March 2022 Pre-Sale Real Estate Market Insights

THIS EPISODE IS NOW AVAILABLE IN AUDIO

Listen on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio

"While our market faces rising interest rates and increased construction costs, there is still strong market confidence as many of the factors that led to the robust activity, we saw over the last year continue in our market today. At 59%, March saw the same same-month absorptions that were recorded in February. This marks the fifth month where same-month absorptions were above 50% - which is incredibly active for any market.” – Suzana Goncalves, EVP, Sales and Marketing; Partner, MLA Canada

STRONG ABSORPTIONS FOR FIRST WAVE OF CONCRETE PRODUCT IN METRO VANCOUVER

As the sun sets on the first quarter of 2022 and we tally up the surge of sales activity, the first wave of concrete programs launched in Metro Vancouver received much of the same market absorptions we've come to expect over the last year.

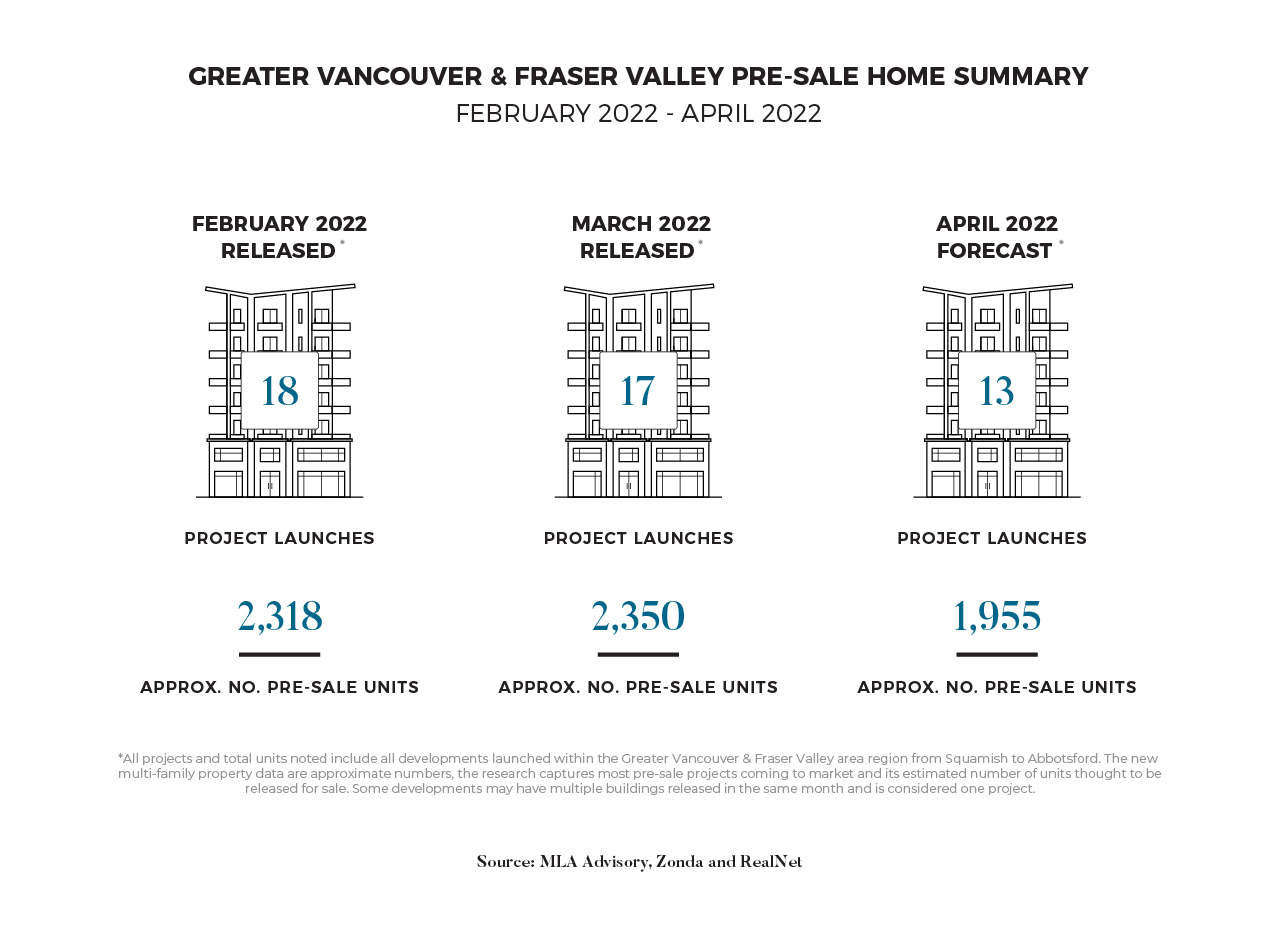

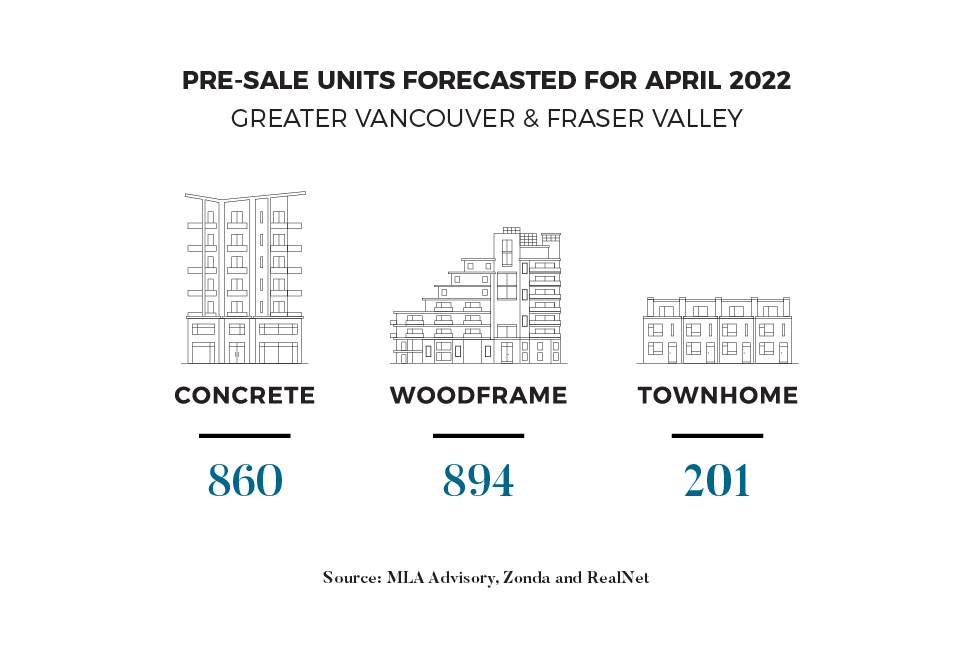

Concrete programs in the Metrotown and Brentwood markets were of particular interest, and for the programs launched in these submarkets over the last month, absorptions averaged over 50%. The first release of Concord Oasis's west tower sold out, and Concord is now actively preparing to launch its east tower. Additionally, Nuvo, which began sales in late February to early March, has sold upwards of 80% of its total inventory. Overall, there were 2,350 units brought to market in Metro Vancouver in March. With approximately 1,387 presales (59%), the same-month absorptions in March matched the robust presale activity in February.

ONE YEAR AFTER A HISTORIC MONTH: WHERE ARE WE TODAY?

March 2021's record-setting month for B.C.'s real estate market was one for the books and will likely hold the title for a while. The REBGV reported 5,843 resales while the FVREB reported 3,187, representing 128% and 158% increases in sales activity from only one year before March 2020, shattering the all-time record for monthly sales. Historically low-interest rates, high demand for space, increased household savings, and a positive outlook on economic recovery drove demand and helped create a sales momentum that continued through the remainder of the year. A year later, we must look at where we are today and see how our market has changed. As we head into the Spring season, though there appear to be signs of moderation, the market firmly remains in a period of elevated demand and activity. While sales are down 25-30% from March 2021, it was almost inevitable in light of the sheer strength of the 2021 numbers. While our market may face new headwinds in rising interest rates and increased construction costs, many of the same factors that drove demand in March 2021 are still present in today's market.

THE SPOTLIGHT IS ON VANCOUVER AS PROGRAMS PREPARE TO LAUNCH IN THE SPRING MARKET

In the past two years, markets outside of Vancouver have been catching up with pricing in Vancouver's market. Historically, there has been a significant discount when moving eastward when leaving Vancouver's municipal boundaries. But as prices have increased over the last two years, submarkets such as Burnaby, West Coquitlam, and Surrey City Centre are now achieving values at or near what is transacting in Vancouver's market. This increase in value, in turn, is leading to renewed interest in Vancouver's market and is reflected in a strong lineup of presale launches expected to launch within Vancouver's market over the next 2-3 months. Examples include Frame, a concrete mid-rise by Peterson Group and Coromandel Properties, which has received significant market attention since writing deals in early April. Additionally, 1818 Alberni, Form, and Italia are new programs preparing to launch in or near Vancouver's downtown core.

We want to hear from you! If you have a real estate question that you'd like us to talk about in our next Pre-sale Pulse, submit your questions to us.