“March saw more developers jump into the market and release new projects to take advantage of increased Spring demand. As such, same-month unit absorptions decreased from February even with sales increasing on an absolute basis. In April, we are already seeing a significant increase in realtor/prospect engagement events at presentation centres to capitalize on a generally more active Spring market.” - Garde MacDonald, Director of Advisory

MARCH LAUNCHES SEE BOOST YEAR-OVER-YEAR

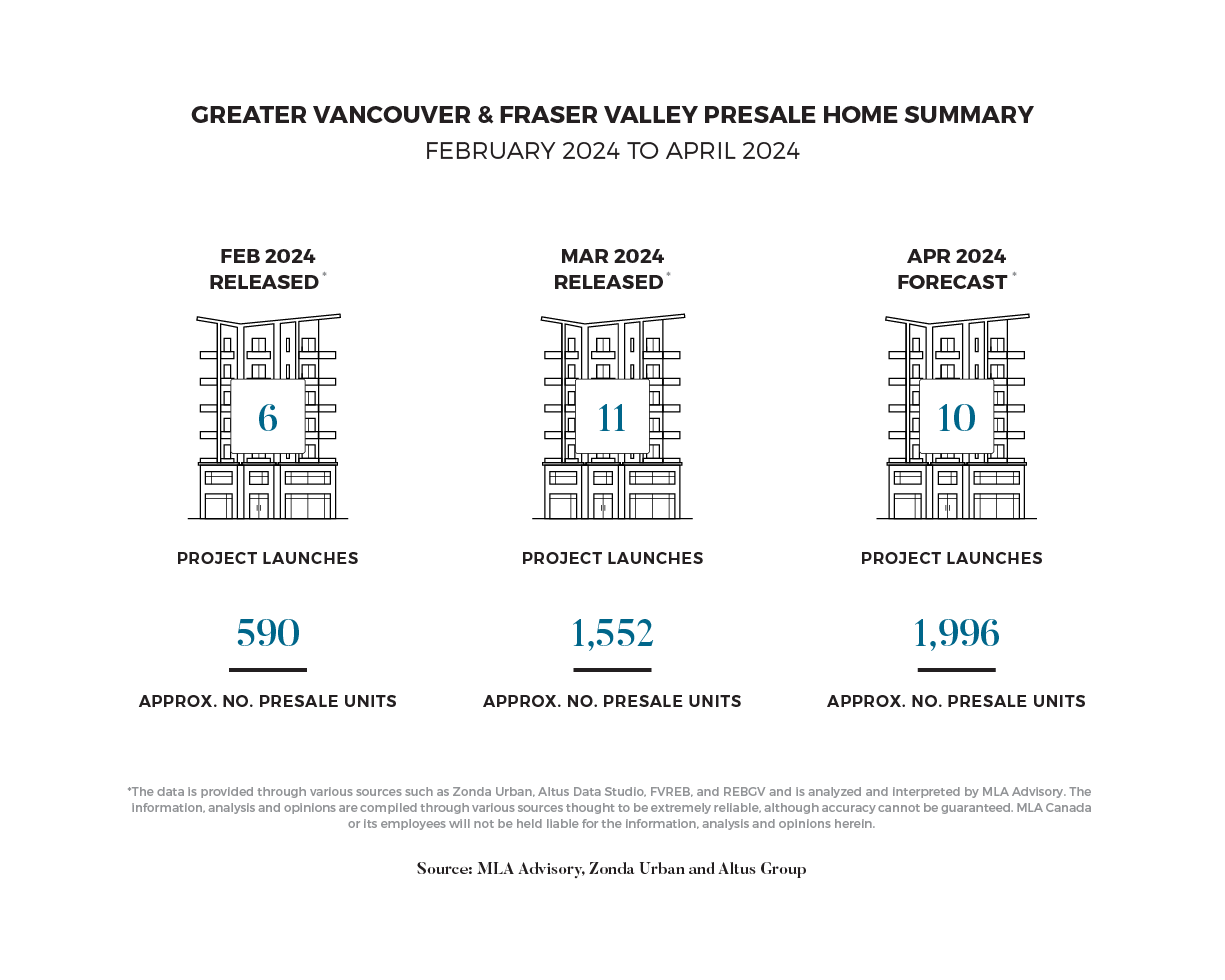

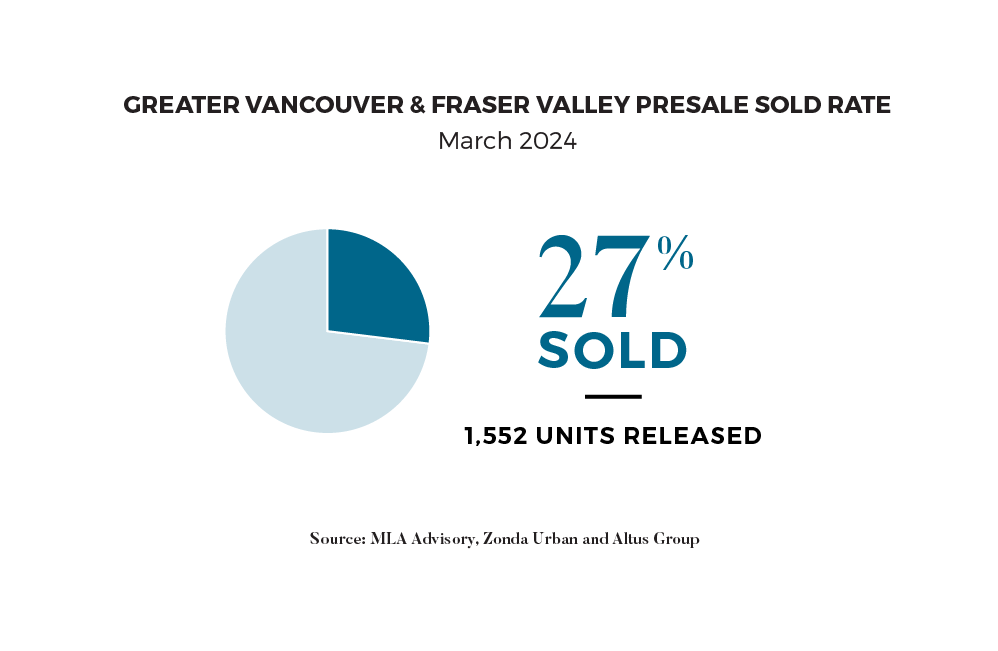

The uptick in presale launch activity in 2024 starkly contrasts with the early months of 2023, which experienced a sluggish start to the year, and only began to gain ground in the early Summer months. So far 2024 has adhered more closely to historical trends, maintaining a steady level of presale activity heading into the Spring. In total, there were 11 project launches that released 1,552 units to the market – over three times greater than March 2023. New presale projects launched in March sold 416 units, achieving a 27% same-month absorption rate.

Among the notable launches in March was Wesgroup’s second tower at Reign in Metrotown, which has seen significant interest, selling approximately 80 homes in 45 days, or 22% of its total units. Another standout was Ledgeview in Surrey City Centre, which sold 200 units, roughly 63% of their total inventory. The project’s attractiveness was enhanced by its competitive PPSF at $850 and a modest 5% deposit requirement, making it a highlight in the month’s presale activity.

WHOSE POLICY IS IT ANYWAY? UNDERSTANDING THE IMPACT OF POPULATION GROWTH ON RENTS

Canada’s recent shift in immigration policy, setting a flat target for 2026 and reducing temporary resident intake, aims to address the link between population growth and the stresses on housing and infrastructure. Historically, immigration has fueled demand and economic activity in Canada, contributing to more consistent growth. However, the country now faces a housing crunch, evidenced by inflated prices and scarce availability, particularly in areas like Metro Vancouver where rental rates surged to 9.5% in 2023.

To alleviate the housing strain, the government has implemented measures such as capping international student numbers and tightening work permit criteria. These steps reflect a broader effort to balance population growth with housing availability. However, simply adjusting immigration levels won’t resolve rental affordability outside of incentivizing new construction. Comprehensive policy support across various sectors, including housing, infrastructure, and healthcare, is essential.

Initiatives like eliminating GST on new rental developments and increasing the available federal financing signal progress towards increasing rental supply. Despite this, the enduring high demand and ongoing affordability crisis are a very nuanced challenge. It underscores the necessity for a multifaceted strategy that ensures the rental market’s long-term stability and affordability, marrying immigration policy with broader socio-economic planning.

CAN APRIL ECLIPSE EXPECTATIONS?

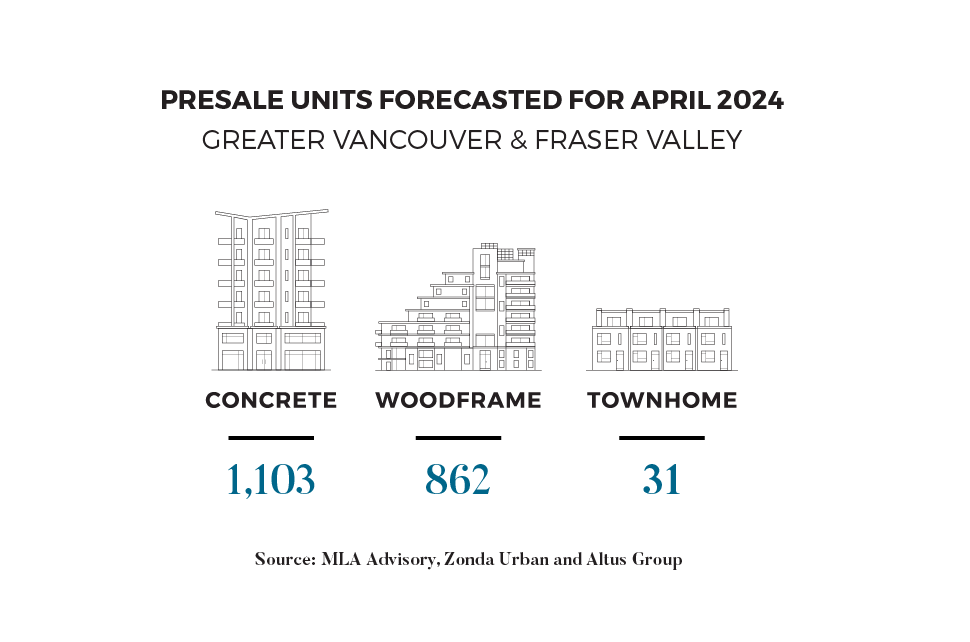

April is expected to be a continuation of the activity experienced in March. MLA Advisory forecasts a total of ten project launches that will constitute 1,996 homes. For reference, this would be the second most significant number of homes to release in a month since July 2022. The Fraser Valley is at the forefront of this activity, making up seven of these projects. Noteworthy launches include Parkway (Building 2) by Bosa Properties and Amson Bloc by Amson Group in Surrey. Parkway began writing in late-March to early-April and is estimated to be targeting a gross blended PPSF in the mid- to high-$1,100’s. Amson Bloc, which includes two buildings and is located on the cusp of Panorama and Sullivan Heights, began previewing in early April. It features custom interior millwork, zebra blinds, and over 3,600 SF of indoor amenities.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, presale, and resale market video report, Presale Pulse.

Subscribe to the MLA Canada YouTube Channel or find the Pre-Sale Pulse on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio.