January Real Estate Market Data & Insights

Learn more about the latest Greater Vancouver pre-sale and resale data and some trends we're seeing in the area affecting the local real estate market by watching the latest Greater Vancouver edition of MLA Canada's Pre-sale Pulse. Featuring MLA Canada’s President, Ryan Lalonde, and Suzana Goncalves, EVP, Sales and Marketing; Partner.

THIS EPISODE IS NOW AVAILABLE IN AUDIO

Listen on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio

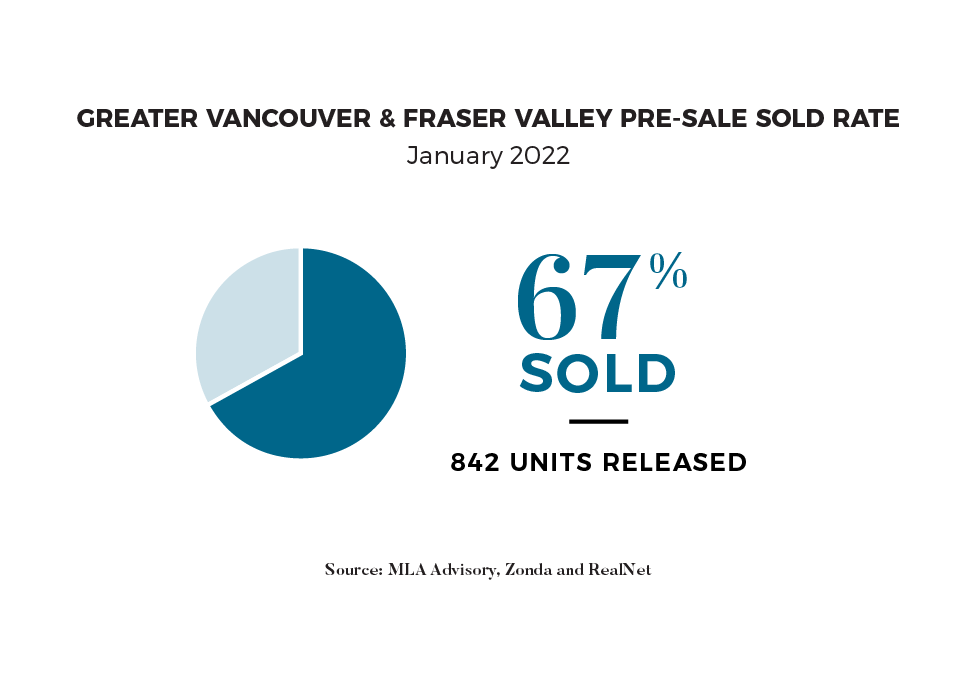

"We saw a very strong 67% same month sales absorption level in January in part buoyed by the lack of inventory. It was also notable to mention that active presale projects previously released saw very strong January sales numbers due to the lack of inventory in the resale market and buyers frustrated with lack of options and extreme bidding wars. Looking ahead we will see much more inventory released as we officially move into the typically robust Spring market." Suzana Goncalves, EVP, Sales and Marketing; Partner, MLA Canada.

STRONG PRESALE ACTIVITY CONTINUES IN THE WINTER MONTHS

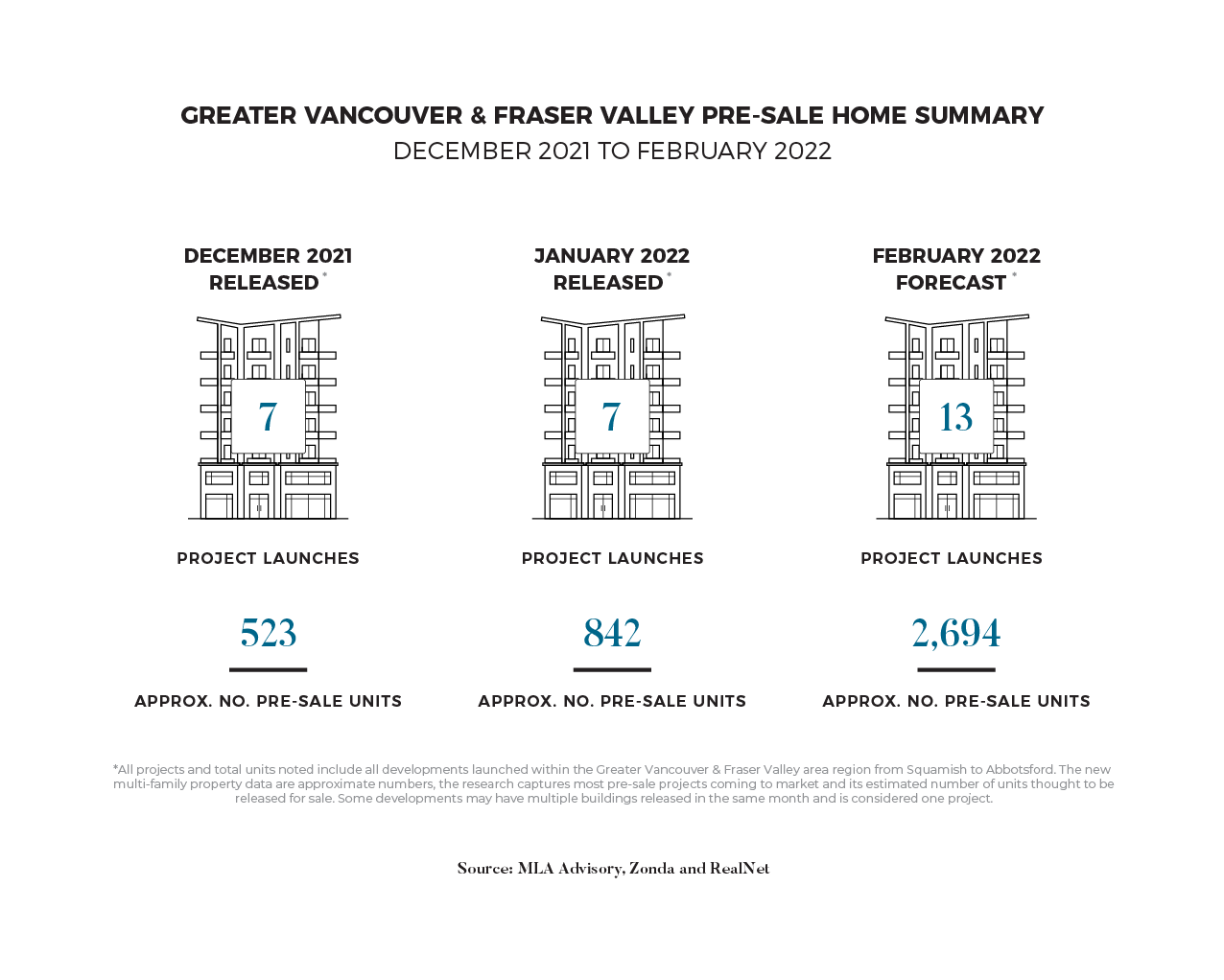

January was a seasonally strong month for Metro Vancouver’s presale market. Active and newly launched programs offered attractive incentives to leverage heightened demand from Chinese New Year and to entice buyers away from presale developments preparing to launch in the early Spring. In total, there were 7 presale launches in Metro Vancouver, releasing 842 condominium and townhome units to market. Same-month sales in January were 562 (67%). Absorptions were largely driven by District Northwest, which saw same-month sales of 63%. The project has now temporarily halted sales and is actively preparing to launch its north tower. There were as well several smaller developments that had strong successes in January. Allaire Living began sales of Stone Ridge, its 28-townhome development in Port Moody, in mid-January and was able to absorb the entirety of the project’s inventory in a matter of days.

INTEREST RATES SET TO RISE

With interest rates at historic lows over an extended period, it can sometimes be difficult to remember that what goes down must eventually go up. Like many Central Banks, the BOC slashed its core lending rate, known as the overnight rate, to safeguard the economy at the advent of the Covid-19 related downturn. Now, nearly two years later, with the economy on steady recovery and our job market near pre-pandemic levels, the Bank of Canada is preparing to raise rates to reign-in on rising inflation. Currently, the market is pricing approximately 5 rate hikes in 2022, and institutional investors are forecasting an overnight rate of 1.25-2% by year-end. Within the real estate market, we’re not like to feel of the full effects of a raising rate environment until the mid-Spring. Given that we’re likely to see month-over-month rate increases, those who can get a rate hold on their mortgage today may be at an advantage compared to those looking to borrow in the summer and fall.

BURNABY PREPARES FOR HISTORIC RELEASE OF CONCRETE PRODUCT

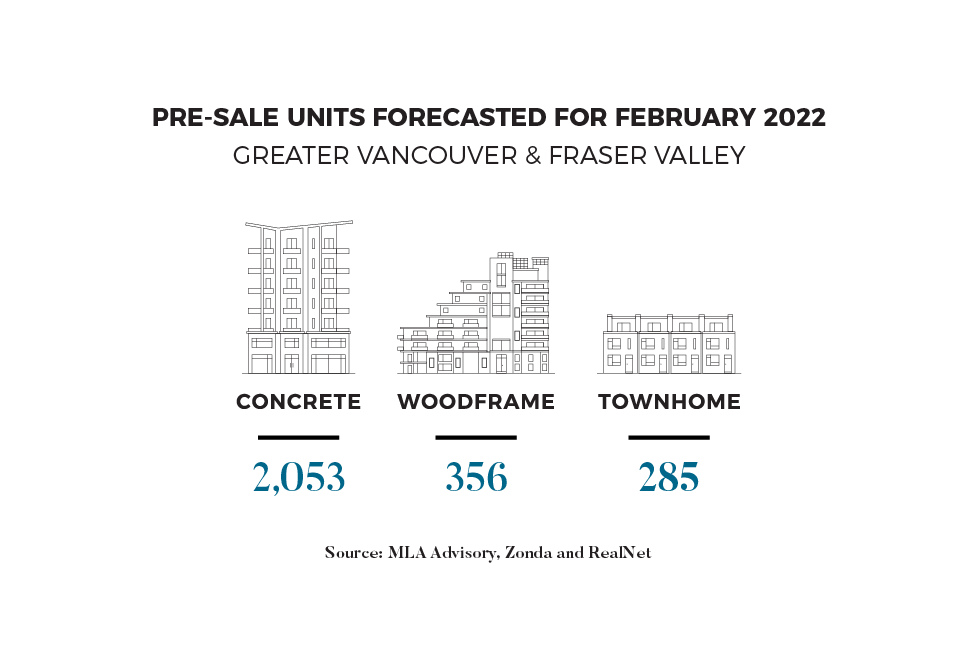

As the seasons' change and temperatures rise, so too does the presale market begin to see increased activity in preparation for the Spring market. After an especially active period of presale activity over the winter, it's unsurprising that February is now poised to be another blowout month for Metro Vancouver’s presale market. In total, 13 developments are forecasted to launch in February, bringing 2,053 concrete, 356 wood frame, and 285 townhome units to Metro Vancouver’s market. This would be nearly double the 1,684 units that launched in February of last year. What makes this such an interesting time to monitor the market is that nearly all (79%) of this inventory is intended for Burnaby alone. Together, there are 4 concrete towers expected to launch in Brentwood and Metrotown in February. Developments such as Solo District (Phase 4), Concord Oasis, and Amazing Brentwood (Tower 5) have already hosted virtual or in-person realtor events and, if they haven’t already begun writing deals, are in the final stages before doing so. In many ways, the activity we’re forecasting for February run counter to headlines surrounding the historically low supply in the resale market. Realistically, those opting to purchase through the presale market this Spring are likely to see increased choice and less buyer competition when compared to the resale market.

We want to hear from you! If you have a real estate question that you'd like us to talk about in our next Pre-sale Pulse, submit your questions to us.