In recent years, the Canadian rental market has witnessed significant changes. The large upward jump in 2022 put significant pressure on tenants and developers in the rental housing space. The upcoming MLA Intel Report will take a deep dive into how that set up the market’s performance in 2023 using comprehensive analysis provided by MLA Advisory. To introduce what’s to come, we’re discussing the key elements observed in last year’s rental real estate: a growing trend of rental households, a surge in purpose-built rental developments, and the varied impacts of market forces and policies on rental rates and vacancies.

THE RISE OF RENTAL HOUSEHOLDS IN CANADA

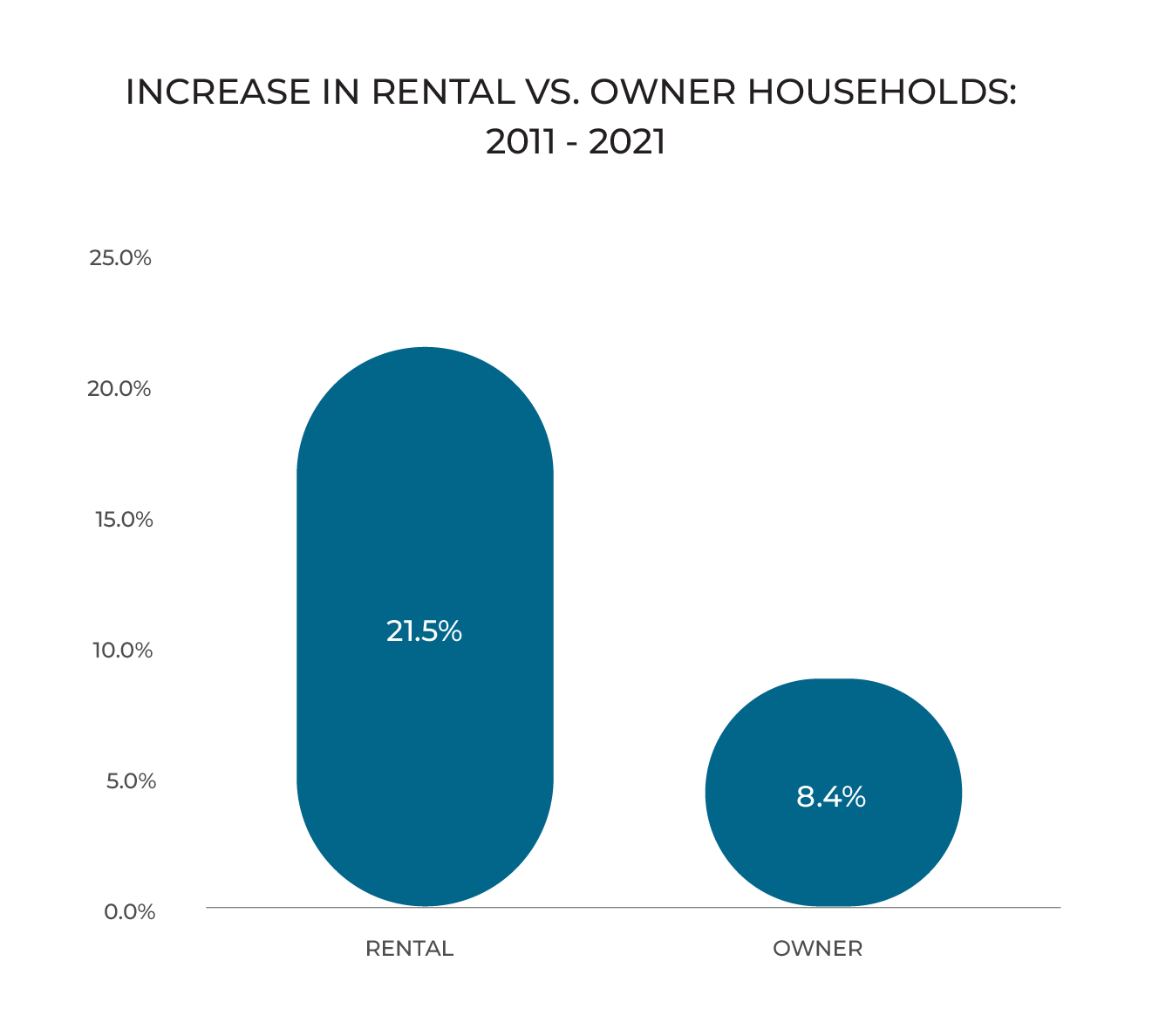

- GROWTH IN RENTAL HOUSEHOLDS: Since 2011, there has been a notable increase in the proportion of Canadian households living in rental accommodation and a decrease in Canadians who own their homes. Statistics reveal a rise from 31% in 2011 to 33.5% in 2021, with a significant 21.5% growth in renter households. This growth notably surpassed the 8.4% increase in owner households.

- ESCALATION IN PURPOSE-BUILT RENTAL DEVELOPMENTS: The past decade has seen a remarkable six-fold increase in purpose-built rental starts. Developers are increasingly catering to the strong demand, with rental starts jumping from 6.9% of all housing starts in 2010 to an impressive 38% in 2022. According to the Canada Mortgage and Housing Corporation (CMHC), the number of units in the purpose-built rental market expanded by 22% from 2010 to 2020, rising from about 1.8 million units to almost 2.2 million units. That’s an addition of approximately 400,000 purpose-built rental units over 10 years. In comparison, in the twenty years between 1990 and 2010, there was an increase of approximately 14,000 net units added to the market.

BC MARKET'S RENTAL APPRECIATION IN 2023

- VARIABLE RENTAL RATES: In 2023, the average rental rates in British Columbia appreciated by about 6%, with variations across different bedroom types and neighbourhoods. Coquitlam and Richmond witnessed significant year-over-year increases of 10% and 9%, respectively. This increase far exceeds the 3.5% rental increase limit set by the provincial government for 2024.

- A COMPARATIVE SLOWDOWN: Just over one-fifth of renter households were recently new renters in 2021, meaning approximately 20% of renters began a tenancy this year at these market rents. However, the rental rate appreciation in 2023 showed a slowdown compared to 2022’s increase, which was between 15% and 20% depending on unit size. This deceleration is a welcome change, offering some respite to tenants in BC.

TRENDS TO WATCH MOVING FORWARD

- PERSISTENT SUPPLY DEFICIT: Despite a significant uptick in rental construction, the development supply deficit is expected to continue. Even with policy enhancements and increased housing starts, there is a lag in the impact of these improvements. Analysis from RBC suggests that without ongoing efforts to remedy the issue, the rental housing gap could quadruple by 2026.

- INFLUENCE OF IMMIGRATION: Immigration will continue to play a crucial role in shaping rental rates and vacancies. Approximately 75% arrive with sufficient savings to buy a home but typically rent for an average of three years before purchasing. The influx of 2.5 million non-permanent or temporary residents, including temporary workers and foreign students, who overwhelmingly rent, is also a significant factor. These demographic changes will have a direct impact on the rental market.

- RENTAL PRICE TRENDS IN 2024: In 2024, rental prices are expected to continue appreciating, albeit likely at a slower rate compared to previous years. Vacancy rates, crucial in determining price movements, remained tight throughout 2023 and are not expected to balance out in 2024. However, a segment of the rental market, soon-to-be first-time homebuyers, may exit the rental market as interest rates decline over the year, potentially moderating the pace of rental price appreciation.

COMING SOON: MLA INTEL 2024

While the market faces challenges such as supply deficits and tight vacancy rates, ongoing developments and demographic shifts make for a complex outlook for the future of Canada's rental landscape. As we move forward, it will be crucial for the real estate industry to continuously adapt to effectively meet the needs of the Canadian rental population.

Our yearly report, MLA Intel, will be released later this month with expanded information on the Victoria market, and the rest of British Columbia, and a deep analysis of the real estate landscape for the coming year. Keep an eye out at mlacanada.ca or sign-up for Newswire to be the first to read the soon-to-drop report.