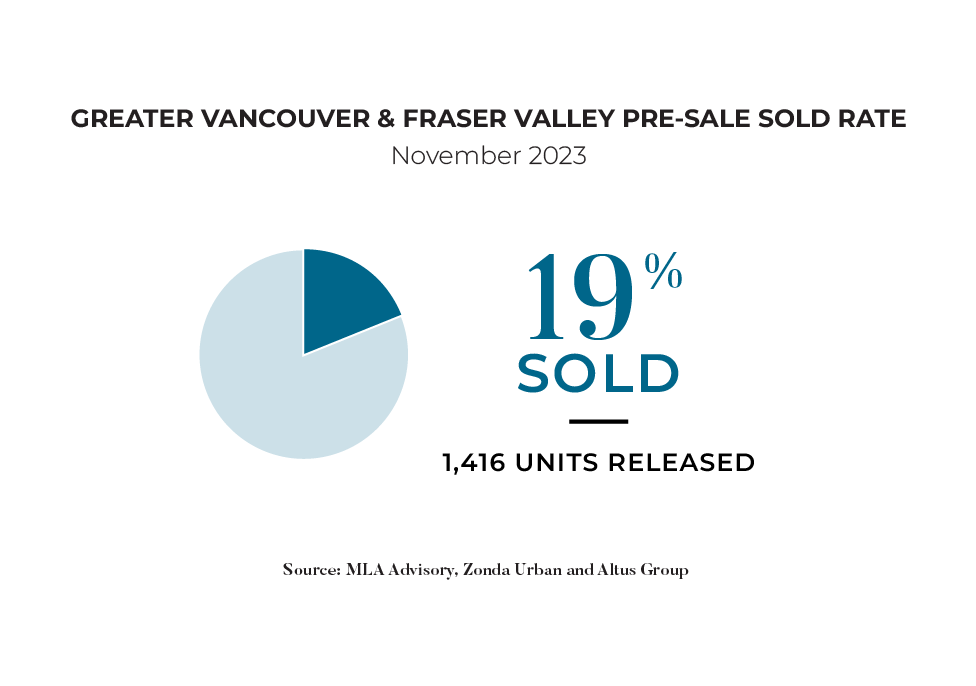

“Following typically seasonal patterns, new launch activity was muted in November as actively selling projects hustled to absorb units prior to the holiday season. During the month, we witnessed an emphasis on creative marketing messaging coupled with larger purchase incentives targeted both at homeowners and realtors alike. In this nervous environment, sales teams are having to work harder for deals, and developer expectations are continuing to adjust to the present reality.” - Garde MacDonald, Director of Advisory

A SEASON OF MIXED SUCCESS

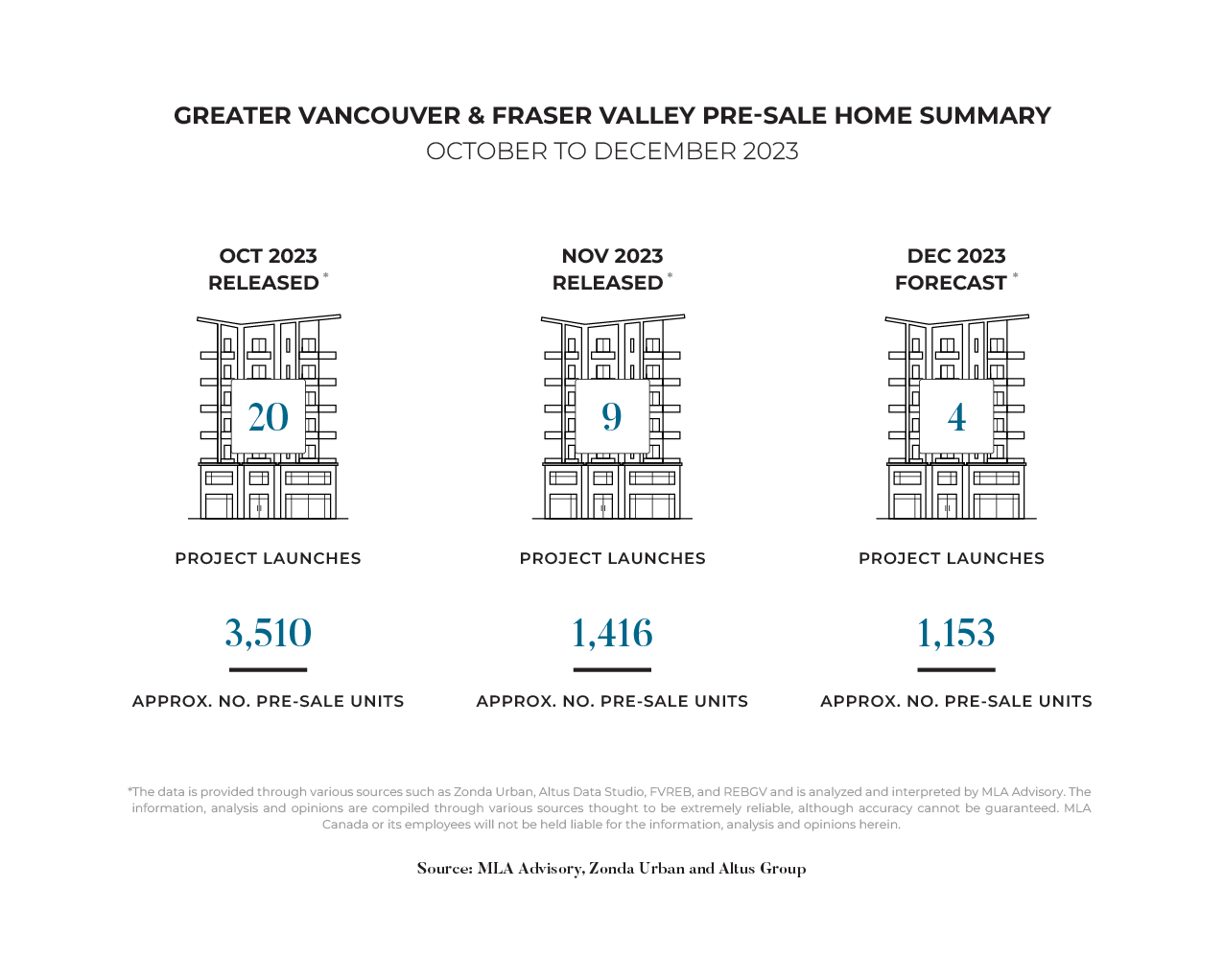

Over the last quarter of 2023, the Metro Vancouver presale market saw the launches of 33 projects containing over 6,000 units of new supply. In the context of today’s market conditions and expectations for 2024, this is a substantial volume of products that will certainly test the depth of the market.

The results have been mixed – with a great disparity in levels of success across various projects. Well-positioned products, often from experienced, established, and well-financed developers, have transacted significant volume over the past quarter. Projects such as Fraser Mills and High Street Village sold the majority of available inventory within the first month of launch. At the same time, several projects have floundered – with sales teams citing some of the most difficult launch experiences in recent memory. The difficulty has been enough to make programs like Metro 21, which had already begun promotional campaigns for a Fall launch, pull back and delay into 2024.

Projects that are seeing success typically have a few elements that provide them an advantage in the current market. In a slower season like the winter, foot traffic is diminished, but the quality of buyers is increased. Buyers that do come through sales centres during this time are often highly motivated to make deals. Therefore, programs with an experienced sales team, deep connections with realtors, a strong reputation in the local community, and an extensive database are best able to attract traffic and capitalize during this time. Further, well-financed programs are seeing a strong response to offers such as low deposit structures – often as low as 5%. Finally, various larger, master-planned communities have an advantage by focussing on volume over revenue – aiming to sell out the first phases of a project quickly at a discounted rate, generating excitement and with hopes to make up that revenue on the back-end as conditions improve into 2024.

THE SUB-5 MORTGAGE

While the Bank of Canada has yet to pull the trigger to cut the overnight rate, mortgage shoppers across Canada already see lower rates offered. Bond yields have continued to drop since October, with banks now offering a sub-5% fixed 5-year mortgage rate option – the first time since last Spring. This is welcome news for buyers facing completion or renewals and will serve to lessen the mortgage shock filtering into the market. At the same time, rates remain elevated and will need to drop substantially more to bring back favourable conditions.

While the five-year fixed is currently the lowest rate offered, due to decreased risk for lenders, buyers are rapidly shifting their mortgage habits in response to expectations. In 2021, over 50% of homeowners opted for a fixed rate; over the past quarter, that number has been less than 5%. This reflects a widespread consumer belief that interest rates will continue to decline in the short- to medium-term.

AN EYE TOWARDS THE NEW YEAR

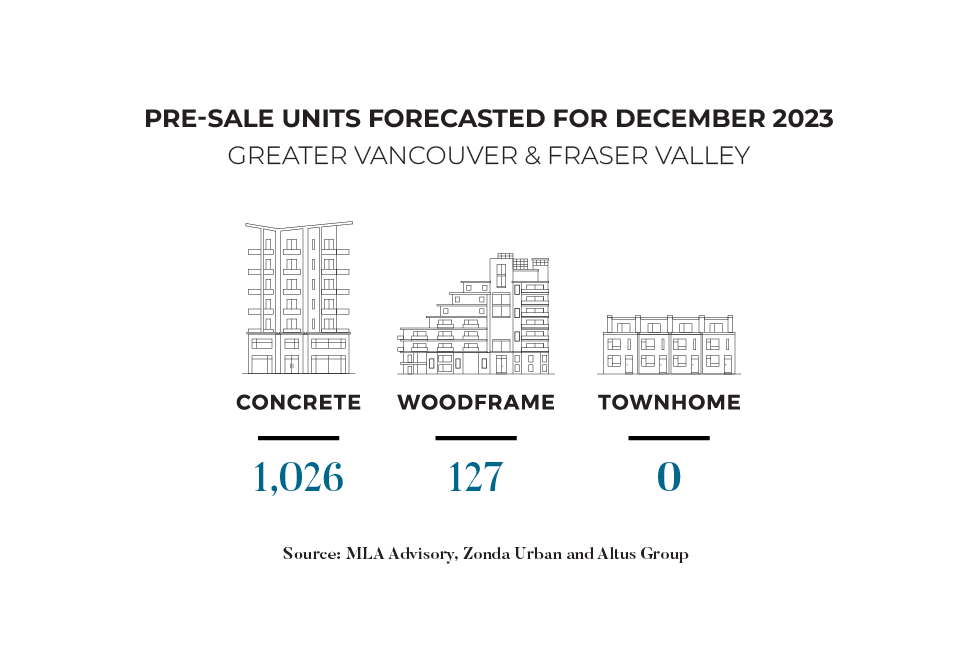

MLA forecasts the launches of four programs in December, bringing approximately 1,150 units to market. These programs include South Yards by Anthem, which is releasing Tower B following success with their first building, and Town & Centre by Mosaic Homes, which is expected to be the first presale opportunity in Coquitlam Town Centre in over five years.

While launch activity is greatly diminished from October and November, current levels align with December's expectations. Per MLA’s conversations with developer clients and industry leaders, several programs are internally gearing up for a Lunar New Year’s push. The season is expected to be marked by the launches of several programs that were placed on hold since Spring 2023 and by aggressive incentive offerings by already active programs looking to clear out inventory.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, presale, and resale market video report, Presale Pulse.

Subscribe to the MLA Canada YouTube Channel or find the Pre-Sale Pulse on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio.