JANUARY PRE-SALE REAL ESTATE MARKET INSIGHTS

“The Lunar New Year sales sprint this year in the presale market did not disappoint – with several programs offering aggressive incentives and reporting strong resulting absorptions to match. Many buyers are now actively re-entering the market and searching for well-positioned programs with attractive incentives. We will be following closely over the coming months how developers respond to this heightened interest in the context of a slower market.” Suzana Goncalves EVP, Sales and Marketing; Partner, MLA Canada

NEW YEAR, NEW PROGRAMS

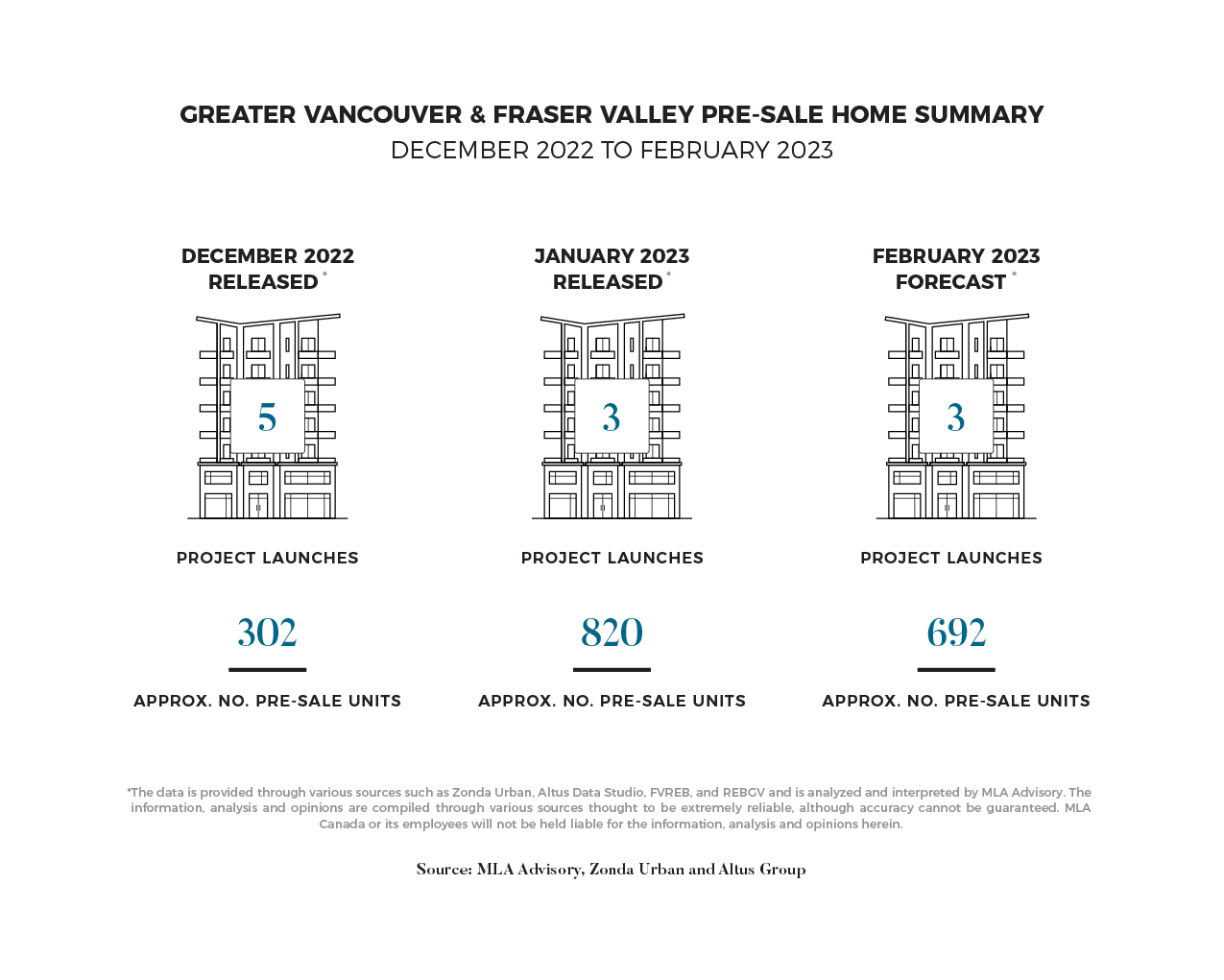

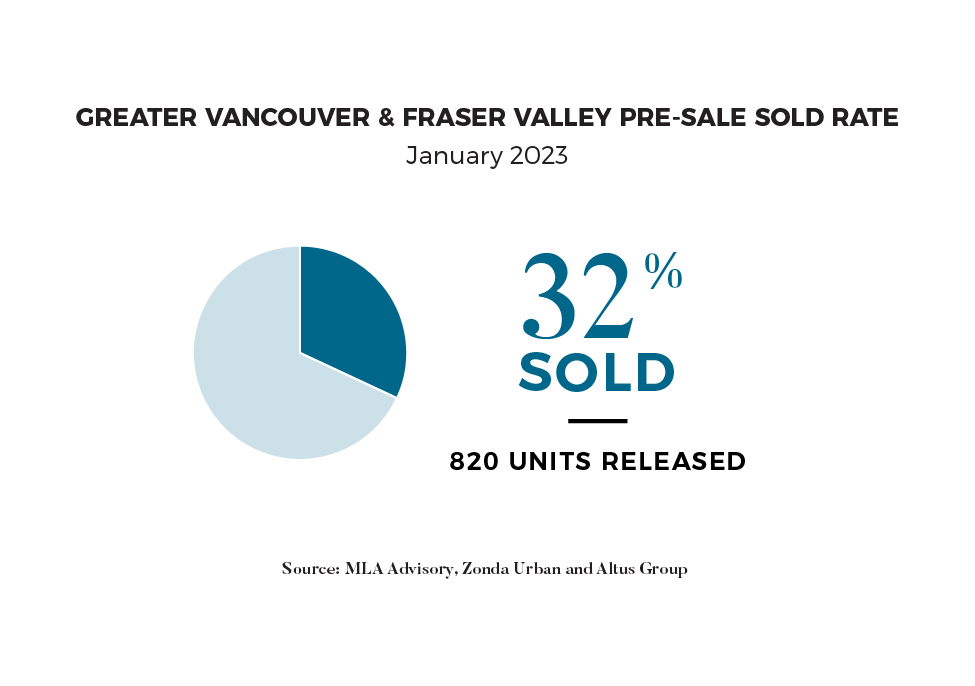

January saw the launches of three presale projects – a continuation of the “hold and see” trend from developers as they gauge the strength and health of the market before proceeding with their developments. While this activity was relatively limited, programs that did launch garnered considerable interest. For example, South Yards by Anthem was heavily marketed as part of its “Master Plan” program and finally came to market this month. Early indications suggest that approximately 30-40% of its inventory sold at just under $1,250 PPSF. A robust same-month absorption rate in the context of a slowing market and a typically quieter time of the year. Likewise, Lucent by Landa Global Properties came to market in Surrey and similarly achieved 35% of inventory in recission within the first month of sales. The relatively strong performance of these programs should give other developers on the sideline increased confidence to come to market.

In addition to these program launches, January saw several ongoing programs reactivating to capitalize on the Lunar New Year period. Several programs approached the holiday period aggressively – offering high cash-back credits, low deposits, and various other purchaser incentives. In return, we have seen these programs rewarded for their proactivity – multiple towers in the Burnaby and Coquitlam markets, for example, advertised absorbing 20-30 and as many as 80 homes since releasing their incentive programs.

BANK OF CANADA: THE LAST HIKE

Last year in this report, we covered at length the record-breaking interest rate hikes that would quickly become the dominant storyline in the real estate market. Now a full eight hikes and 425 basis points later, the new language from the Bank of Canada indicates the strong possibility of a pause. Governor Macklem reiterated that if the economy in the coming months develops in line with their current forecasts, the Bank now sees no further need for hikes. So what does this mean for our market?

Firstly, it’s important to note that despite the substantial shift in tone, The Bank of Canada cannot rule out the possibility of further rate hikes. If the economy does not cool as much as the BOC models currently predict, there is no question that the Bank will proceed with further policy action.

Assuming the outlook develops in line with their projections, we should see confidence and stability restored to the market for both buyers and developers. The environment of unpredictable, brisk rate hikes meant that financing costs could vary drastically over a short period. For many, this uncertainty was a sufficient deterrent to entering the market. However, as the effects of a pause filter through the market, we expect to see a lift in demand in the market.

On the other hand, it’s important to note that a pause does not mean a pivot, and we do not expect the BOC to begin rate cuts in the near term. Those who face affordability and the difficulty of acquiring a mortgage will likely continue to experience challenges for the remainder of the year. Likewise, sellers who are disincentivized from listing their homes because it will mean they have to secure a new mortgage rate at a higher rate will continue to face the same deterrents. Whether this will indeed be “the last hike” remains to be seen – but regardless of direction, BOC policy will continue to impact our market heavily.

THROUGH THE GRAPEVINE

As we begin to look forward to the Spring season in our market, one of the pressing questions will be the extent of launch activity that we can expect in the coming months. Anticipating the launches of programs in our current market have, at times, been a challenge – we have seen several programs begin their marketing campaigns only to go on hold in response to the market. One such program is Riviera by Ledingham McAllister, which began marketing in the Spring of last year before going quiet. However, it is possible that Riviera could come to market in the coming months if the performance of related projects remains strong.

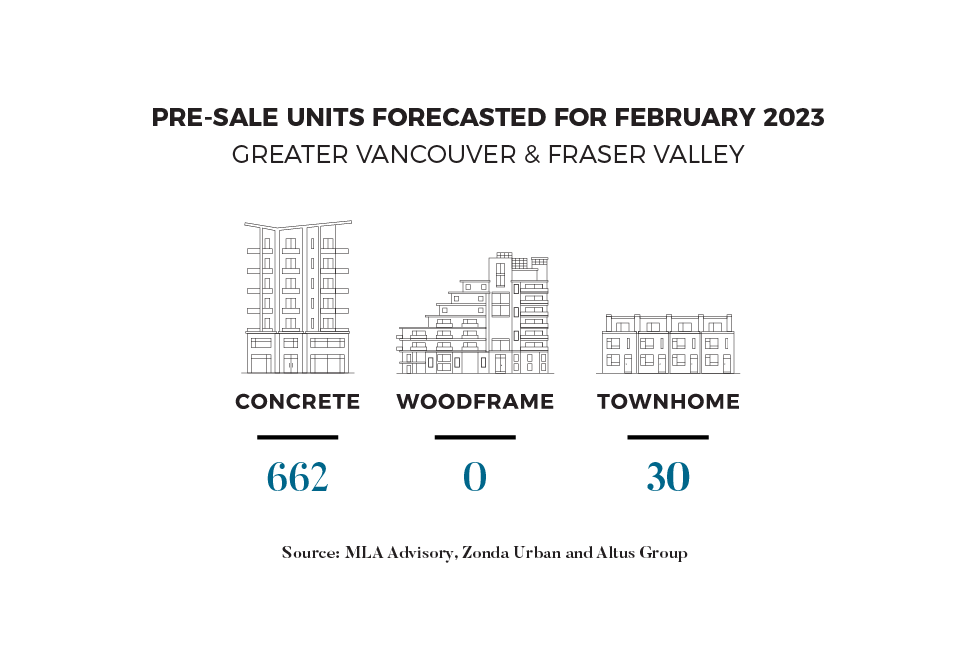

To this extent, monitoring the rumour mills and listening closely through the grapevine has been critical to forecasting upcoming launches. We have heard, for example, that Curv by Brivia Group, a program we have monitored for some time, intends to come to market next month. Similarly, Perla by Polygon is actively marketing and will likely launch in the coming weeks. In total, MLA Advisory forecasts the launches of three programs in February for a total of 692 units to come to market.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, pre-sale, and resale market video report, Pre-Sale Pulse.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, pre-sale, and resale market video report, Pre-Sale Pulse.

Subscribe to the MLA Canada YouTube Channel or find the Pre-Sale Pulse on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio