After a prolonged and unsustainable price escalation, the market hit its peak last March, before declining and then levelling off by the new year. Even so, the Lower Mainland showed an increase in benchmark price of over 20%, and 2016 ended with a Sales-to-Active Listing Ratio of 28% – higher than the average over the last five years. 2017 will see a return to a more balanced market and modest price increases. We expect the single-family market will continue to stabilize over the course of 2017, returning to an equalized market due to diminishing supply and continued high demand – despite August’s introduction of the Foreign Buyer Tax and other government implementations. Housing starts reached an all-time high in 2016, but are not expected to remain at those levels. Paired with continued low interest rates, steady population growth, and stable employment trends, we expect to see demand keeping up with supply, maintaining relatively constant activity levels and more modest price increases compared to 2016.

In 2016, the Greater Vancouver real estate market encountered unprecedented growth. Record sales activity and price increases were experienced across much of Metro Vancouver, particularly within the Vancouver West Side single-family home market. This historical growth peaked in March 2016 and went on to decline over the course of the summer. The implementation of numerous government policies, such as the Foreign Buyer Tax introduced in August, accentuated the decline before markets leveled off and recovered near the end of 2016. While these declines were widely reported, the greatest decline was isolated to the niche market of single-family homes over $3.25 million. The apartment market segment on the other hand continued to outperform 5-year and 10-year averages with robust buying and selling activity. Additionally, single-family homes under $3.25 million enjoyed very stable activity and ended 2016 with a Sales-to-Active Listing ratio of 25%. Looking ahead to 2017, the overall market is expected to see a modest growth trajectory, while maintaining more stable conditions.

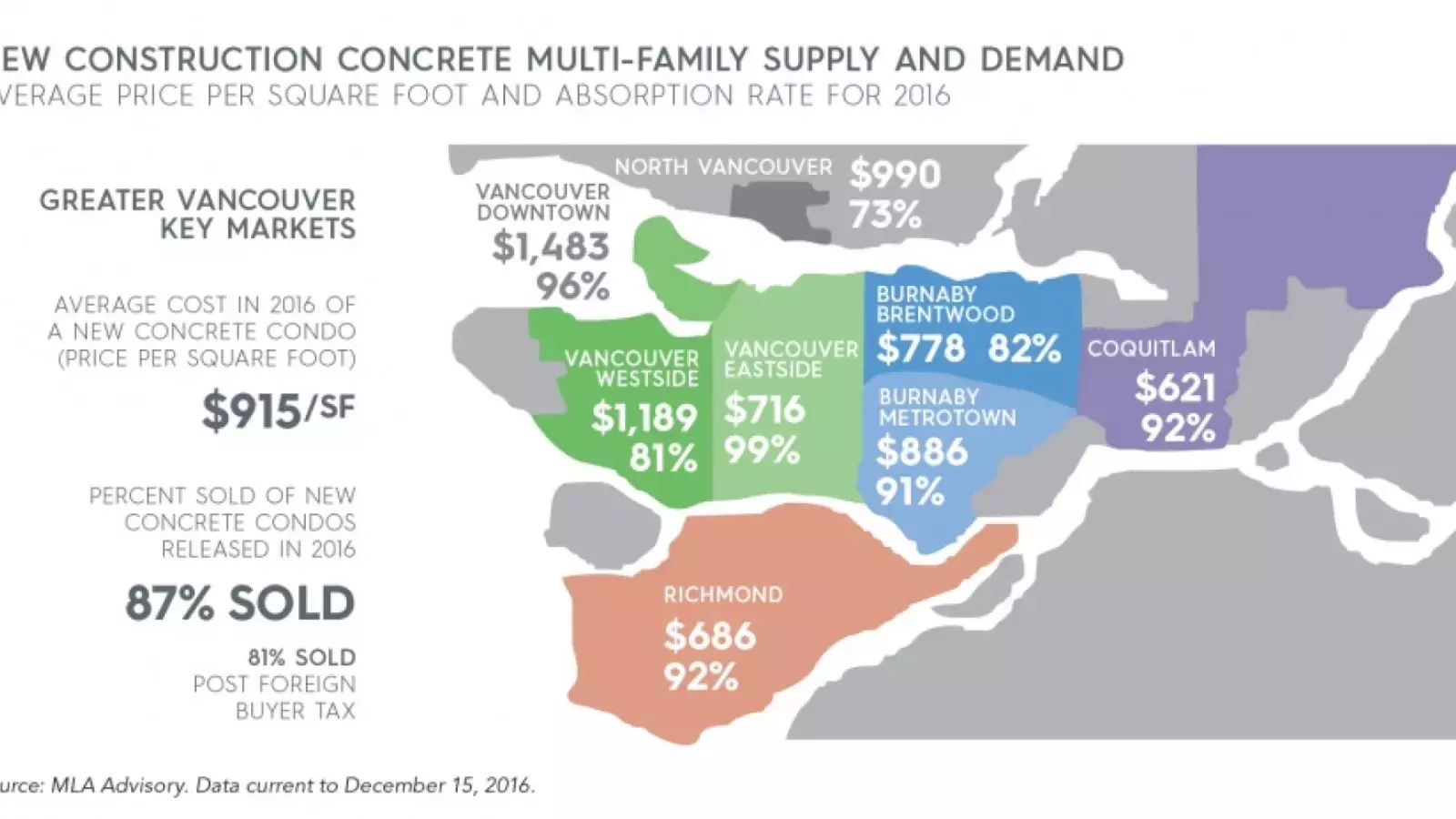

PRE-SALE NEW CONSTRUCTION MARKET

Although the recently introduced Foreign Buyers Tax, along with other government policies, did curb activity levels in the resale market, the pre-sale market has shown minimal signs of slowing down. After analyzing the pre-sale concrete developments released post-Foreign

Buyers Tax in major sub-markets, we found that over 81% of this inventory has been absorbed. The various government interventions have shown little effect on the pre-sale market to date, and with over 10,000 concrete units currently being planned for 2017, we anticipate continued steady absorption figures. This increase in pre-sale supply will likely dampen the massive price jumps in markets across Greater Vancouver that we saw in 2016, which should help affordability, especially in markets such as Richmond and the Tri-Cities.

RENTAL MARKET TRENDS

Rental vacancy remains extremely low at less than 1%, where it has been for the past several years. This continued low vacancy has led to a record average rental rate increase of over 6%. The average rent of $1,223 includes all rental supply in the Greater Vancouver area, but, it is important to note, average rental rates for newly completed apartments for both privately-held and purpose-built rental supply yield a much higher monthly lease. Urban areas, such as Downtown, UBC, and the Cambie Corridor, have achieved over $3.00/SF and show few signs of slowing.

ABOUT MLA ADVISORY

Leading with the ability to precisely collect and analyze data, our industry-leading Advisory team is the largest in-house Analytics and Advisory group in Western Canada. Applying our innovative approach and sales-centric expertise, we make recommendations that strategically position client projects in an extremely competitive landscape. Download the full MLA Advisory Intel Report here.

Become Real Estate Intelligent, please visit mlacanada.com for market and project updates.