As we bid farewell to 2023, a year marked by shifting economic landscapes and policy evaluations, we find ourselves at the cusp of a new year with the Okanagan real estate market in focus. The journey through the past year has been one of adaptation and resilience, grappling with challenges that continue to shape the real estate sector. Let's start by looking at the broader economic conditions in Canada to better understand the intricacies of the Okanagan market.

Economic Landscape in 2023: A Recap

In 2023, the Canadian economy witnessed fluctuations in key indicators. Inflation, once a concern at 8.0%, showed signs of tapering off but remained above the target range at 3.5% - 4.0%. The Bank of Canada cautiously raised the overnight rate by 75 basis points across three meetings, hinting at a potential end to the cycle. GDP growth, impacted by monetary policy, experienced a contraction in Q3 despite record-breaking population growth. The labour market, surprisingly robust historically, softened in the second half of the year, with the unemployment rate rising to 5.7%.

Immigration played a significant role in Canada's economic story, with over 450,000 immigrants welcomed in 2023, breaking records. Equities staged a recovery in the stock market, particularly in the technology sector, with the S&P gaining 24% throughout the year. The Canadian Survey of Consumer Expectations reflected increased confidence among households, particularly in the housing market.

Okanagan Presale Stats: A Microcosm of Real Estate Dynamics

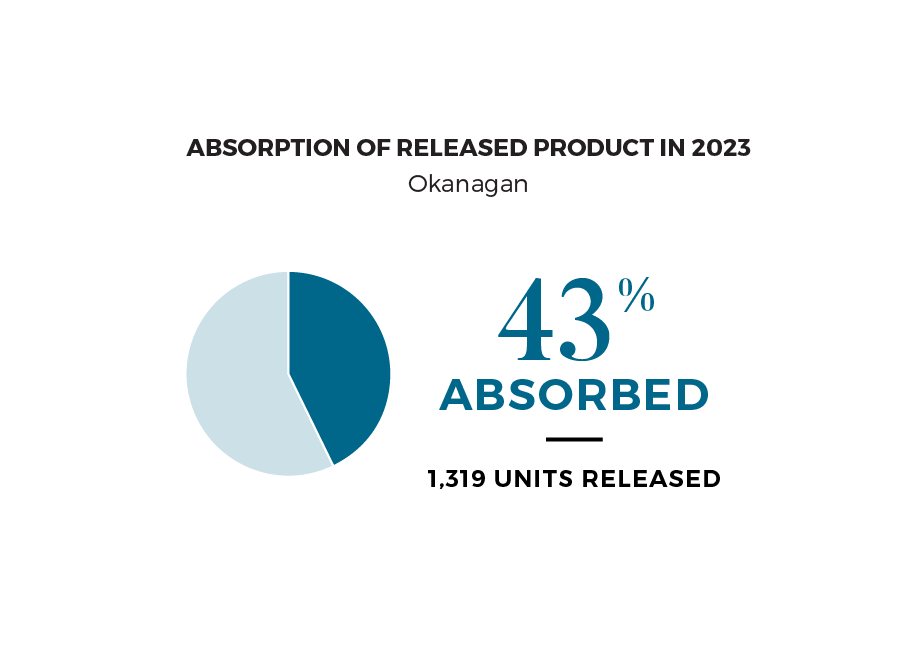

The Okanagan real estate market saw 13 new projects launching presales in 2023, introducing 1,319 new units to the market. Despite rising interest rates and affordability concerns, 43% of these units were absorbed, resulting in 565 total sales. Central Kelowna took the lead with five projects, followed by three in the downtown core, two in West Kelowna, and three in Penticton. The diverse offerings in terms of property sizes, scenic locations, and lifestyle amenities catered to various investment goals and personal preferences.

However, challenges loomed large for developers, with the absorption of presales being the most difficult aspect in 2023. Rising interest rates forced both buyers and sellers into a delicate dance of price discovery. As Garde Macdonald, Director of Advisory at MLA, notes, "The state of the industry is largely the same as it was one year ago. Material and labour costs are elevated, sales velocity and revenues remain relatively flat, and the impact of higher interest rates has yet to fully filter through the economy."

Central Okanagan Residential Resale Stats: Resilience Amidst Challenges

In August 2023, the McDougall Creek wildfire posed a significant challenge, prompting the evacuation of over 10,000 residents. Despite a temporary decline in resales, benchmark prices remained steady, signalling ongoing demand. Post-wildfire fluctuations were observed, but as the fall market commenced, pricing increased, and the market stabilized.

The introduction of new short-term rental legislation in October 2023, effective May 2024, added a layer of complexity. The mandate for short-term rentals to be the homeowner's primary residence raised concerns, especially in tourist-centric areas like Kelowna and Penticton. These areas heavily rely on short-term rentals to accommodate travellers and support student housing.

2024 Outlook: Navigating Uncertainties with Optimism

As we gaze into the crystal ball of 2024, the real estate landscape remains uncertain yet promising. The challenges faced by developers are more evenly distributed, emphasizing the tightening constraints on access to capital and lending. Rising costs, particularly in materials, labour, and borrowing, pose hurdles to achieving necessary hurdle rates.

Looking ahead, Garde Macdonald notes, "While the path forward is not clear, we anticipate a marked improvement in unit absorption, prices, and consumer sentiment toward the second half of 2024 and into 2025." The presale metrics from 2023, though subdued, present an opportunity for resilience and adaptability in project strategies.

Amidst these challenges, the allure of British Columbia and the Lower Mainland's real estate remains undiminished. The region's stability, safety, and overall livability continue to heighten its value on the world stage.

To conclude, the Okanagan market spotlight reveals a microcosm of the broader real estate dynamics in Canada. As we step into 2024, embracing the potential for increased macroeconomic stability and pent-up demand, we remain optimistic about the future of Okanagan's real estate. May this year bring prosperity and success to all stakeholders in the real estate industry.

Coming Soon: MLA Intel 2024

Our yearly report, MLA Intel, will be released later this month with expanded information on the Okanagan market, and the rest of British Columbia, and a deep analysis of the real estate landscape for the coming year. Keep an eye out at mlacanada.ca or sign-up for Newswire to be the first to read the soon-to-drop report.