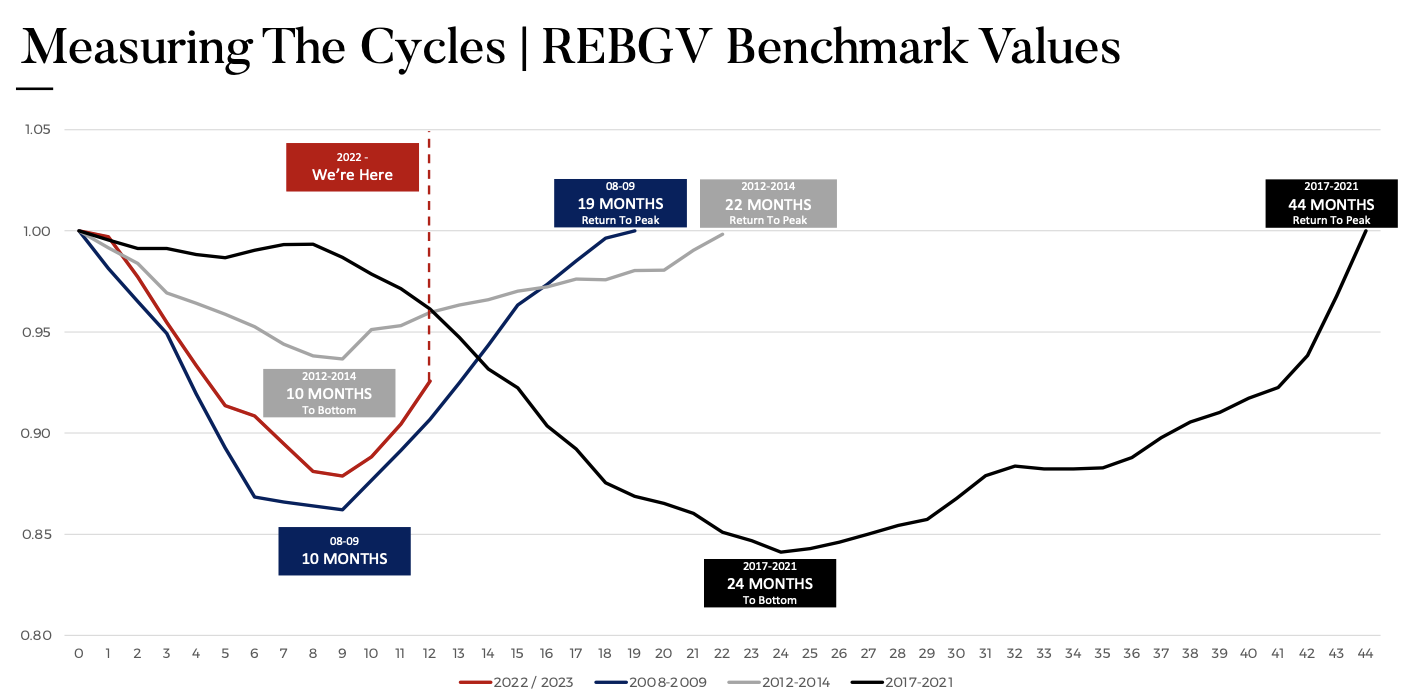

In our industry, forecasting market trends and potential recovery patterns is a pivotal tool for potential buyers, sellers, and investors. Last year, the focal point of such forecasts centered on understanding the impending market slowdown: its duration, its depth, and its overall impact on the industry. The conversation this year has taken a decisive shift towards the anticipated recovery: what that might look like, when it might commence, and - most importantly - how it might evolve. To help answer these key questions, the MLA Advisory team applied its ongoing mandate to a comprehensive deep dive into numbers, historical trends, and past recoveries. Their data stretched across two decades, analyzing all major corrections and scrutinizing the time it took for each market correction to hit the lowest point (the trough), and the subsequent period it took to recover to the previous high (the peak). This analysis revealed two particularly applicable insights.

Downturn Durations Match Recovery Timelines

The first finding highlights a strong correlation between the length of a downturn, or correction phase, and the corresponding duration of the recovery phase. The ratio of recovery to downturn was found to be approximately 1 to 1. This essentially demonstrates that, historically, if a market endured a 10-month downturn, it generally required around 11 months to return to its former peak. This correlation was observed to be remarkably consistent across all major cycles of the past, including those in 2008, 2012, and 2017. Considering that this is, so far, lining up in our current cycle, we could potentially see prices reverting to their 2022 peaks by early 2024. Of course, this projection rests on the critical assumption that we have truly reached the bottom of this cycle, a conclusion that remains uncertain.

Swift Price Rebounds Observed Post Correction

The second finding addresses the path that real estate prices tend to follow after a strong correction. Historical data indicates that post-correction, prices recover at a similar rate to their decline, rebounding swiftly. All major correction cycles in the past 20 years have witnessed subsequent major rebounds followed by an extended plateau, providing ample evidence that prices in our market bounce back quickly. To translate this finding into practical advice, potential buyers should exercise caution while attempting to perfectly time the market. Given the rapidity of market rebounds, waiting for the 'perfect' moment could mean missing out on the opportunity altogether. Our analysis suggests that as soon as prices begin to recover, they will do so at a pace that may make it too late for on-the-fence investors to capitalize on the recovery.

Investment Strategy: Timing and Long-Term Vision

This insight holds relevance for those who continue to hesitate, wondering why they should commit to an investment in the face of current uncertainties. Our data suggests that today is the best time to buy in the next five years. The reasoning is simple: five years from now, real estate is unlikely to be any cheaper than it is today. The same advice we gave last year holds good today; despite uncertainties, the potential benefits of a robust recovery make a compelling case for immediate investment. MLA Advisory utilizes a careful balance of leveraging historical data and understanding present-day market dynamics to make insightful predictions about the future. While historical trends offer significant insights, it should be noted they are not infallible predictors of future market behavior. However, the correlation is statistically strong enough that past cycles provide valuable information and insight into what might lie ahead. These findings should be utilized as guideposts for informed decision-making rather than treated as absolute guarantees.

Understanding market rhythms and their implications can be the deciding factor between a missed opportunity and a strategic investment. Using these insights as our compass, we can navigate the ever-changing real estate landscape, make informed predictions, and position ourselves optimally for the impending recovery phase. While the best time to invest might be now, it's also crucial to keep in mind that perfect timing in the market is nearly impossible to achieve. The key is to stay informed, be prepared, and make the best decision with the information at hand.