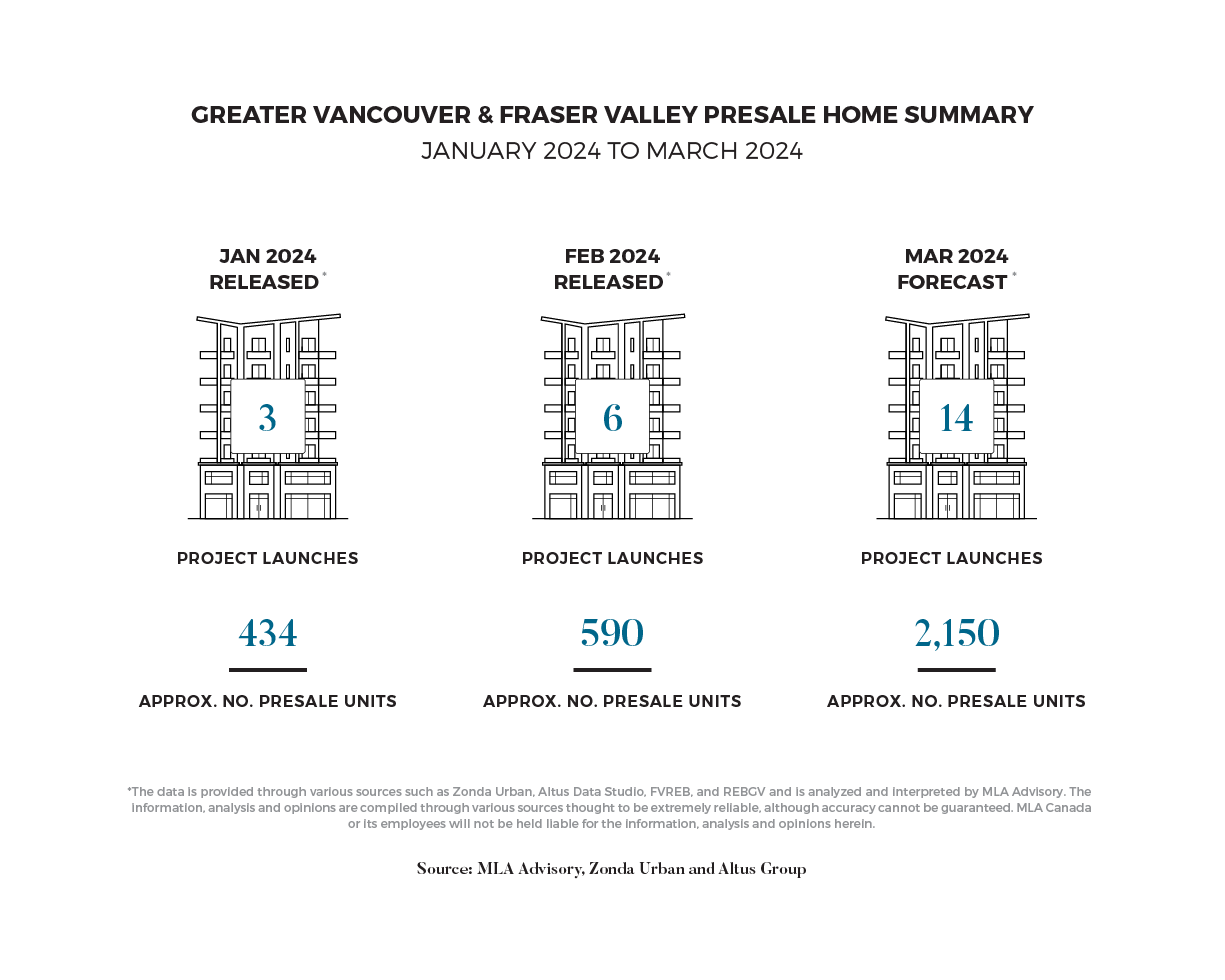

“In line with the resale market, the volume of new presale supply increased month-over-month, matching typical seasonality. On our active sites, foot traffic and deal activity are generally increasing, giving us confidence going into the Spring. We anticipate new project launches to double from February to March and give us an indication of market breadth for the remainder of 2024.” - Garde MacDonald, Director of Advisory

FEBRUARY EXCEEDS EXPECTATIONS WITH STRONG SAME-MONTH ABSORPTIONS

Six presale programs launched in February, bringing a total of 590 homes to market and achieving a 42.2% same-month absorption rate. A noteworthy launch is Juno, marking the debut of the year's first concrete tower in Surrey. After weeks of early previews, Juno came to market with 50% of inventory sold, achieving strong initial sales.

Similarly, the Partington Creek development on Burke Mountain commenced sales between late January and early February. Its opening release introduced 24 homes to the market, many of which can be found on MLS. In an effort to kick-start sales with compelling messaging, the initial pricing strategy for these homes was set at an average of $700 PPSF. While homes are large at around 2,000 sq ft, this pricing positions the project competitively within the market, offering attractive value in comparison to other options available to homebuyers.

TRIALS AND TRIBULATIONS: THE OKANAGAN MARKET NAVIGATES SHIFTING DEMAND AND INCREASED RENTAL RESTRICTIONS

The Okanagan real estate market in 2023 showcased a period of correction with dynamic shifts influenced by broader economic factors. Throughout the year, 13 new projects initiated presales, releasing 1,319 units into the market. Of these, 43% were absorbed, resulting in 565 sales, reflecting a healthy market response. The majority of these projects were centered in the Central Okanagan, with a significant number located in downtown cores and surrounding areas. Wood frame constructions dominated the launches, appealing to buyers looking for entry-level pricing or investment properties, although investor sentiment slightly shifted following the announcement of new short-term rental legislation by the Provincial Government in October.

Resale activity in the Central Okanagan, including Kelowna, experienced a downturn, with total resales dropping by 27% compared to 2022 and by 50% compared to 2021, influenced by rising interest rates and changes in work-from-home policies. Despite these challenges and the impact of significant wildfires, the market remained resilient, buoyed by the region's high quality of life and growing population.

The forthcoming short-term rental restrictions, effective May 2024, aim to improve housing supply and affordability but pose challenges for the tourism industry and the broader community. As the market anticipates potential shifts in interest rates and policy impacts in 2024, the Okanagan real estate sector stands at a crossroads, facing both opportunities and challenges in maintaining its appeal and vitality.

MARCH MADNESS BRINGS WAVE OF NEW LAUNCHES

The Spring market is typically the busiest time of the year for real estate, and it appears that 2024 won’t be an exception. 14 presale programs are expected make their debut in March, introducing as many as 2,150 units to the market. It comes as no surprise that the bulk of these homes will be concrete condominiums, with significant launches including Reign by Wesgroup’s north tower, Ethos by Anthem, and Bosa’s Parkway 2 in Surrey.

Amidst a backdrop of strong competition within the market, developers are looking for ways to differentiate themselves through the crafting of distinctive narratives and imaginative launch promotions. A notable example includes Reign’s ‘‘Ticket to the Top” campaign—a clever twist on Willy Wonka’s golden ticket. Prospective buyers who buy on lower floors stand a chance to win an upgrade to the penthouse of their chosen bedroom type. An incentive like this creates buzz and leaves a memorable impression.

Overall, the sentiment among developers remains tepid. There are far too many uncertainties and not enough guarantees in the current market environment. Sights remain primarily on the latter half of this year when interest rates are expected to decline and, with it, bring renewed sales activity from pent-up demand.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, presale, and resale market video report, Presale Pulse.

Subscribe to the MLA Canada YouTube Channel or find the Pre-Sale Pulse on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio.