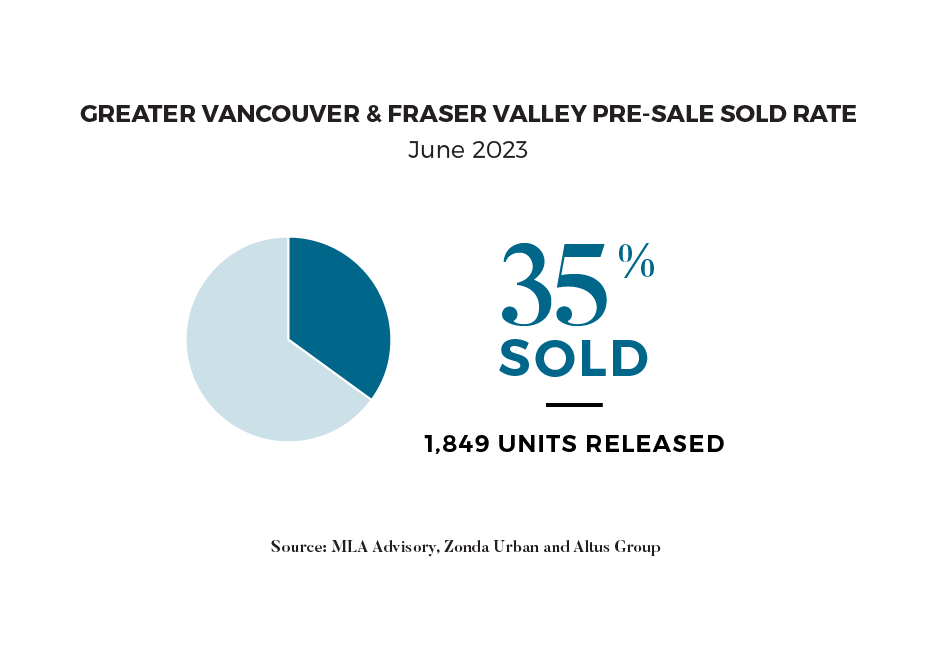

"A strong June with over three times as many units released as May and a stable 35% same month absorption rate as developers raced to release product before an uncertain summer and fall market. We continue to see steady demand in this relatively low inventory market overall with an expectation that volumes will fall through the summer.” Suzana Goncalves, EVP, Sales and Marketing; Partner, MLA Canada

JUNE SEES LARGEST RELEASE OF INVENTORY IN OVER A YEAR

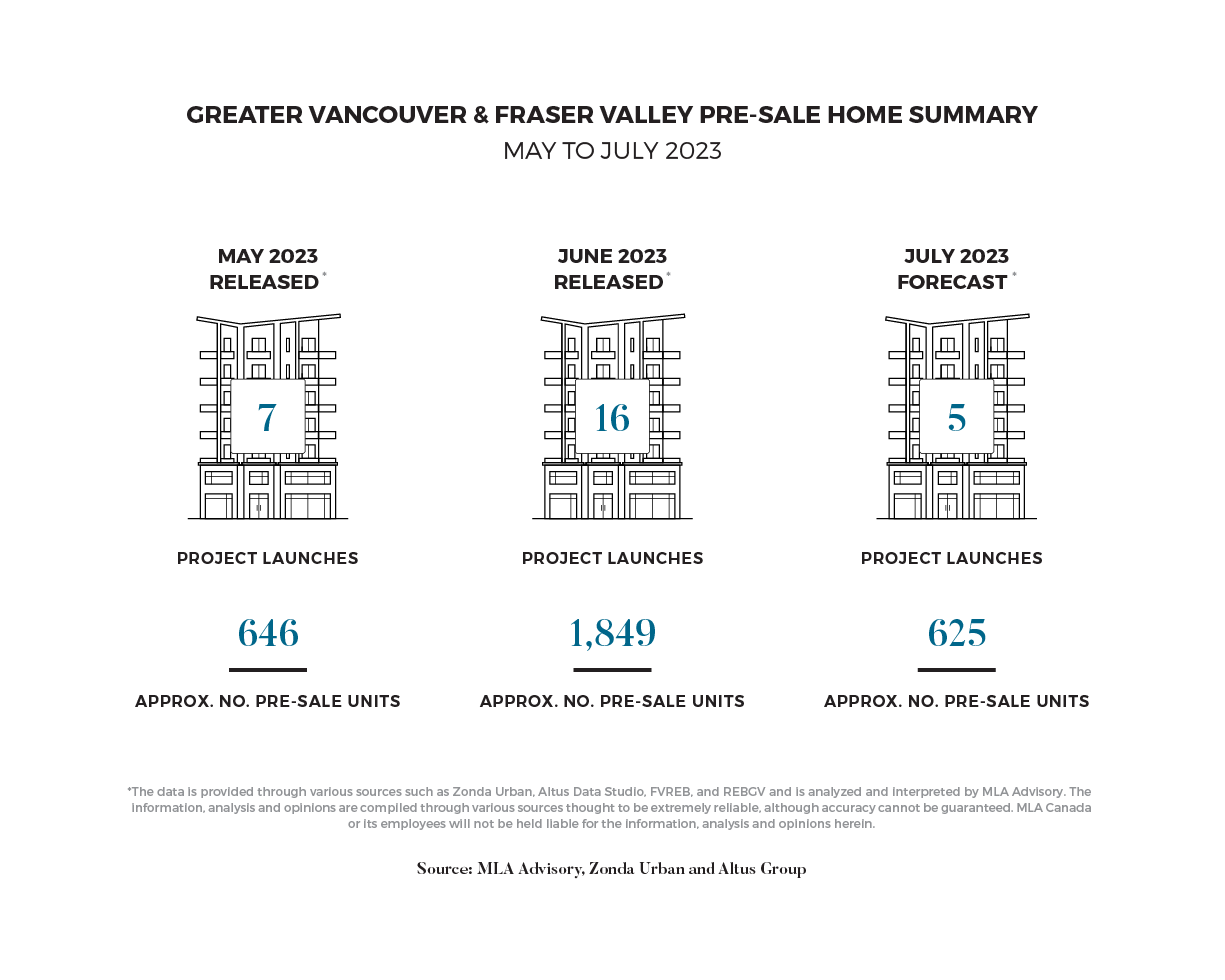

Real estate developers have been encouraged by returning demand and upward pressure on real estate values, which signal a favourable market for them to launch their developments. As a result, a wave of programs began marketing in mid-April and May, leading to the release of over 1,800 units in June, the largest for a single month so far in 2023.

Remarkably, despite the significant increase in available units, the same-month absorptions remained consistent with the early-spring market, reaching an impressive 35%. Absorptions of concrete product was highest in West Coquitlam, while Harlin by Wesgroup achieved strong sales success in Vancouver, with over 100 deals finalized within two weeks of its launch.

While the market still faces headwinds, positive market conditions and the robust buyer response have instilled confidence in developers to move forward with their programs and contribute to ever-growing need for supply. With demand continuing to strengthen and property values appreciating, the market is expected to remain favourable in the Fall.

THE IMPORTANCE OF AN INTERNATIONAL PERSPECTIVE WHEN CONSIDERING HOUSING AFFORDABILITY

Housing affordability continues to be a pressing issue with far-reaching consequences for individuals and communities worldwide. Cities like Vancouver have experienced a significant decline in housing affordability, as rising prices and limited rental options present barriers to homeownership and secure housing for many. Factors such as supply and demand dynamics, labor shortages, and increased costs have contributed to the worsening crisis.

However, the issue of housing affordability extends beyond Vancouver's borders. A staggering 90% of cities globally are deemed unaffordable when average house prices are compared to average household incomes. This disparity underscores the magnitude of the problem and highlights the need for comprehensive and innovative solutions.

Experts emphasize the importance of tailored definitions of affordability that consider local conditions. It is crucial to address the diversity of housing needs and to explore options that promote density and variety. By reevaluating zoning regulations and considering alternatives to single-family dwellings, cities can provide a wider range of housing choices.

Successful housing policies from around the world offer valuable lessons. Models such as Singapore's public housing, Berlin's upzoning of single-family areas, and Austria's strong social housing portfolio showcase strategies that prioritize affordability and inclusive communities.

Collaboration and innovation are crucial in tackling the housing affordability crisis. Lowering municipal fees, investing in improved transit systems, adopting new construction technologies, and promoting creativity can contribute to more efficient and cost-effective housing solutions.

Addressing housing affordability requires the concerted efforts of policymakers, developers, and communities. It demands a commitment to providing accessible housing options for individuals and families across various income levels. By adopting comprehensive approaches and learning from successful global examples, cities can take significant strides towards achieving housing affordability and creating vibrant, inclusive communities.

In the pursuit of housing affordability, the importance of ongoing discussions and the exploration of innovative solutions cannot be overstated. With a collective commitment to change, it is possible to transform the dream of affordable housing into a reality for individuals and families around the world.

TIMING OF THE RATE HIKE WILL IMPACT FALL MARKET

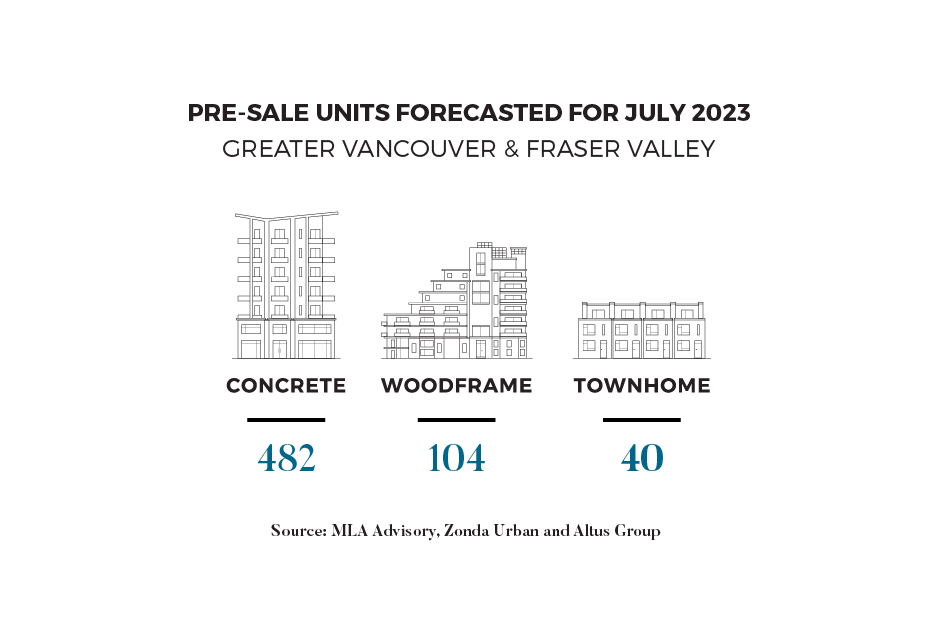

MLA Advisory forecasts five presale launches in July, bringing 625 units to market. One highly anticipated project set to launch is City of Lougheed Tower 3 by Shape. This development is expected to offer competitive pricing, accompanied by enticing incentives to generate early sales momentum. Notably, it stands out from other projects in the market as it is being sold as completed product, which may pose challenges for conventional investors seeking longer completion periods to mitigate the impact of current interest rates.

While the recent increase in interest rates adds greater uncertainty in the market over the short-term, the decision to raise rates now, rather than in September, is likely the better of the two options for the industry. By acting promptly rather than waiting until September, the Bank of Canada ensures that the market has time to adjust to the higher rates before the start of the Fall market.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, pre-sale, and resale market video report, Pre-Sale Pulse.

Subscribe to the MLA Canada YouTube Channel or find the Pre-Sale Pulse on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio.