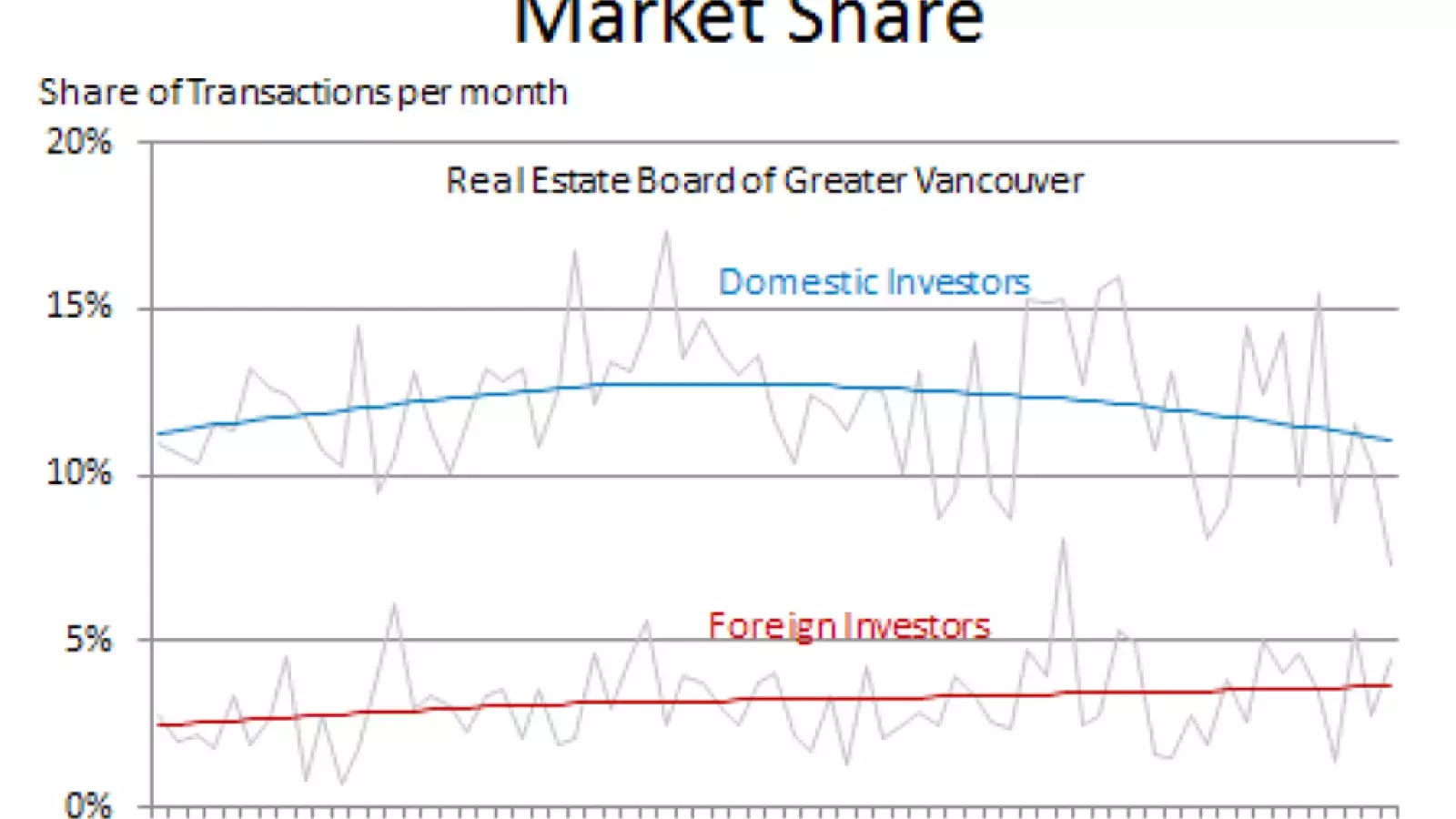

Official figures don’t exist for the British Columbia real estate market but realtor and media polls have reported anywhere from 3.5% to 20% of housing sales coming from foreign investors. (Earlier this month, the British Columbia Real Estate Association (BCREA) released the report \"Market Implications of Foreign Buyers\" which found foreign ownership to be no more than 5%.)

How do other major real estate markets compare to Canada’s open-door foreigner home ownership policies?

Countries with Similar Minimal Restrictions:

Germany

The lack of restrictions in this country closely resembles those of Canada. The only caveat for foreigners is that financial institutions may require a higher down payment due to the lack of long-term financial records.

United States of America

There are also less restrictions for foreigners to buy homes, with the exception of the purchase of housing co-ops which is generally prohibited. Financial institutions also require a higher down payment (usually 30%).

United Kingdom

Rules in the U.K. are similar. However, as of 2010, up to 28% of the profit earned on a property at the point of sale will be collected, which is the same tax a British home seller must pay. (Non-resident Canadians selling property are also subject to Capital Gains tax.)

Countries with Greater Restrictions:

China

New restrictions for foreigners were created in 2010. Foreigners are limited to one residential property for personal use and must reside in the country one year before they can purchase a home.

Switzerland

An annual quota is assigned by the government to limit the number of houses and flats that can be purchased by foreigners and only one home can be owned per family. The home can be used as a holiday home but cannot be purchased for the sole purpose of renting it out.

Australia

Since 2010, the country prohibits foreigners from buying existing housing for investment, with an exception made if the foreigner plans to demolish and redevelop within two years, where the development will increase the number of housing units.

Singapore

Similar to Hong Kong, Singapore is one of the most costly places for foreigners to invest in home ownership as they are charged a ‘foreigner premium’ of 15% Buyer’s Stamp Duty and higher tax levels.

What is the Answer?

With 20% or less of home sales in the Lower Mainland being made by foreign investors this is not the only factor contributing to housing prices. There are a multitude of factors affecting housing prices including property transfer taxes, municipal fees for development and public amenities, land constraints, rate of housing supply, and regulated financial pressures just to name a few. The foreign ownership debate is really about affordability and affordability is a complex issue with a number of factors all playing a role.

The reality is that as long as Vancouver continues to be one of the best places to live in the world we likely will be having this debate for a long time to come.