“The summer has been very quiet in the presale market. The July 30 interest rate hold by the Bank of Canada added little relief for homebuyers as the promised lower rate environment is not coming to fruition as expected. With continued slow sales centre traffic and negative sentiment toward investor product, we are expecting zero new project launches in August across the Lower Mainland.” — Garde MacDonald, Director of Advisory, MLA Canada

Seasonal Slump

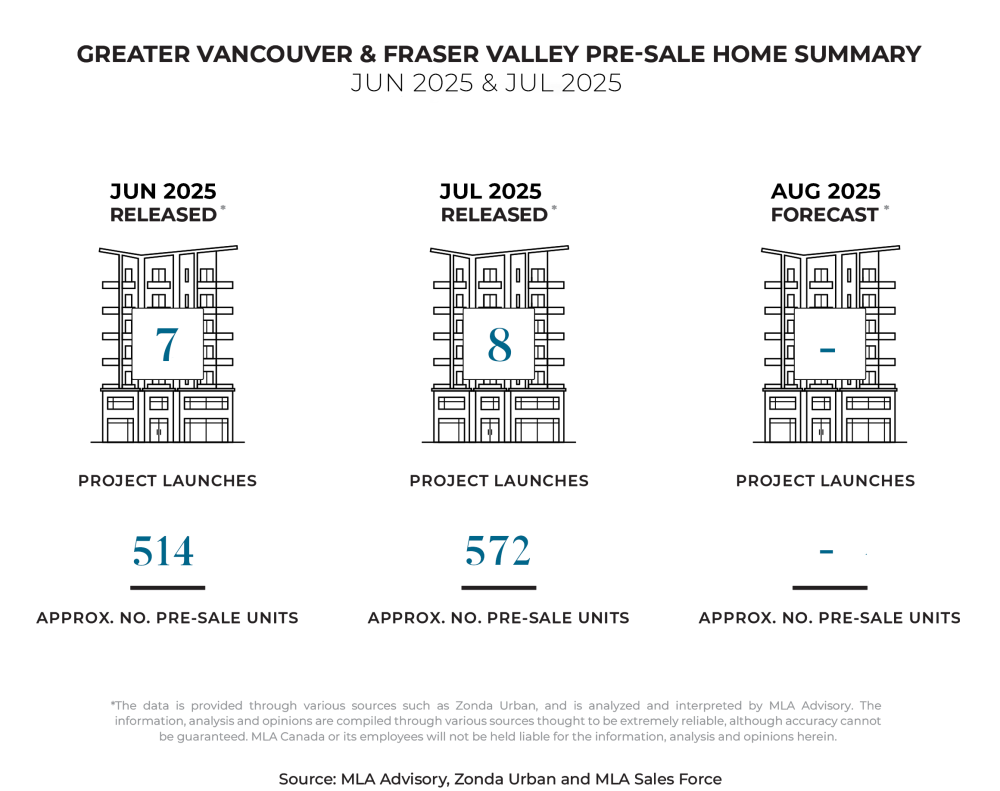

While eight new projects launched in July—on par with the five-year average for this time of year, the number of units released fell short. Only 572 units came to market, marking a 33% decline from the five-year July average of 857. This shortfall is largely due to a predominance of wood frame and townhome product, which yield fewer units per project than typical concrete offerings.

The Fraser Valley continues to lead activity, accounting for six of the eight new launches. This reinforces a sustained developer focus on more affordable, family-oriented submarkets.

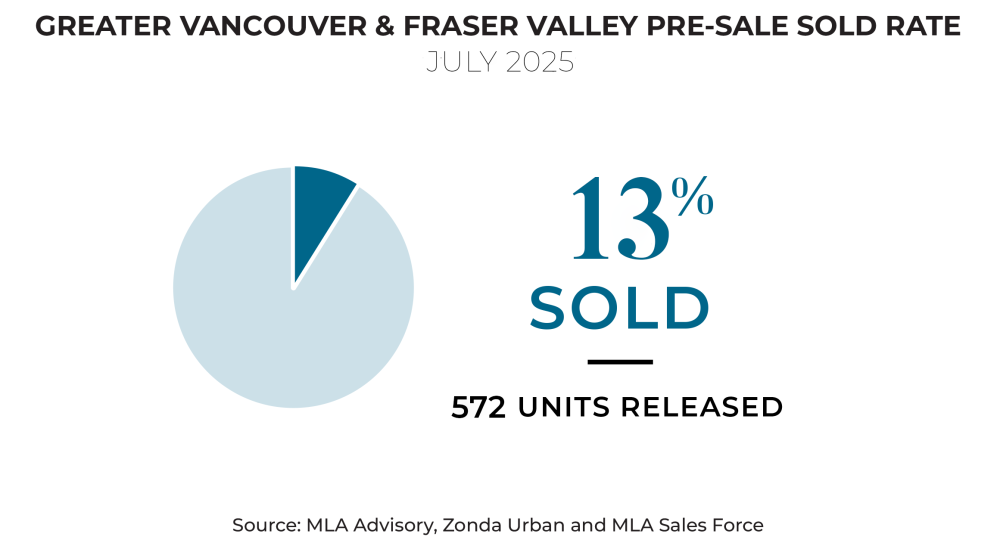

Sales absorption reached 13% in July, well below the five-year seasonal average of 29%. However, a few standout projects in the Fraser Valley recorded 25–30 sales in the month, showing that buyer interest remains—but is highly selective in today's market environment.

Steady Rates and Trade Debates

The Bank of Canada maintained its policy rate at 2.75% in July, marking the third consecutive hold. While GDP shrank slightly by 0.1% in May, overall economic performance remains more resilient than expected. Service sector strength is offsetting weakness in manufacturing, contributing to marginal improvements in consumer and business confidence.

Meanwhile, U.S. and Canada trade relations are facing new turbulence. A July announcement of a 35% U.S. tariff on Canadian goods—up from 25% sparked concern. While 95% of exports are still covered by CUSMA and exempt, businesses relying on non-North American components could feel pressure. Looking ahead, the 2026 CUSMA review may have broader consequences. The Bank of Canada estimates a potential 1.25% reduction in real GDP by 2027 if the agreement is not renewed.

Fall Forecast Looking Foggy

August is traditionally a quieter month, but this year it’s expected to be dormant. No new project launches are anticipated, a notable deviation from the five-year average of seven August launches and 800 units.

The resale market also remained soft in July. Greater Vancouver recorded a small month-over-month increase in sales, while the Fraser Valley saw no change. Both markets remain below their 10-year seasonal sales averages, by 14% in Greater Vancouver and 23% in the Fraser Valley.

Inventory remains elevated, sitting 40% above the 10-year average in Greater Vancouver and 50% higher in the Fraser Valley. Home prices slipped slightly month-over-month, adding further pressure. If any market shifts are to occur, they are likely to unfold in the fall.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, presale, and resale market video report, Presale Pulse.