“August was extremely quiet in the presale market. With summer coming to a close and the odds of a rate cut climbing for the September meeting, we are optimistic that the Fall will bring more housing activity, specifically in the entry-level resale segment.” — Garde MacDonald, Director of Advisory, MLA Canada

End of Summer Burnout

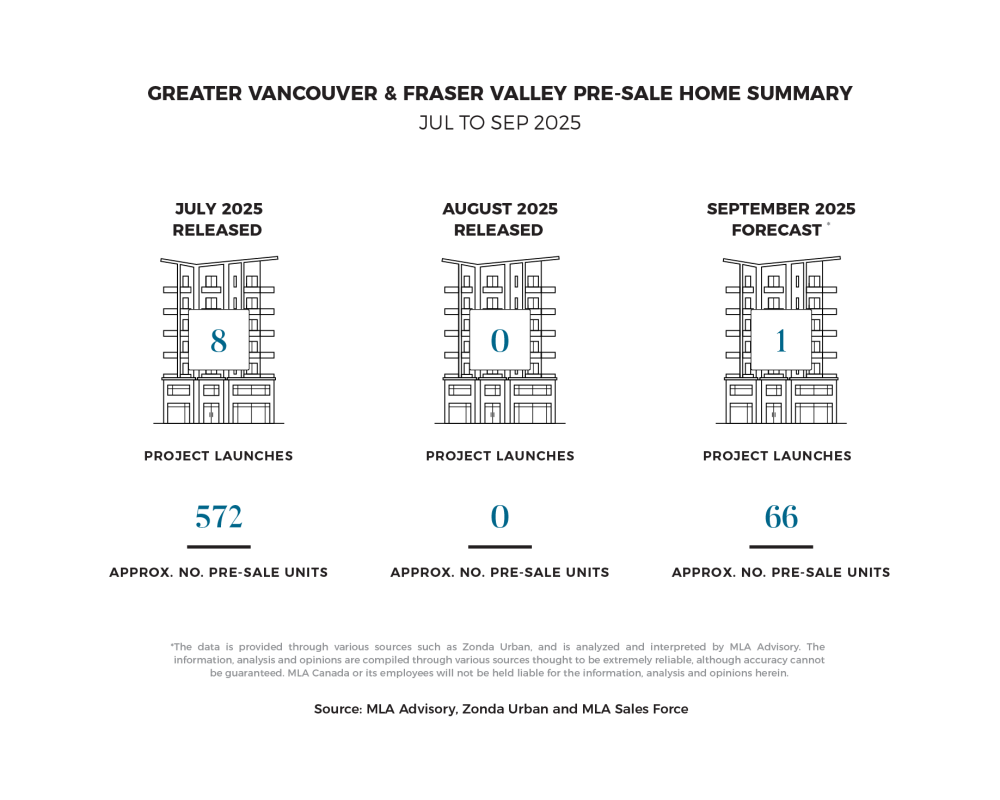

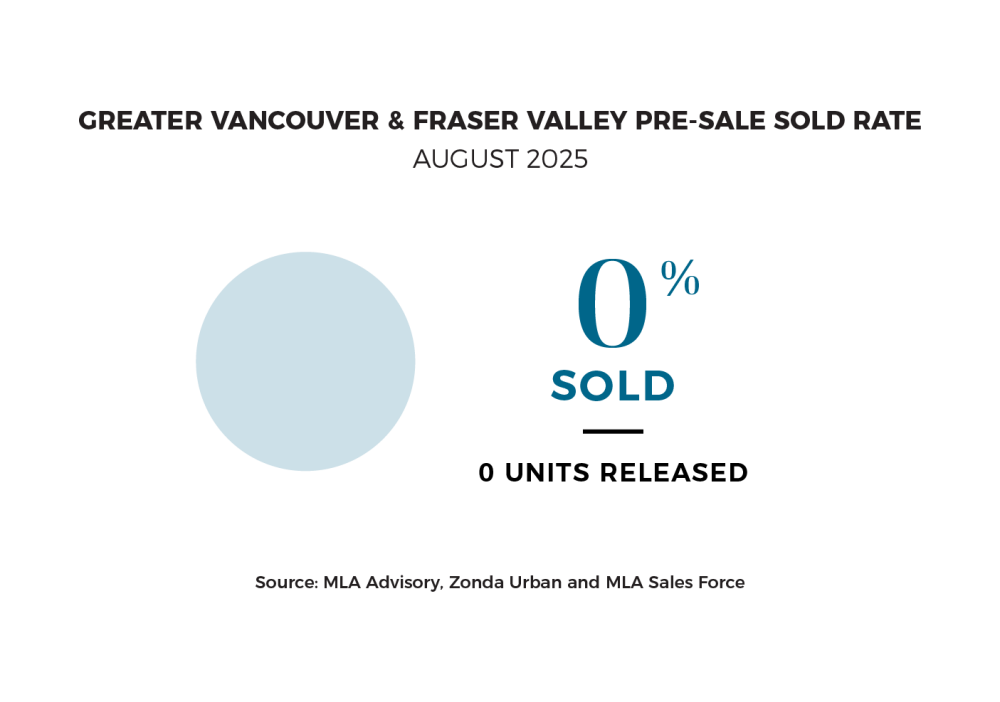

Presale launch activity came to a standstill in August, with no new projects coming onto the market throughout the month. While August is typically slower for new releases, second to the winter months of December through February, the past five-year average still shows about seven projects coming to market, with a release of more than 850 units. This slowdown was expected given the rest of the year has trended below historical norms, but it still represents the slowest August for project launches in the past five years of tracking. Many developers with projects ready to launch have chosen to wait until the fall, when buyers return from summer holidays and are more prepared to re-engage with the market ahead of the holiday season.

Over the past year, many projects that have come to market have stalled, scaled back, or shifted direction—particularly concrete high-rises. Surrey has seen several notable examples. Earlier this summer, Allure Ventures’ SkyLiving pivoted from 449 condos to a mix of 207 rental units and 215 strata condos after struggling to meet sales targets. Oviedo Development’s BridgeCity paused sales in July to pursue a full redesign, while Darshan Builders’ Parksville 96 recently returned deposits and is reportedly converting its planned 404 condos entirely to rental. The Surrey market has been hit harder than most, with concrete high-rises proving especially difficult to move given the slowdown in investor activity.

GDP Slips, But Domestic Demand Holds Strong

Canada’s economy contracted in the second quarter of 2025, with GDP posting three consecutive months of decline and falling at an annualized rate of 1.6%. While this raised recession concerns, economists caution that one negative quarter alone does not constitute a technical recession. Q1 still recorded 2% growth, making Q2 the first quarterly decline in nearly two years. Early estimates point to a modest 0.1% rebound in July. The weakness seen in Q2 was concentrated in tariff-related industries. Exports dropped 7.5% in Q2, the steepest decline in five years while business investment in machinery and equipment also retreated for the first time since the pandemic. These pullbacks underscore growing caution among Canadian firms facing global uncertainty.

On the other hand, domestic demand proved resilient, rising 3.5% in Q2. Household spending and residential investment both climbed, a trend usually not seen when recession fears are high. This signals that Canadians are reinvesting in local goods, services and housing and providing an important buffer against external shocks. Looking ahead to the Bank of Canada’s September 17th rate announcement, analysts remain divided. Some argue the weak Q2 data supports the case for a rate cut, while others note the slowdown was largely in line with the bank’s forecasts and may already be factored into policy.

Fall Forecast Looking Foggy

September has historically carried the lingering effects of summer, with activity levels typically mirroring August and averaging about eight launches and nearly 1,000 units over the past five years. This year, however, only one project with 66 units is expected to come to market, well below seasonal norms and underscoring how quiet conditions remain. While September is often softer before activity ramps up in October and November as buyers return from summer routines, 2025 is shaping up to be another slow burn rather than a year of major corrections, with presale activity unlikely to reach historical averages.

Resale activity cooled further in August, with sales sitting 19.2% below the 10-year average in Greater Vancouver and 36.0% below in the Fraser Valley. Active listings remain elevated compared to last August, up 17.6% in Greater Vancouver and 21.1% in the Fraser Valley, pushing sales-to-listing ratios down to 12.4% and 8.9%, respectively – clear signs of a buyer-leaning market. Month-over-month benchmark prices slipped approximately 1% for both markets, with benchmarks down 3.8% year-over-year in Greater Vancouver and 5.7% in the Fraser Valley. Townhomes remain the most resilient product type, holding value better and selling faster than other product types.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, presale, and resale market video report in the September edition of the Presale Pulse.