With rumors of the real estate market taking a down turn recently, let’s take a look at what has happened so far in Greater Vancouver as we reach the yearly half way mark. Although many predicted the market would soften in 2016 that has not been the case. Since the start of 2016, sales activity and prices have increased significantly, staying strong and continuing to set a new precedent.

GLOBAL AND DOMESTIC TRENDS:

The global economy continues to positively affect local real estate markets in Vancouver. The weaker Canadian dollar has made the high price of real estate still relatively affordable in foreign currency compared to other world-class cities. Despite many pressures on the Canadian economy, BC continues to be a safe place for foreign and domestic money. Historically low interest rates have also positively stimulated sales in British Columbia helping many first-time home buyers and investors take part in the housing market. This increased demand coupled with the limited supply has caused our market to be one of the most talked about investment opportunities in the world leading to price escalation.

DEMOGRAPHIC AND POPULATION TRENDS:

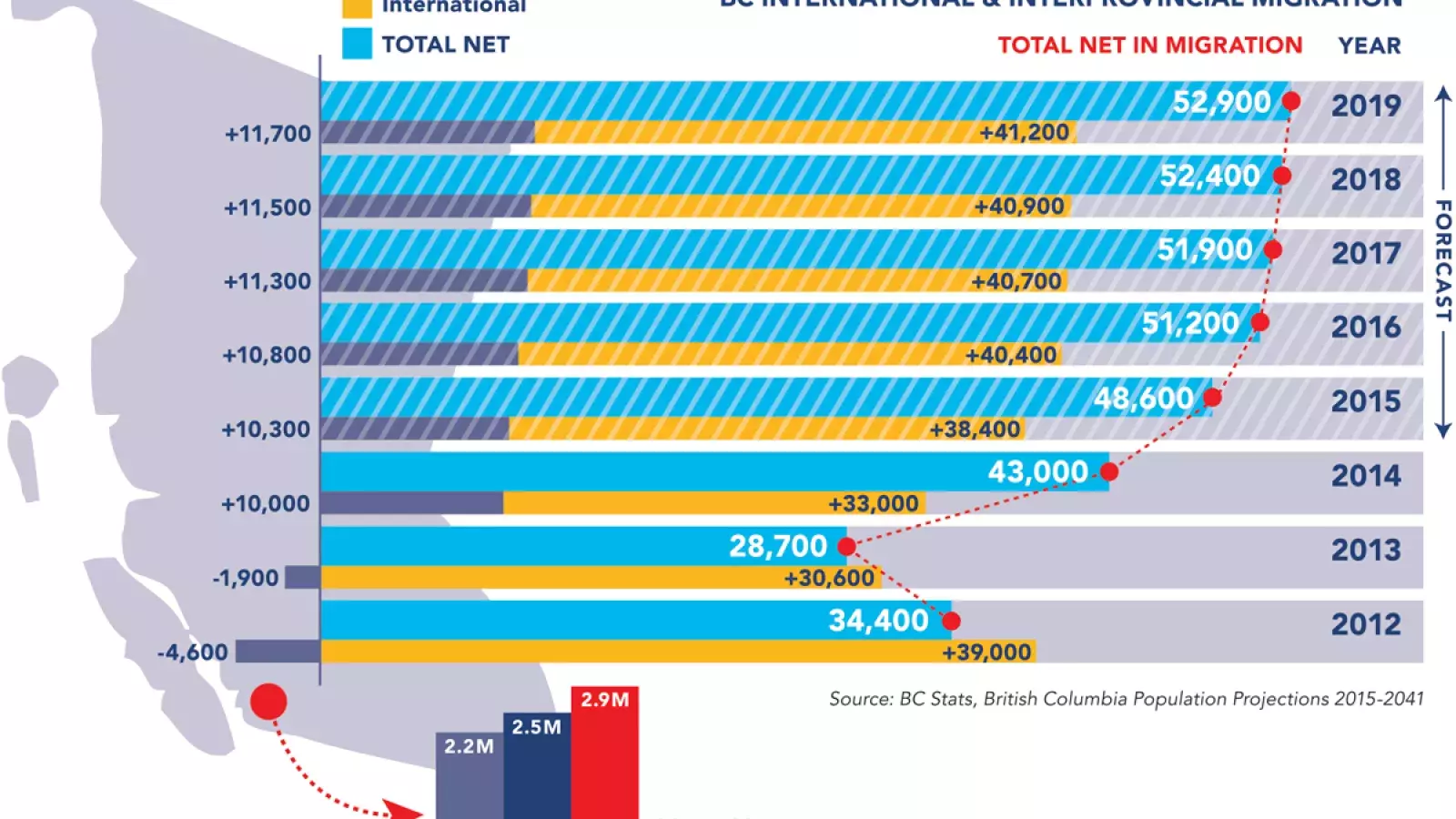

British Columbia’s population increased substantially over 2015 with the instability of the oil and gas sector in Alberta as people looked west for job opportunities. With inter-provincial and international migration into BC expected to continue to rise year after year, stronger demand will only become more prevalent across Metro Vancouver and in other areas around British Columbia. Specifically, by 2025, it is expected that Metro Vancouver’s total population will rise by 400,000 people to 2.9 million residents.

SUPPLY AND DEMAN:

Vancouver continues to be in great demand as a place to live and invest in with all the positive externalities affecting the real estate market. The geographic orientation of Vancouver and the limited amount of land coupled with tight city regulations is restricting the supply of homes. Although housing starts are up, demand continues to clearly outpace supply driving up local prices and it is anticipated that this sellers marketing will continue throughout the rest of 2016. As single-family home demand remains extremely high, apartments and townhome continue to be a more viable option, increasing demand and putting pressure on prices. This demand has impacted municipalities throughout the lower mainland, not just Metro Vancouver, and is expected to continue. Although the market has started to normalize with fewer sales in the month of June down slightly from the peak in March, prices have still increased slightly due to this limited supply.

NOTABLE STATISTICS FROM THE REAL ESTATE BOARD OF GREATER VANCOUVER FROM THE MONTH OF JUNE 2016:

- Sales-to-listings ratio was at 56.3%. If this ratio is above 20%, prices experience upward pressure

- Sales were 28.1% above the 10-year average for the highest selling June on record

- Benchmark Price for single detached home in Vancouver West: $3,547,300 (up 36.7% from last June)

- Benchmark Price for apartment in Vancouver West: $696,200 (up 31.8% from last June)

- Benchmark Price for townhouse in Vancouver West: $1,092,900 (up 35.6% from last June)

In summary, we continue to see an extremely strong real estate market in the Lower Mainland throughout all regions. Prices have been driven up across all markets and will continue although the rate of the increase should ease which is good news for the market. “The best place to live” therefore will continue to be one of the safest and most desired places in the world to invest in.

For more information on the significant economic factors and market trends effecting the real estate industry, please contact our Advisory Team at advisory@mlacanada.com.