Speculation about mortgage rate increases has been in the news a lot lately. Fourteen months ago it was rumoured rates would start climbing, and even though the Bank of Canada recently decided to hold the key interest rate at 1%, economists are still predicting the rate will likely rise within the next eighteen months.

Why do mortgage rates change and what does it mean for you?

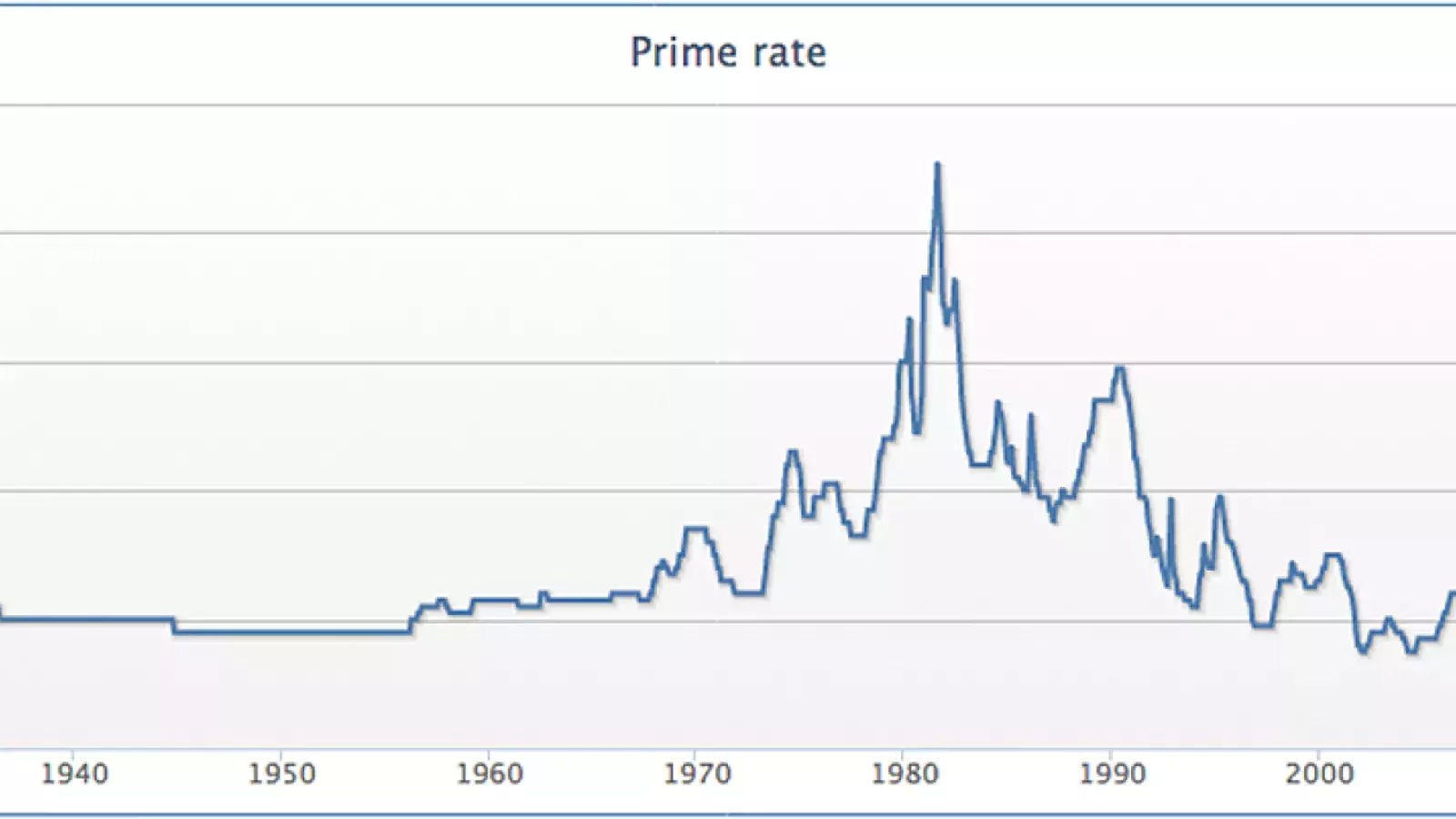

Mortgage rates change as a reflection of changes to the key interest rate (or the amount of interest major financial institutions charge each other to borrow and lend money). The Bank of Canada sets the key interest rate approximately every six weeks by analyzing a variety of economic indicators. The Bank watches these indicators closely and sets the rate to maintain a stable economy. Simply put, when a sluggish economy needs stimulus, rates are reduced to encourage borrowing. Conversely, when an economy is showing signs of rapid growth, rates are increased to balance future inflation. Increases in the key interest rate, in turn, trigger increases to the mortgage rates offered by financial institutions. To learn more about historic interest rates trends, visit the Bank of Canada website.

As soon as you start to think about buying a home, it’s time to get a really good grasp on what you can afford. Start the mortgage pre-approval process right away and ask your bank if a fixed or variable mortgage rate would be better for you. Remember, when calculating the cost of a home, you need to factor in your monthly mortgage payment as well as utilities, property taxes and legal fees. Make sure you are not stretching your finances too far if you borrow the total the bank will pre-approve you for. This will help protect you as interest rates eventually rise from their historic lows.

The sooner you get pre-approved and the better you understand and plan your total homeownership costs, events like mortgage rate increases will actually have very little effect on you over the course of the 25 year term of your mortgage.