"The holiday months are typically quiet as sales galleries close and kids are off for Winter Break. This year was no exception, and it shows in the data. As we enter a new year in the presale space, developers remain challenged with the same themes from last year – mainly high costs to deliver and wavering buyer confidence. The first test of market depth will occur around Lunar New Year, with themed purchase incentives and marketing campaigns attempting to capitalize on new year cheer.” - Garde MacDonald, Director of Advisory

MISTLETOE AND MARKET LOWS

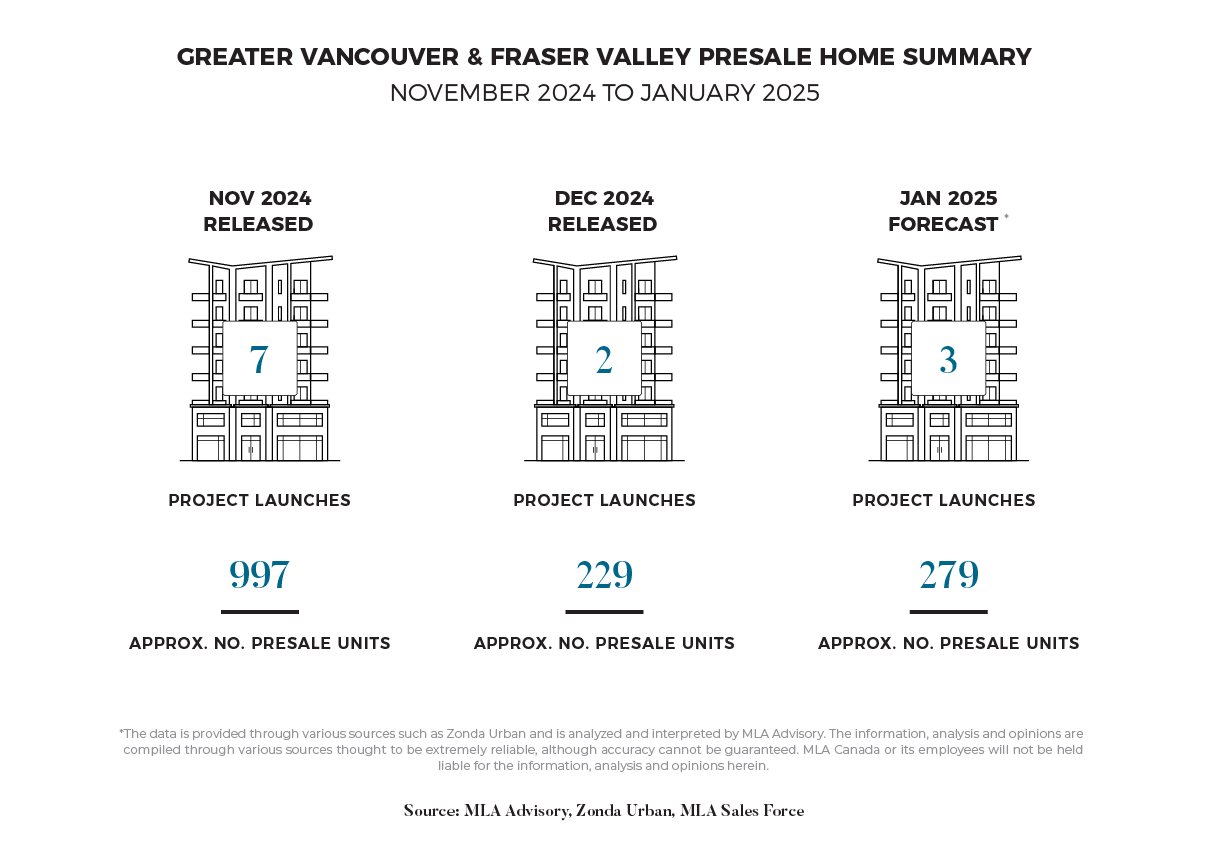

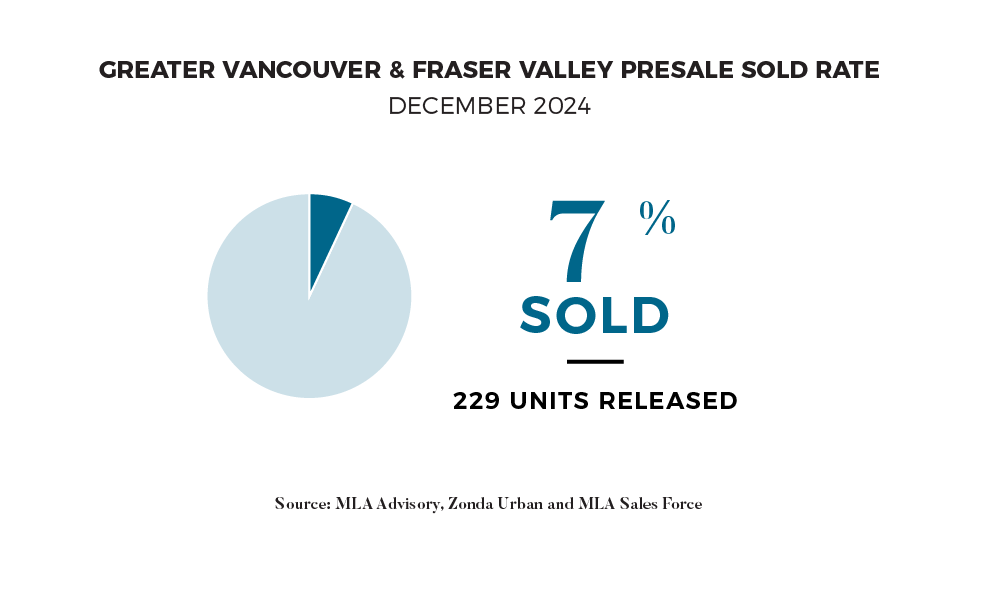

December followed the usual seasonal trends, with the presale market slowing as the holidays took centre stage. Developers typically hold off on launching new projects during this time, as demand softens, and holiday festivities take precedence. As a result, only two projects were introduced last month, releasing a total of 229 units. These projects saw a modest absorption rate of around 7%, reflecting the slower market and heightened buyer selectiveness. This marks the lowest absorption rate since December 2020.

Many presentation centres closed for the final weeks of the year, but a few stayed open by appointment, offering Boxing Day incentives—often repackaged from earlier promotions—to capture any remaining buyer interest. With several projects delaying their year-end launches, more inventory is expected to hit the market in the New Year. As interest rates continue to decline and incentives remain enticing, we anticipate a wider range of options for buyers looking to take advantage of current market conditions.

NEW YEAR, NEW FEES

Starting January 1, 2025, the Metro Vancouver Regional District (MVRD) will implement significant increases to Development Cost Charges (DCCs), with additional hikes also planned for 2026 and 2027. These fee increases will apply to new developments and are intended to fund vital infrastructure projects, including higher charges for water and liquid services, as well as the introduction of a new Parkland Acquisition DCC. DCC fees will vary depending on location, with apartment charges expected to rise by $11,360 to $14,657 per unit by 2027, marking an increase of up to 235% compared to the current rates.

With rising costs in an already challenging presale market, developers are struggling to reach the construction phase and maintain profitability. The current economic climate, combined with the recent increase in Development Cost Charges, will likely result in developers passing these costs onto end users. This could reduce the number of viable projects, slow the delivery of new supply, and further exacerbate affordability issues for both buyers and renters.

STEADY STRIDES IN 2025

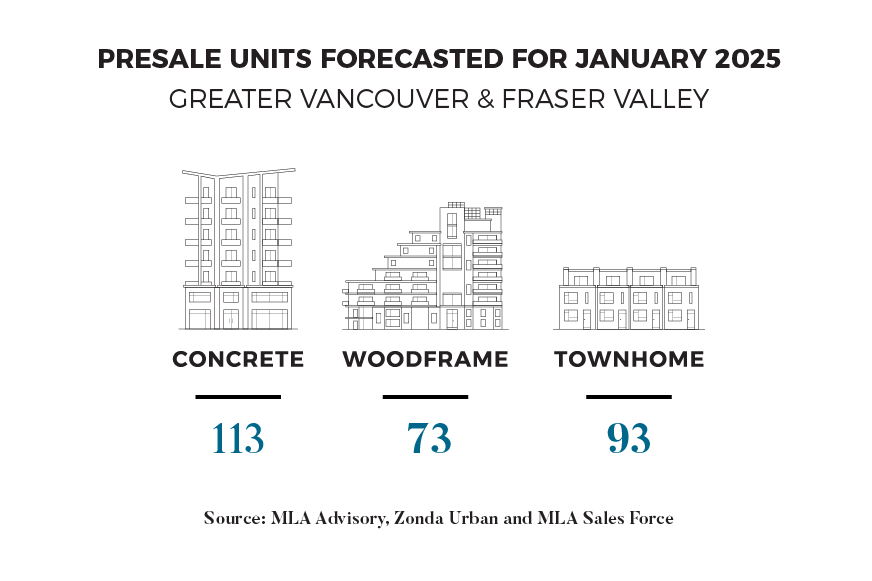

In January 2025, three projects are set to launch, releasing 279 units, in line with the slower pace seen in December. While buyer sentiment is expected to gradually improve as we enter the New Year, developers are likely to continue taking a thoughtful approach when releasing new product. Looking further into 2025, the challenges faced by the presale market in 2024 are anticipated to persist. MLA forecasts that, while the number of projects coming to market may increase slightly, the overall number of units released will remain lower. The market’s shift toward smaller-scale low-rise developments seen in 2024 is expected to continue into 2025, driven by limited investor interest and end-user demand as the primary market forces.

The resale market in 2024 was generally quiet, with the year marking a significant turning point as interest rates gradually declined. In December, sales continued to dip, although they still surpassed the previous year's low point. Throughout the year, supply continually exceeded demand, creating a scenario where slight price reductions had minimal effect on buyers and didn’t deter sellers. The market remains balanced, with buyers having an edge due to the wide range of available options. Looking ahead to 2025, while it will take some time for supply and demand to align, the market is well-positioned for increased buyer activity.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, presale, and resale market video report, Presale Pulse.

Subscribe to the MLA Canada YouTube Channel or find the Pre-Sale Pulse on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio.