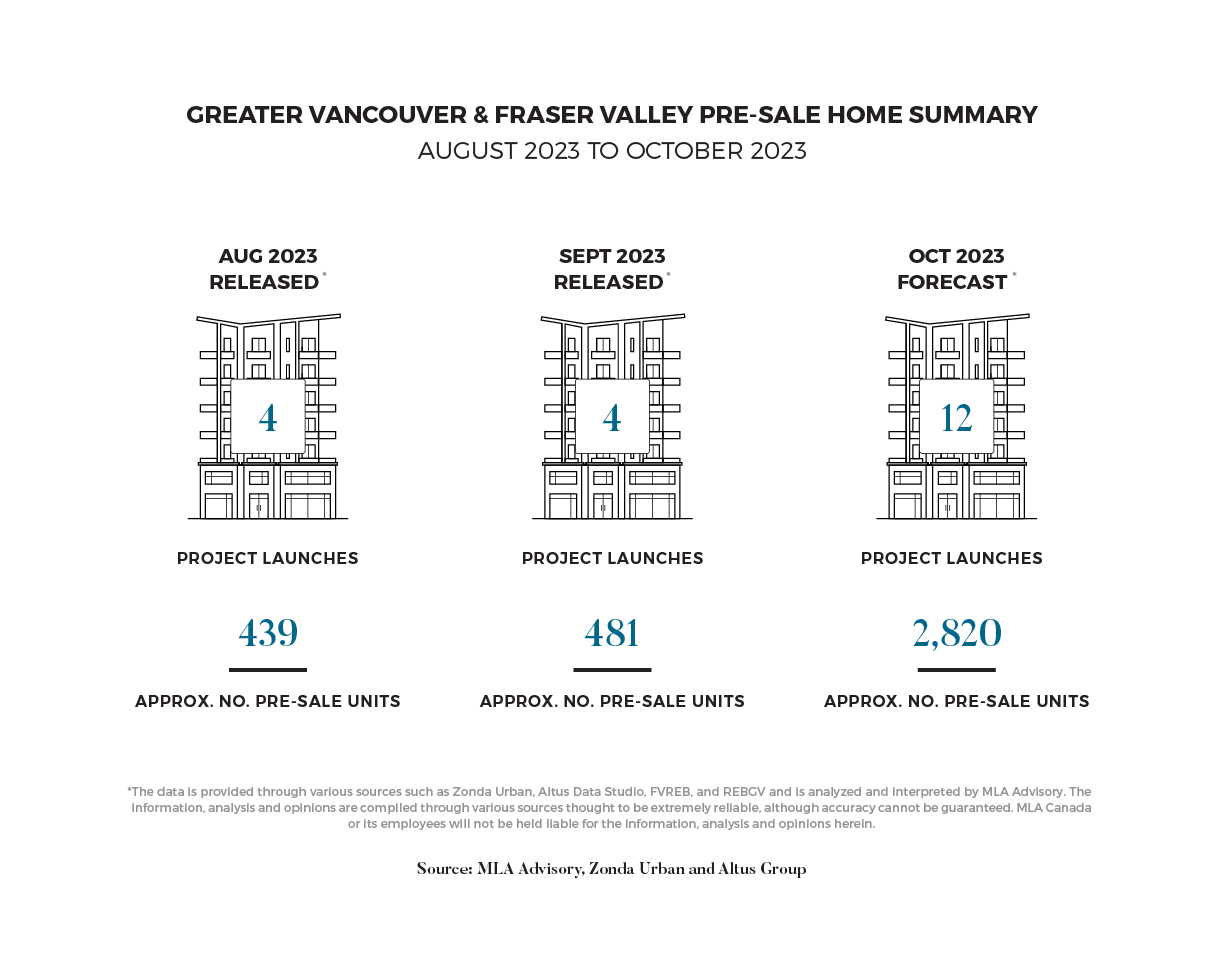

"The majority of new projects on the horizon spent September previewing, gauging prospect interest, and refining offerings ahead of October contract writing. The anticipated surge in released units is largely due to mixed-use, high-rise projects in Burnaby, which will surely be a test of market depth as this volume of new units has not been seen since Q2 2022.” - Garde MacDonald, Director of Advisory

SEPTEMBER PRE-SALE MARKET GEARED UP FOR FALL LAUNCHES

September was a quiet month in terms of pre-sale launch activity, as most developers remained in the preparation phase for Fall launches. Over the month, numerous developers cautiously tested the waters of the market by advertising, previewing and refining their upcoming programs. The surge in activity in part has been fueled by increased confidence due to the recent hike pause from the Bank of Canada, as well as the expected seasonal uptick in activity. As a result, October is expected to be a busy month in terms of project launches.

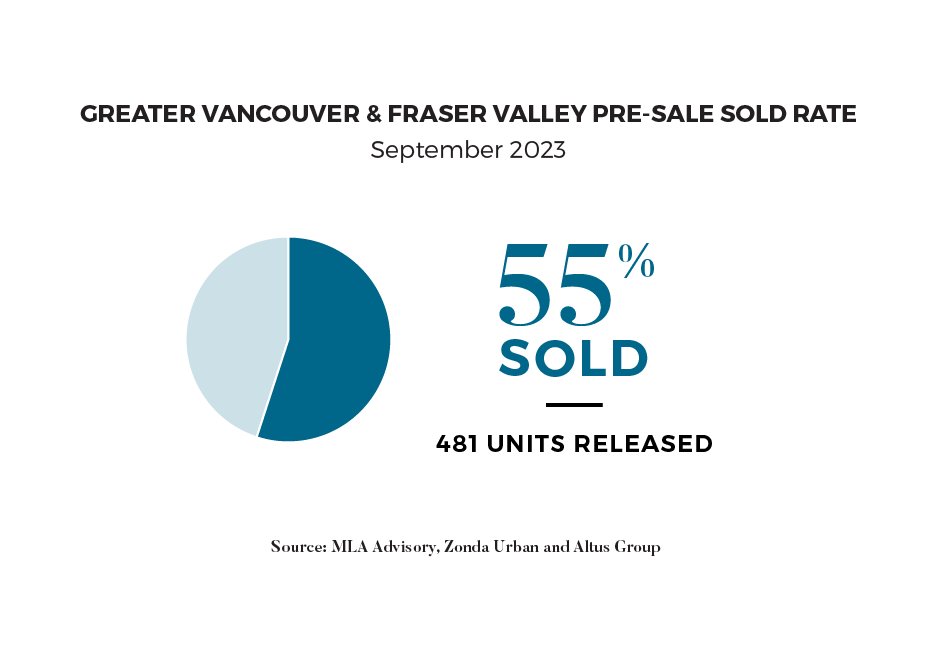

For reference, there were four pre-sale launches in September, bringing 481 units to market. Same-month absorptions in September was 55%, a meaningful increase when compared to the previous month and relative to typical figures. Absorptions have been supported by the overall relative lack of new supply, as well as stand-out performances of projects in strong markets such as Burnaby and West Coquitlam.

PROVINCIAL AND FEDERAL GOVERNMENT POLICY ROUND-UP

With affordability taking center stage, a multitude of new policies have been introduced by various levels of government. Firstly, the Liberal government recently announced the removal of GST on purpose-built construction, reducing construction costs by around 5%. This change, aimed at addressing long-standing cost barriers, is expected to boost rental construction and unit availability in the market. Furthermore, the provincial government raised the annual rent increase cap to 3.5%, a significant jump from previous years set at 1.5-2%. However, this increase still lags behind the actual market appreciation, which reached as high as 10-15% in 2022.

In terms of increased supply, the Vancouver City Council approved citywide densifications for all R5-zoned single-family lots, permitting multiple dwellings on each lot. Boosting density in single-family neighbourhoods is a crucial step toward tackling affordability. In addition to the topic of supply, the Prime Minister announced a $4 billion housing accelerator fund to provide funding to local governments for middle-class home construction. While promoting development is undoubtedly beneficial, with the current trajectory of the fund it appears there will be a minimal impact on affordability.

Lastly, BC has recently undergone significant revisions to its building codes, with a heightened focus on incorporating accessibility and inclusivity criteria into the specifications. While the intent behind these changes is well-meaning, some of the design implications related to circulation spaces and minimum lengths could potentially lead to reduced efficiency in homes, potentially resulting in either decreased utility or higher prices.

INCREASED ACTIVITY IN THE HORIZON

Following a prolonged period of sluggish summer market activity, several project launches are anticipated for the upcoming fall months in October and November, particularly in the form of concrete towers in Metrotown. The level of overall expected inventory aligns with past years, but its release is occurring within an atypical macro environment. Regardless, relatively robust absorptions are expected as buyers continue to adapt to a somewhat stabilized, higher-rate environment. This adjustment is already underway, and activity is expected to gain momentum during the upcoming busy season.

While projects in Metrotown are gearing up for October launches, the West Coquitlam market is also picking up momentum. Circadian Group's development, Lodana, is introducing 123 units to the market this month, Magnolia by Intracorp is the second building in their Gardena masterplan releasing 150 more homes, and Burquitlam Park District a masterplan community by Intergulf is bringing 364 homes in their first tower to West Coquitlam.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, pre-sale, and resale market video report, Pre-Sale Pulse.

Subscribe to the MLA Canada YouTube Channel or find the Pre-Sale Pulse on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio.