February 2022 Pre-Sale Real Estate Market Insights

THIS EPISODE IS NOW AVAILABLE IN AUDIO

Listen on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio

"The pre-spring market is now fully in swing, and last month did not disappoint. We saw 2,318 presale homes come to market in February – 59% of which absorbed within the month. This is incredibly active – even for this time of year. Although our market saw strong increases in active inventory, up 19.1% month-over-month in February, we are still in a historically low inventory environment throughout many markets within the Greater Vancouver and Fraser Valley regions. As we have been saying for some time now, demand continues to outpace supply and last month was no exception." – Suzana Goncalves, EVP, Sales and Marketing, MLA Canada.

METRO VANCOUVER CONTINUES TO EXPERIENCE WHITE HOT MARKET & SURREY CITY CENTRE SEES HISTORIC PRESALE PRICING

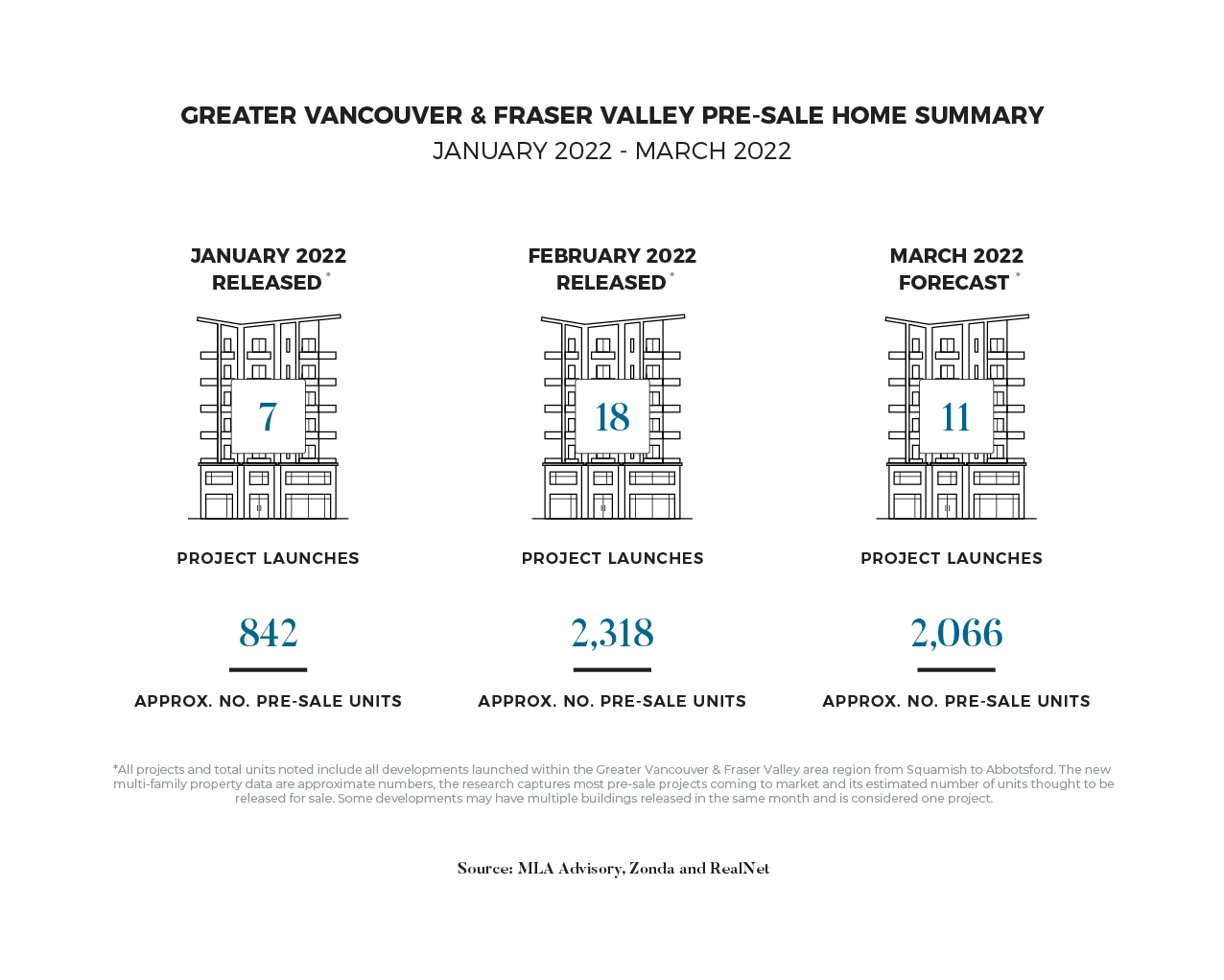

February was characterized by heightened presale launch activity as our market transitioned from the slower winter months into the Spring market. In total, 18 projects launched in February, releasing 2,318 units to market – 38% more than the same period last year. Several programs that had been marketing before the new year saw significant market absorptions – leading to strong same-month sales for the market as a whole (59%). Concrete product was especially active – making up 55% (1,291) of released inventory and achieving a same-month absorption of 70%. Aspect, the first tower in Bosa Properties Parkway development in Surrey City Centre, saw same month absorptions of 88% and achieved a blended average PPSF of approximately $1,100. While its blended PPSF is elevated because the stratified residential portion of the building doesn't start until the 18th floor, it shows investors' confidence within the Surrey market. Presale condominium product in Surrey City Centre is now priced at or above several active programs in West Coquitlam. With projects such as Concord Pacific's 'The Piano' preparing to launch at $1,200 PPSF in Surrey City Centre later this year, the relative values between the Greater Vancouver and Fraser Valley markets are continuing to blur.

RENTAL VACANCY RATES RETURN TO PRE-PANDEMIC LEVELS

According to the Canada Mortgage and Housing Corporation (CMHC) report, vacancy rates in BC's urban areas were cut by more than half as markets across the province continue to feel a significant rental crunch. The change stands in stark contrast to other population centres such as the Toronto region, where vacancy rose to 4.6% in 2021. At its worst in 2020, Metro Vancouver saw the highest vacancy rates in 21 years as the realities of the global pandemic forced Canadians to adjust their lifestyles – often away from urban population centers, to meet changing needs. But as Omicron slows and restrictions lift, a rebound in immigration, returning out-of-region students, and strong economic growth drove vacancy rates back to pre-pandemic levels, from 2.6% in 2020 to 1.2% in 2021. Data from a recent census shows that all surveyed areas in BC saw the number of new permanent residents increase to above pre-COVID levels. In contrast, the number of international students admitted between October 2020 and August 2021 increased by over 44% compared to earlier during the pandemic. Vancouver continues to have the highest rents in Canada, with the average asking rent for vacant units 21.4% higher than the overall average rent for occupied units. The high cost to rent suggests landlords are taking advantage of strong demand by aggressively raising prices, which will likely continue to fuel the already strong investor presence within Metro Vancouver's presale market.

METRO VANCOUVER PREPARES FOR ACTIVE SPRING MARKET

With sales momentum high, available supply low, and the threat of consecutive rate increases looming overhead, developers are now ramping up marketing for what is expected to be an especially active Spring market. While we’re unlikely to see the historic sales activity that occurred in March of last year, buyers continue to remain motivated to enter the market. In March, MLA Advisory is forecasting 11 presale launches that will bring 1,991 condominium and 75 townhome units to market.

We want to hear from you! If you have a real estate question that you'd like us to talk about in our next Pre-sale Pulse, submit your questions to us.