DOWNLOAD THE 2018 MARKET INTEL

A new year means a new Market Intel report prepared by our Advisory division. Our dedicated team of advisors and industry-leading professionals tirelessly analyze market trends and study consumer demand to compile the latest report. The Market Intel analyzes the outgoing year, current market conditions and provides a forecast for 2018, including global economic trends and a focus on Canada and Greater Vancouver. Report highlights include new statistics on the local pre-sale market, the impact of the city entitlement process and the increase to land and construction costs.

“BC’s economy will continue to thrive in 2018. Although NAFTA negotiations could have a major impact on the nation, BC’s exports only account for 8 per cent of Canada’s total exports compared to Ontario at 44 per cent,” explains Cameron McNeill, Executive Director of MLA Canada.

Affordability was an issue across much of Canada in 2017 and remains so in 2018, due to tighter lending regulations and the restricted land supply’s inability to keep up with demand. This continued upward pressure on price places demand on the market for an increase in housing options with emphasis on new condos and apartments.

In the City of Vancouver, compliance costs for developers are extremely high, equating to nearly $78,000 per new home being built. Contrary to recent rhetoric, all of these costs, whether Community Amenities Contributions, transit levies, or policies requiring fees, eventually get passed to the consumer, adding additional pressures to the debate around affordability.

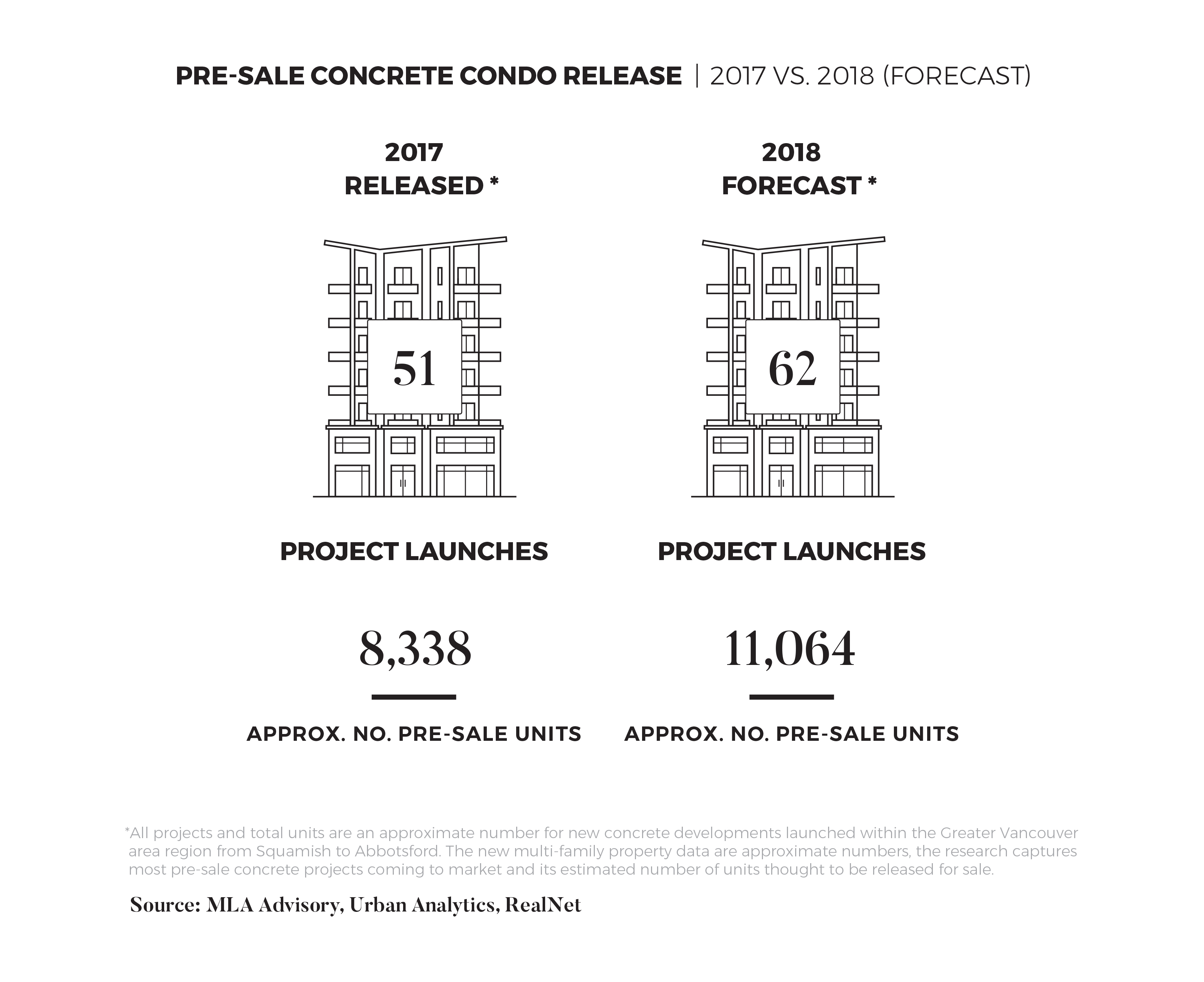

PRE-SALE MARKET EXPECTING OVER 11,000 NEW UNITS IN 2018

Though BC is expected to see a decrease in housing starts, the concrete condo market in the Lower Mainland is expected to see 62 projects and 11,064 units, an increase of over 33 per cent compared to 2017, which is largely due to a number of projects being delayed in their approvals process from the previous year.

Burnaby will continue to have the most concrete supply with an estimated 4,500 new units coming to market this year.

“Sales activity for multi-family developments will remain strong throughout 2018,” shares Suzana Goncalves, Chief Advisory Officer at MLA Canada. “Although we are expecting slower absorptions than 2017 and more sustainable price escalation closer to 8 to 10 per cent.”

FORECASTING THE YEAR AHEAD

Market fundamentals indicate 2018 to be a stable and positive year. GDP, job growth, consistent population and housing starts, plus nominal interest rate changes all maintain consumer confidence and a natural flow of investment. The largest threat to this forecast is the political landscape.

Looking ahead, uncertainty around government policy intervention to cool housing costs in Vancouver and Toronto, along with U.S. impacts on the North American Free Trade Agreement could cause significant shifts in our 2018 outlook. MLA Advisory will continue to monitor real estate trends throughout 2018 releasing regular updates to ensure the industry and our clients are kept abreast on the latest market information.

To read our full Market Intel, please click here.