“As we enter the quieter summer months, the condominium segment of the presale market remains stagnant. The limited number of projects releasing new units are doing so due to impending construction completions (ie. townhomes) or mounting financial pressures. On the policy front, the newly announced Provincial DCC Policy, allowing developers to defer 75% of payments until completion, is set to come into effect on January 1. This marks a step in the right direction and a medium-term tailwind for the presale market.” - Garde MacDonald, Director of Advisory, MLA Canada

MUTED MOMENTUM AT MID-YEAR

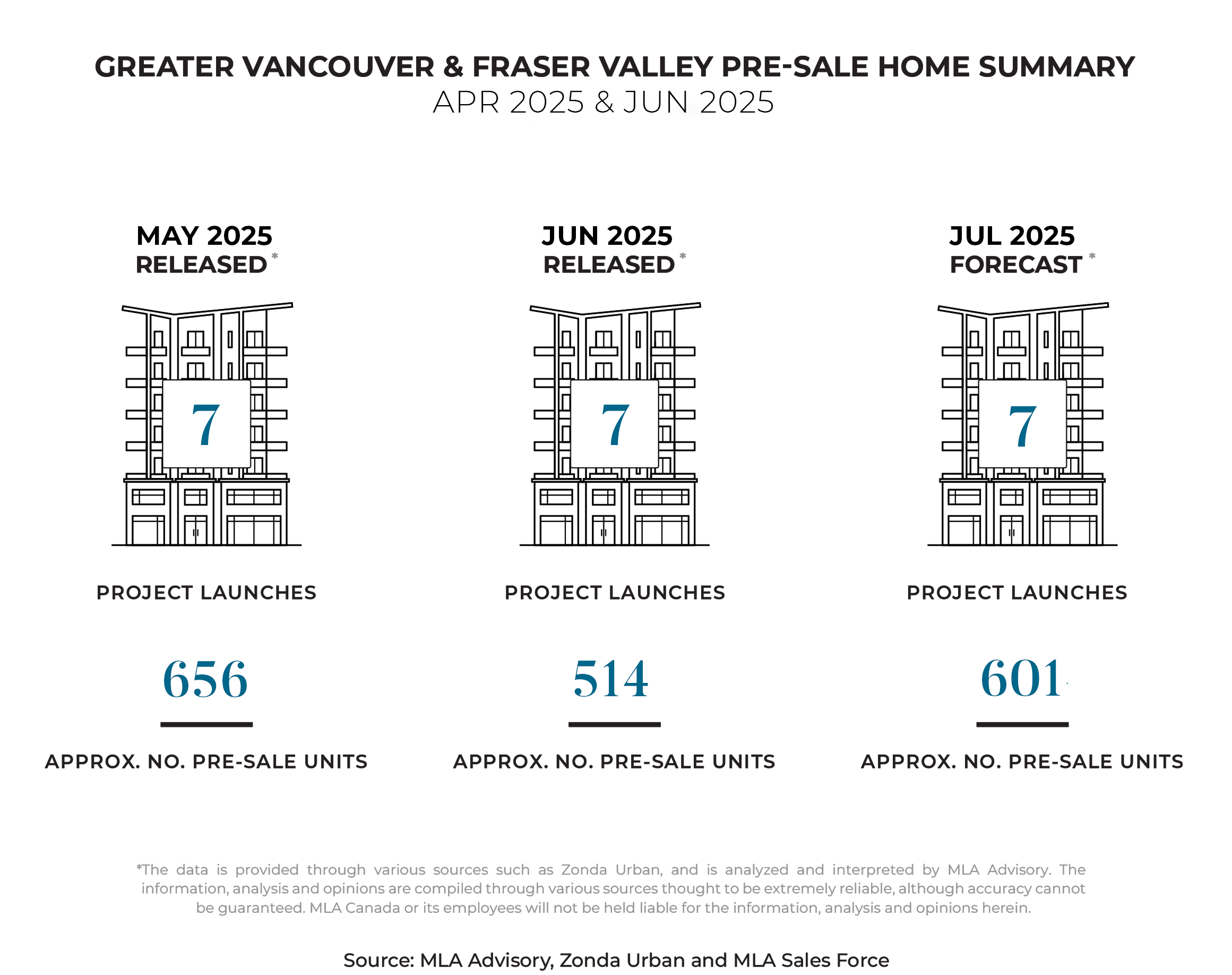

Seven new projects launched in June, bringing 514 presale units to market—matching the pace of May and April. However, that figure represents only about half the number of typical June launches and a third of the units usually released this time of year. Year-to-date, 35 projects have launched, over 40% below the five-year average, with under 400 units sold—an 85% drop from historical benchmarks.

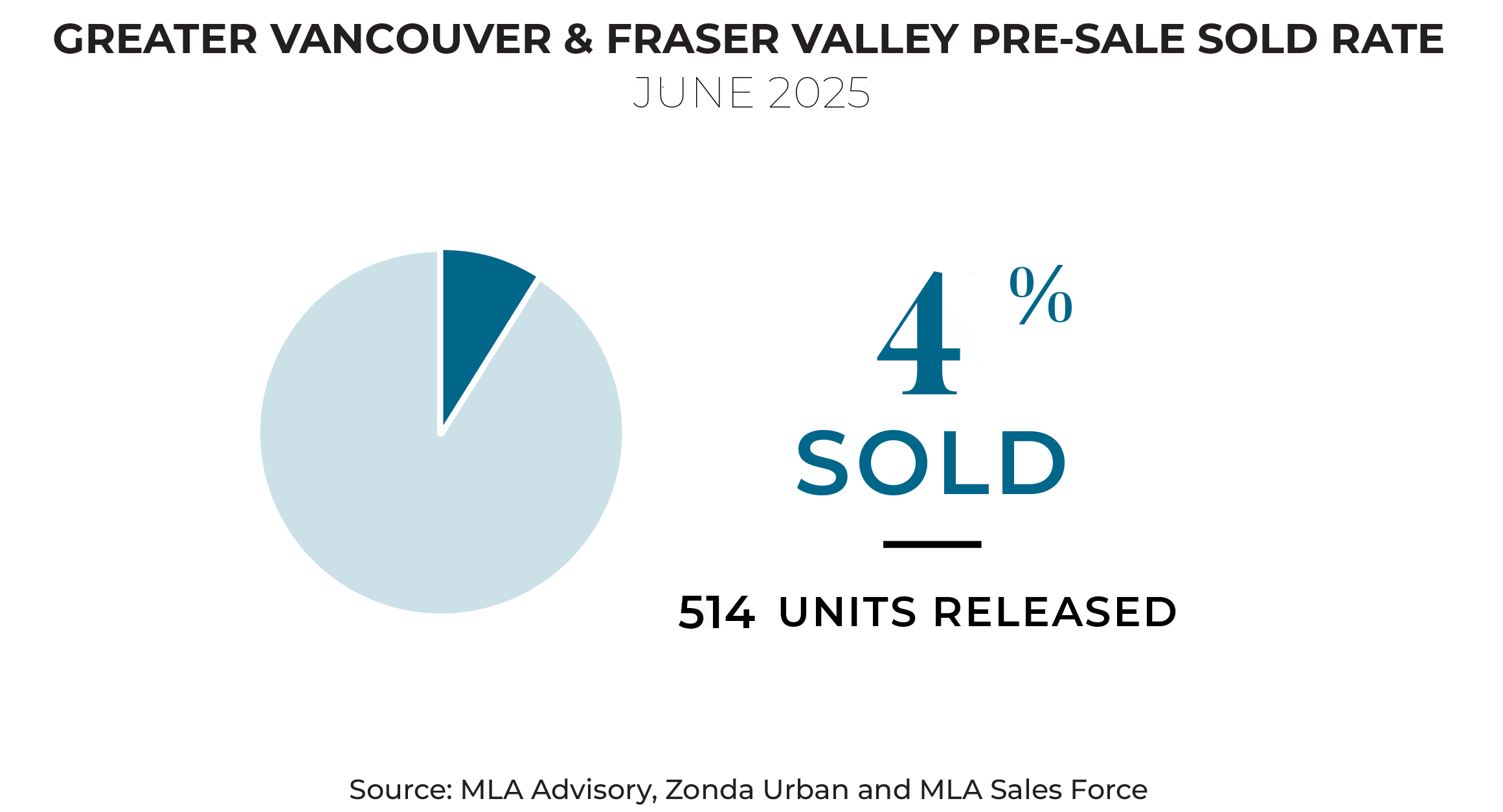

Absorption was particularly sluggish in June, with only 20 homes sold—a 4% same-month absorption rate compared to the five-year average of 27%. Market engagement continues to soften, with elongated preview periods and gradual release strategies making sales harder to track in real time.

ECONOMY COOLS: WILL DCC FLEXIBILITY FUEL MORE DEVELOPMENT?

The most notable policy development comes from the provincial government’s recently announced changes to the Development Cost Charges (DCC) payment structure. Effective January 1, 2026, developers will only be required to pay 25% of their DCCs at permit approval, with the remaining 75% deferred until occupancy or within four years.

While the total cost remains the same, this deferral offers critical cash flow flexibility during early project stages—allowing more time to begin presales before significant capital is needed. It’s a positive move in an otherwise tight development landscape and may help unlock stalled projects.

A SLOW BURN THROUGH SUMMER

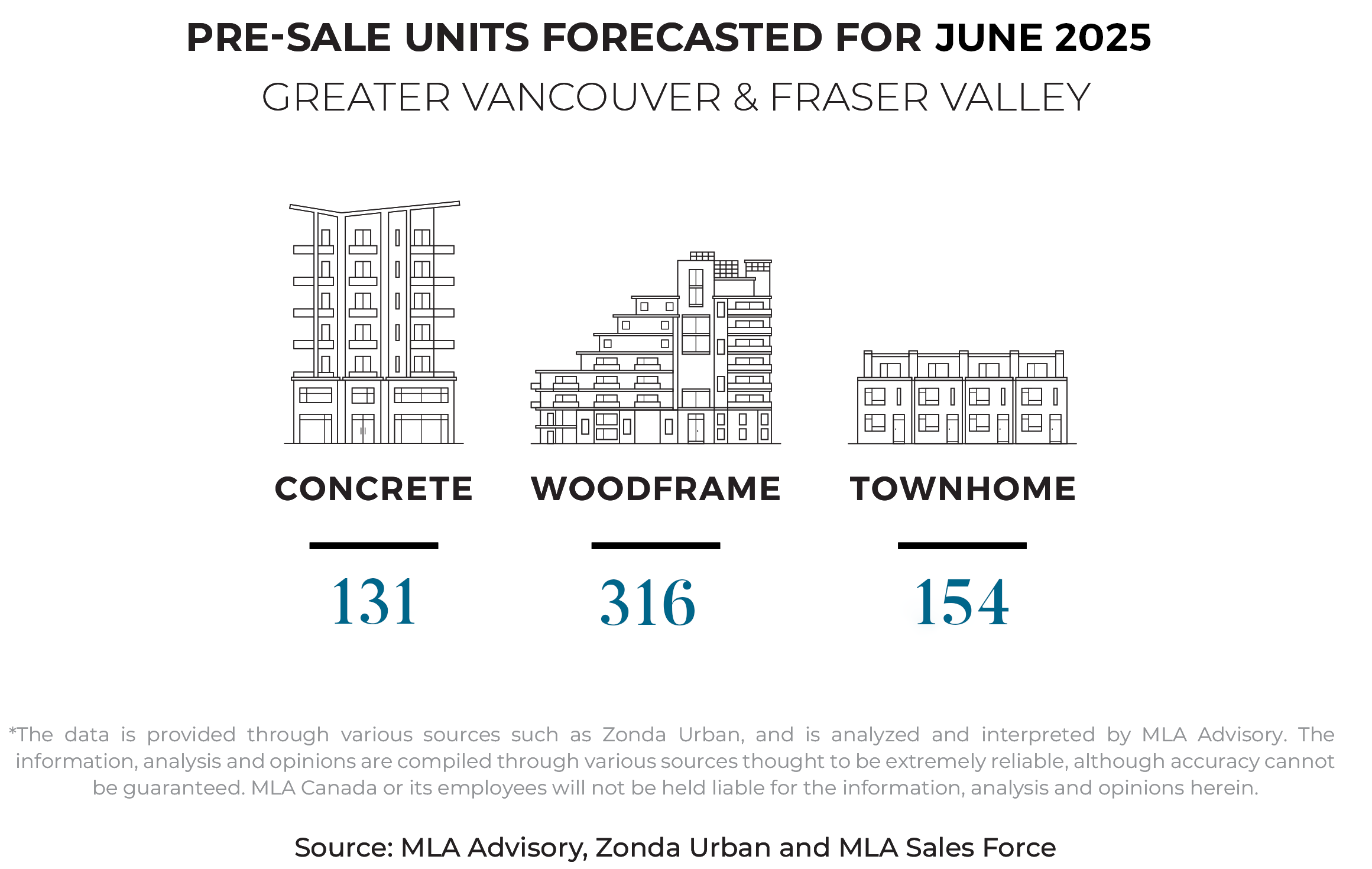

Looking ahead, July is forecasted to mirror the past few months, with seven project launches bringing approximately 600 units to market. These launches are heavily concentrated in low-density, end-user product such as townhomes and low-rise condominiums, particularly in the Fraser Valley. Multiple wood frame developments are expected to contribute over 100 units each.

However, these launches still fall short of the five-year July average of more than 850 units across eight projects—highlighting the continued conservatism in new supply.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, presale, and resale market video report, Presale Pulse.