“January saw very few projects release new inventory into the market. The story of the month was centred around incentives on existing inventory, targeted toward both prospective buyers and agents. As we enter February, we are starting to see increased foot traffic at Sales Galleries that is likely to carry forward into the Spring. Anticipated project launches in February will serve as a good litmus test for market breadth and will help developers, many of which are in “wait and see” mode, decide whether to enter the market.” - Garde MacDonald, Director of Advisory

NAVIGATING THE MARKET MAZE: UNDERSTANDING TODAY’S MARKET ENVIRONMENT

Calling the current market environment ‘tricky’ wouldn’t be doing it justice. Costs associated with financing and construction continue to trend upwards, yet revenues remain stubbornly flat. This dichotomy has limited the ability of developers to bring new supply to market and is increasing the market signals they need to see before they are comfortable starting contract writing. Ironically, there are unprecedented levels of pent-up demand from buyers. Their dream of homeownership is ensnared in a lending environment that leaves much to be desired, sidelining many from entering the market until rates begin to lower in the second half of this year.

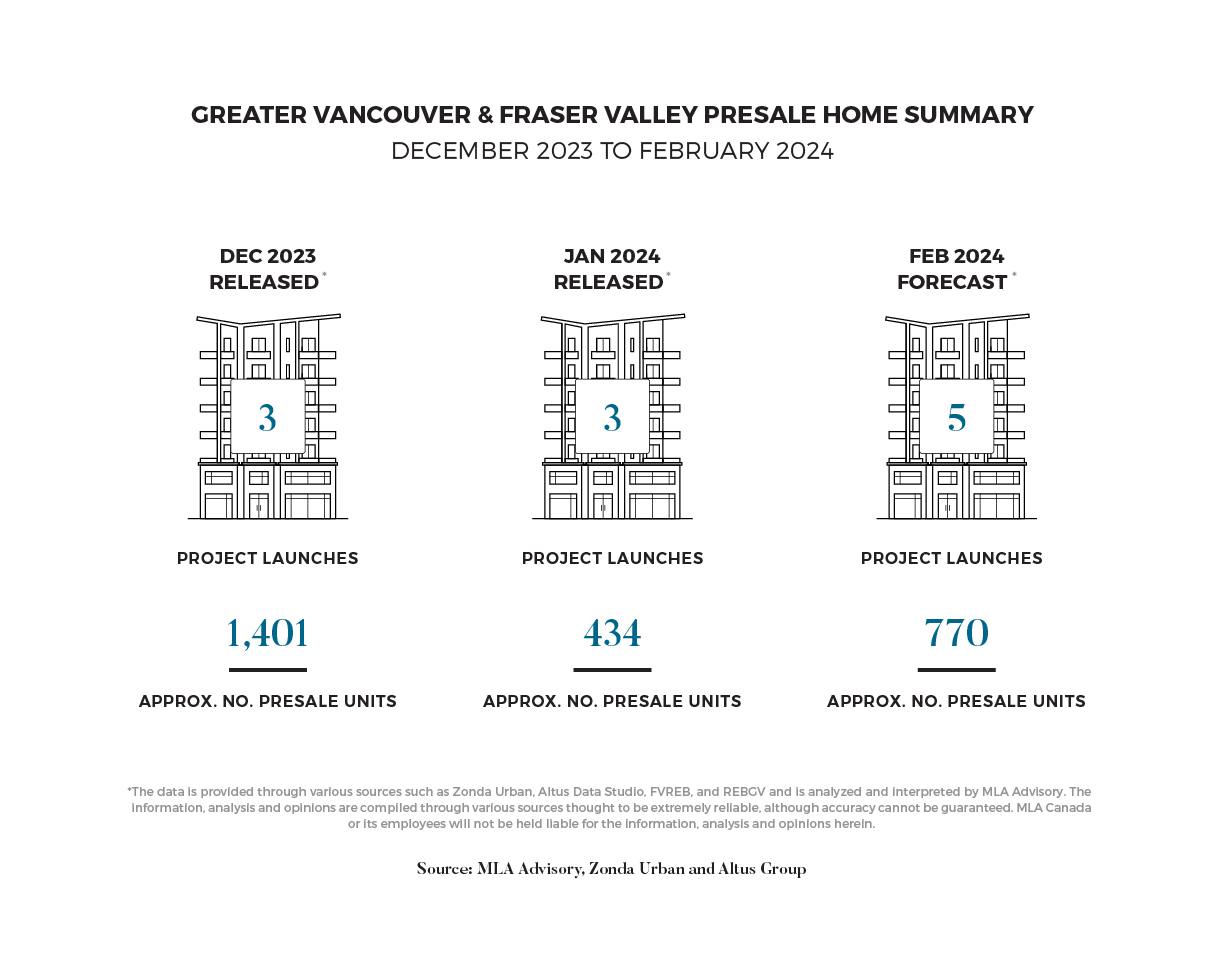

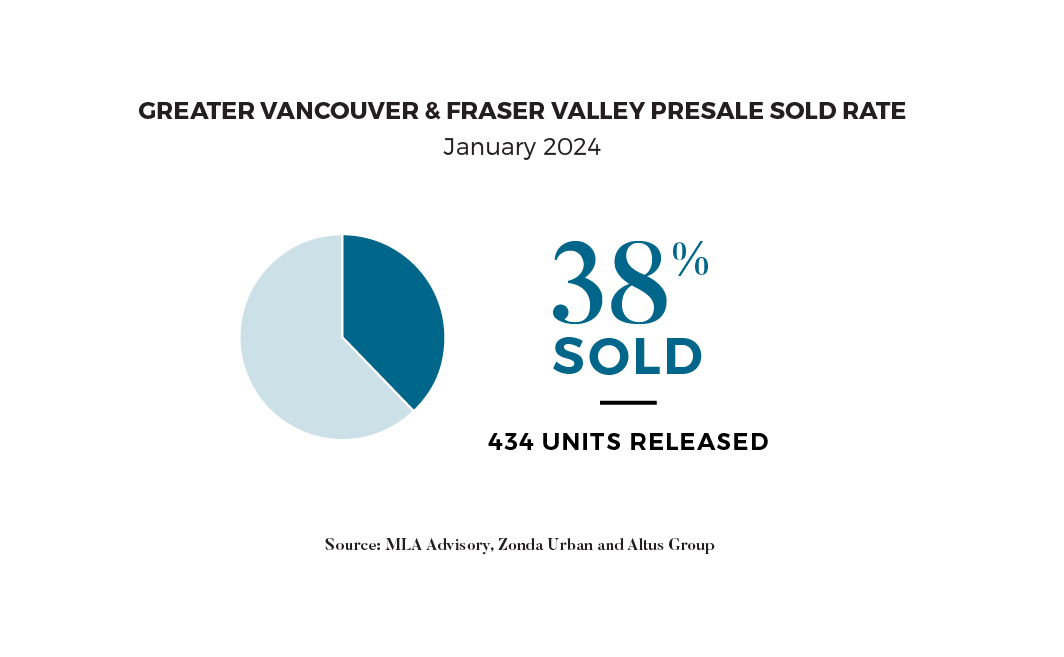

January witnessed the launch of three presale projects, bringing 434 units into the market. A significant portion of this new inventory came from Encore, the second tower in Beedie's Fraser Mill’s development. Encore has made a big splash in the market, with 50% of its inventory absorbed within the first month of sales. Despite the lack of detailed pricing information, it’s estimated that Encore has achieved a gross blend of $1,075 PPSF, increasing from Debut’s $1,050 PPSF yet below the $1,140-$1,150 PPSF typical of towers along the North Rd Corridor.

As we dissect these recent developments, the real estate market’s future hinges on a delicate balance between cost, demand, and access to financing. Encore’s launch provides an example of how opportunities remain for developers who can attract buyers with a competitive price point in a challenging economic landscape.

RENTAL MARKET SNAPSHOT: HISTORICALLY LOW VACANCIES AND HIGH RENT INCREASES

Currently, vacancy rates in Metro Vancouver hover around a restrictive <1-2% across most submarkets, indicative more of rental friction than true vacancies, leading to an 8% increase in average rental rates in 2023, and an even more staggering 24% for new rental leases. This surge is driven by a growing number of renters, now constituting about 34% of Canadian households, a segment expanding at twice the rate of homeowners, fueled by affordability issues and a significant influx of people through immigration, study, and work permits, who predominantly rely on rentals upon their arrival.

The supply side also faces its challenges, notably a prolonged deficit in purpose-built rental construction. This issue, rooted in historical underinvestment, saw rental starts constituting a mere 7% of all housing starts in 2010, though efforts like the CMHC rental housing subsidiary have recently boosted this figure to 38% as of 2022. Moreover, the removal of the 5% GST cost on purpose-built rentals and policies banning short-term rentals aim to alleviate some pressure by encouraging more long-term rental availability. Despite these measures, the rental market is still playing catch-up, grappling with the long timelines required to bring new rentals to market, which can span 3-7 years.

In the near term, some relief might be seen as interest rates adjust, potentially easing vacancy rates as would-be homeowners transition out of the rental market. Nonetheless, the structural issues within the rental market are likely to persist.

LUNAR NEW YEAR BRINGS NEW PROJECTS AND INCREASED INCENTIVES TO MARKET

As February ushers in the Lunar New Year, there’s anticipation for a renewal in market demand and increase in project launches. Activity has primarily been driven by active programs offering substantial incentives. In Burnaby, for example, buyer incentives range from $20k-$40k, with realtor bonuses scaling between $5k-$10k.

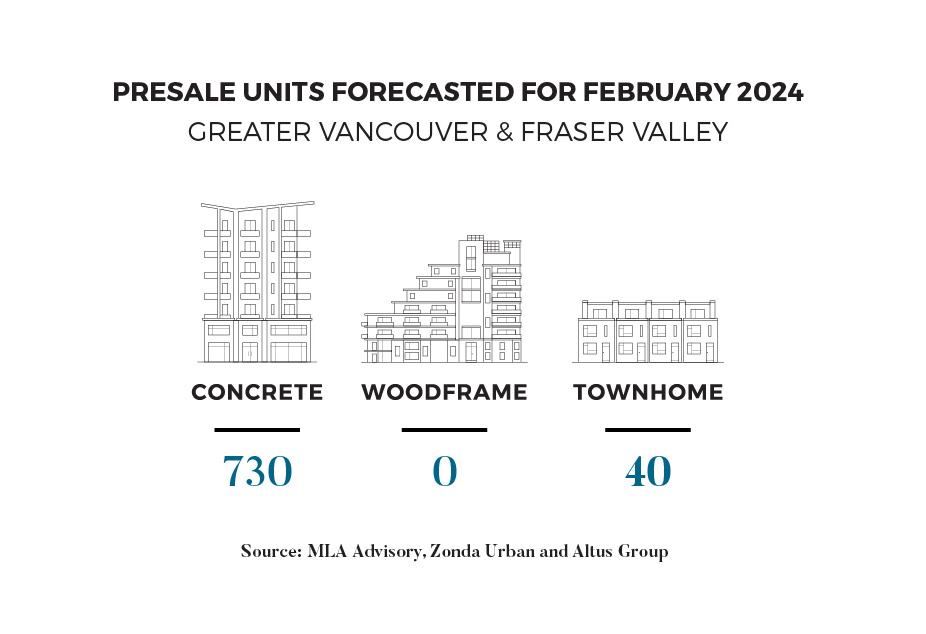

MLA Advisory anticipates five presale launches in February, bringing 770 units into the fray. Among these, Juno by StreetSide in Surrey City Centre stands out, banking on its 10% deposit structure to attract investors. Offering such low deposits at the start of the sales program is a bold strategy that could offer a significant draw. This move, along with the project’s extended build-out period, highlights the approaches developers are employing to captivate interest. at a time when overall market activity remains subdued.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, presale, and resale market video report, Presale Pulse.

Subscribe to the MLA Canada YouTube Channel or find the Pre-Sale Pulse on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio.