The MLA Black Book is a quarterly detailed overview of the pre-sale real estate marketplace spanning the Greater Vancouver and Fraser Valley regions. This market intelligence is brought to you by MLA Advisory and covers pre-sale sales results, including active sub-markets, development and rezoning application activity, project launches, and upcoming releases to look out for in the next quarter.

MLA Advisory's Market Update

Over the second quarter of 2023, a resilient Metro Vancouver real estate market continued to march forward to the tune of its own music in defiance of a steady chorus of opposing macroeconomic pressures. Just as the Bank of Canada was ending a four-month pause in rate hikes with a 25 bp increase, the resale market posted its sixth month of consecutive price appreciation – far outstripping any previous forecasts for values this year. Resale condominium prices in Greater Vancouver have now nearly reached the peak values in 2023, a marker of the strength of the rebound thus far.

The backdrop to the positive direction of the real estate market is the continued economic shifts and one of the most elevated lending environments on record. While global disruptions to commodity prices have eased and supply chains continue to see improvements, a robust job market and high consumption levels remained convincing motivators for further action from the BOC. With some irony, inflation pressures are increasingly driven by rising rent costs and mortgage debt servicing.

The backdrop to the positive direction of the real estate market is the continued economic shifts and one of the most elevated lending environments on record. While global disruptions to commodity prices have eased and supply chains continue to see improvements, a robust job market and high consumption levels remained convincing motivators for further action from the BOC. With some irony, inflation pressures are increasingly driven by rising rent costs and mortgage debt servicing.

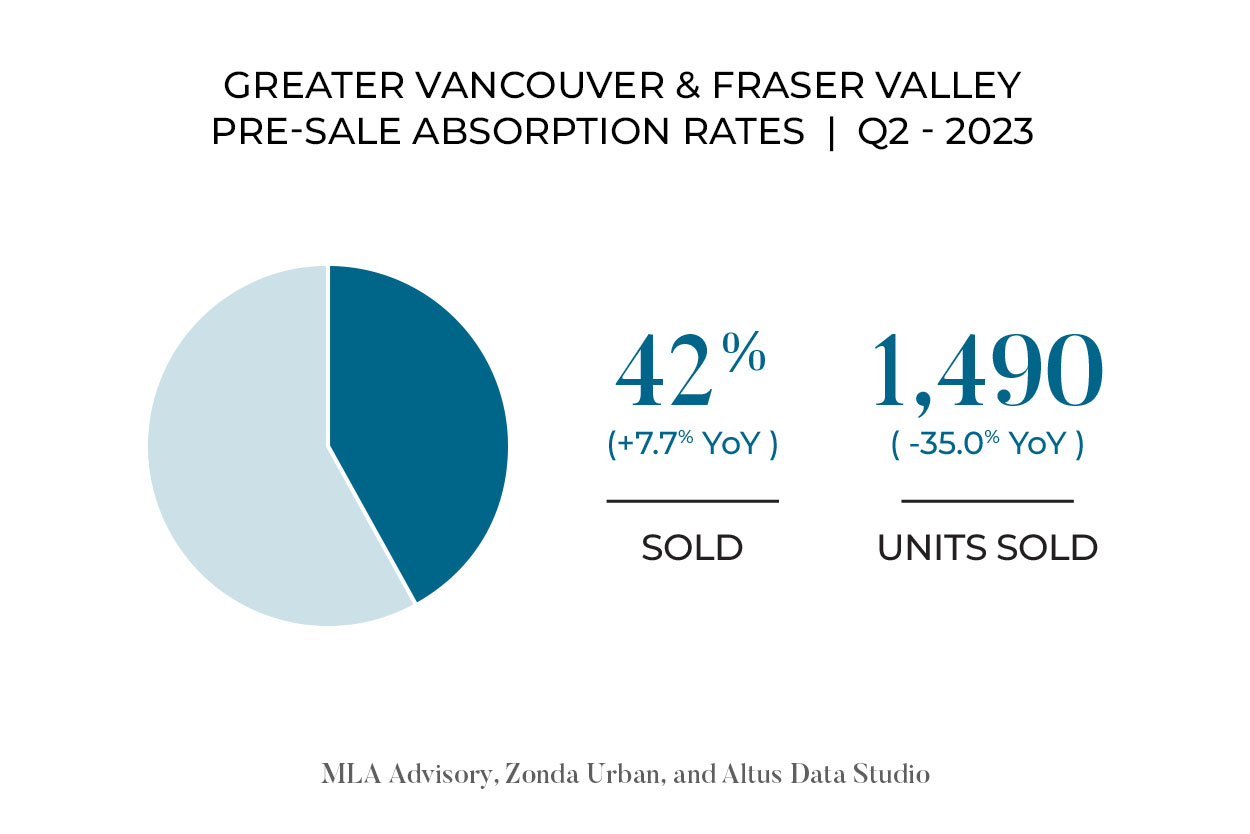

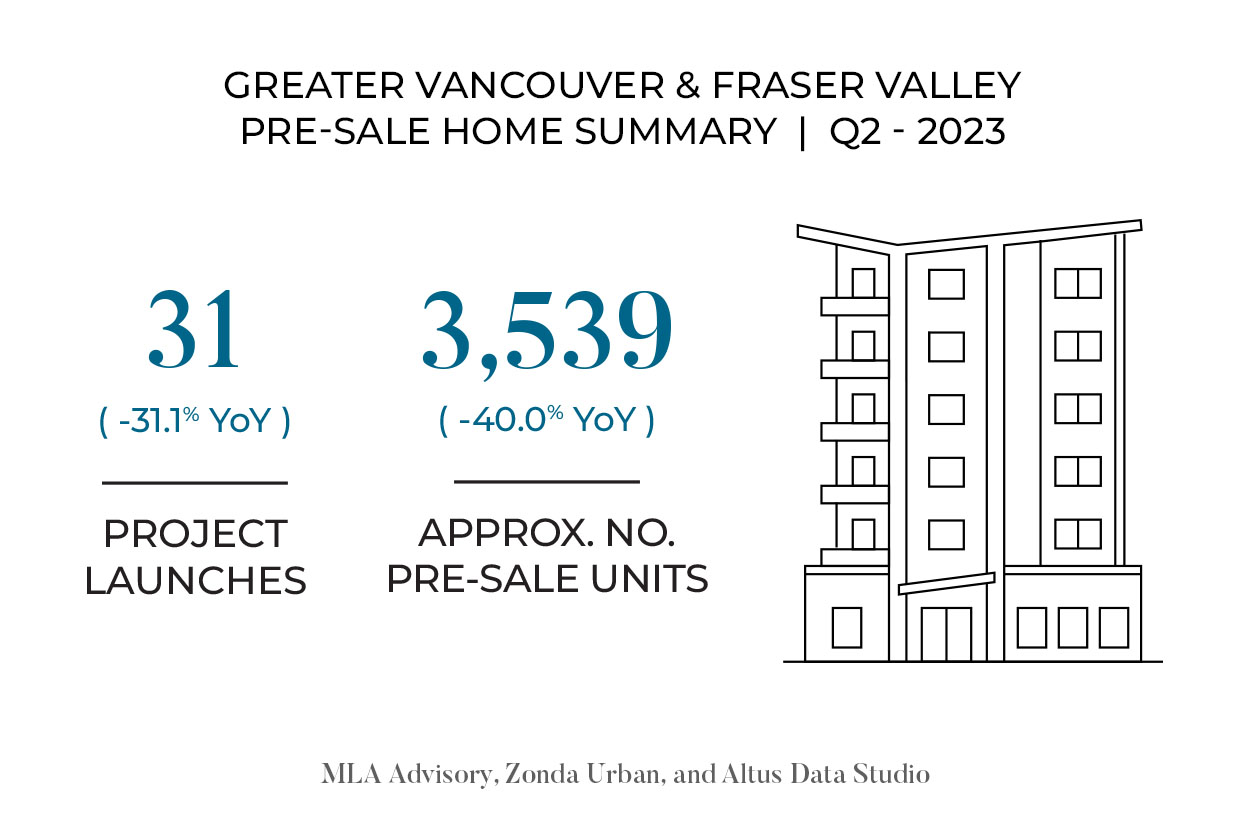

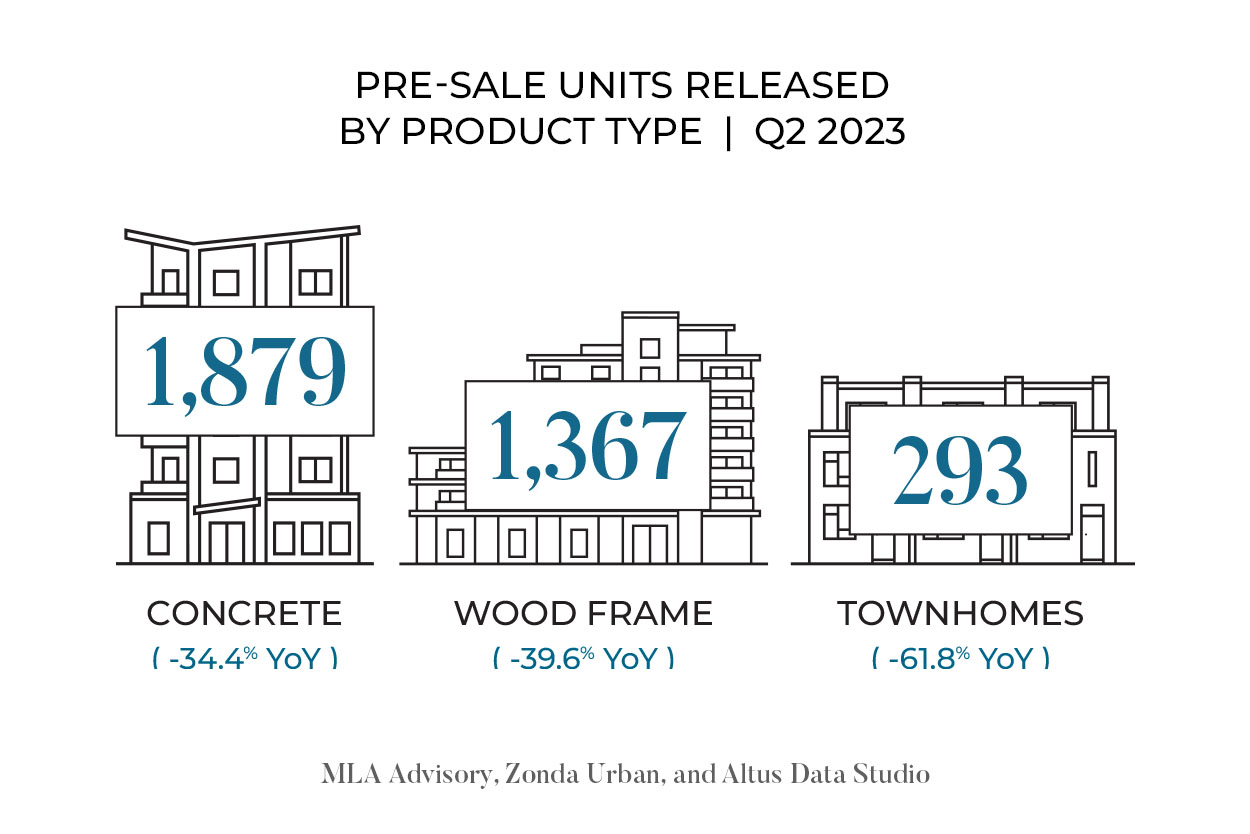

In the presale market, Q2 saw the launch of 31 projects, bringing 3,539 units to market across Metro Vancouver. Unlike in recent years, where market activity peaked in March before seeing a precipitous drop in activity in the months after, the Metro Vancouver presale market’s temperature continued to rise through the Spring market before a slight decline in June. The rising demand experienced over the quarter was especially favorable for developers who launched earlier in the year and could fully capitalize on the rising wave of home sales that have occurred so far this year.

Investor-owners remain a key buyer group in the presale market, accounting for 70-80% of the presale purchasers in tower programs. With the rise in interest rates and prices, these buyers are adjusting their preferences to minimize negative cashflows once the projects are complete. Their emphasis on programs that provide longer completion dates and attractive incentives is particularly noteworthy. The strongest demand among these buyers is for products that offer features enhancing achievable rents, such as parking, storage, and direct access to a SkyTrain station. These elements have proven to be highly sought after in the market.

The coming months look to be increasingly characterized by a symphony of competing and often discordant market forces. On the one hand, Canada’s population recently surpassed the 40 million milestone, driven by natural appeal and aggressive federal targets, positioning Canada to fare better than other developed countries, potentially even “outgrowing” an upcoming recession. Yet in another sense, the market forces in play during the downturn last year are very much still present and have yet to realize the full impact they have on the market.

For information on active sub-markets, development and rezoning application activity, project launches, and upcoming releases to look out for in the next quarter download the report.