“Despite the increase in same-month absorptions in July compared to the previous month, developers continue to face significant challenges in bringing new product to market. This is particularly evident in areas like Metrotown, West Coquitlam, and Surrey City Centre, where sticky costs and stagnant prices are putting pressure on both developers and buyers alike. However, looking toward the Fall market, two 0.25% rate cuts by the Bank of Canada signal that lending rates and consumer sentiment are becoming more favourable." - Garde MacDonald, Director of Advisory

SEASONALITY BRINGS MODEST ACTIVITY TO PRESALE MARKET

Uncertain market conditions and summer heat has had a cooling effect on the presale market as homebuyers turn their attention away from real estate and towards enjoying the good weather. Typically, this seasonal downturn persists into September, lasting 2-3 weeks after the first day of school, at which point the market picks up in October.

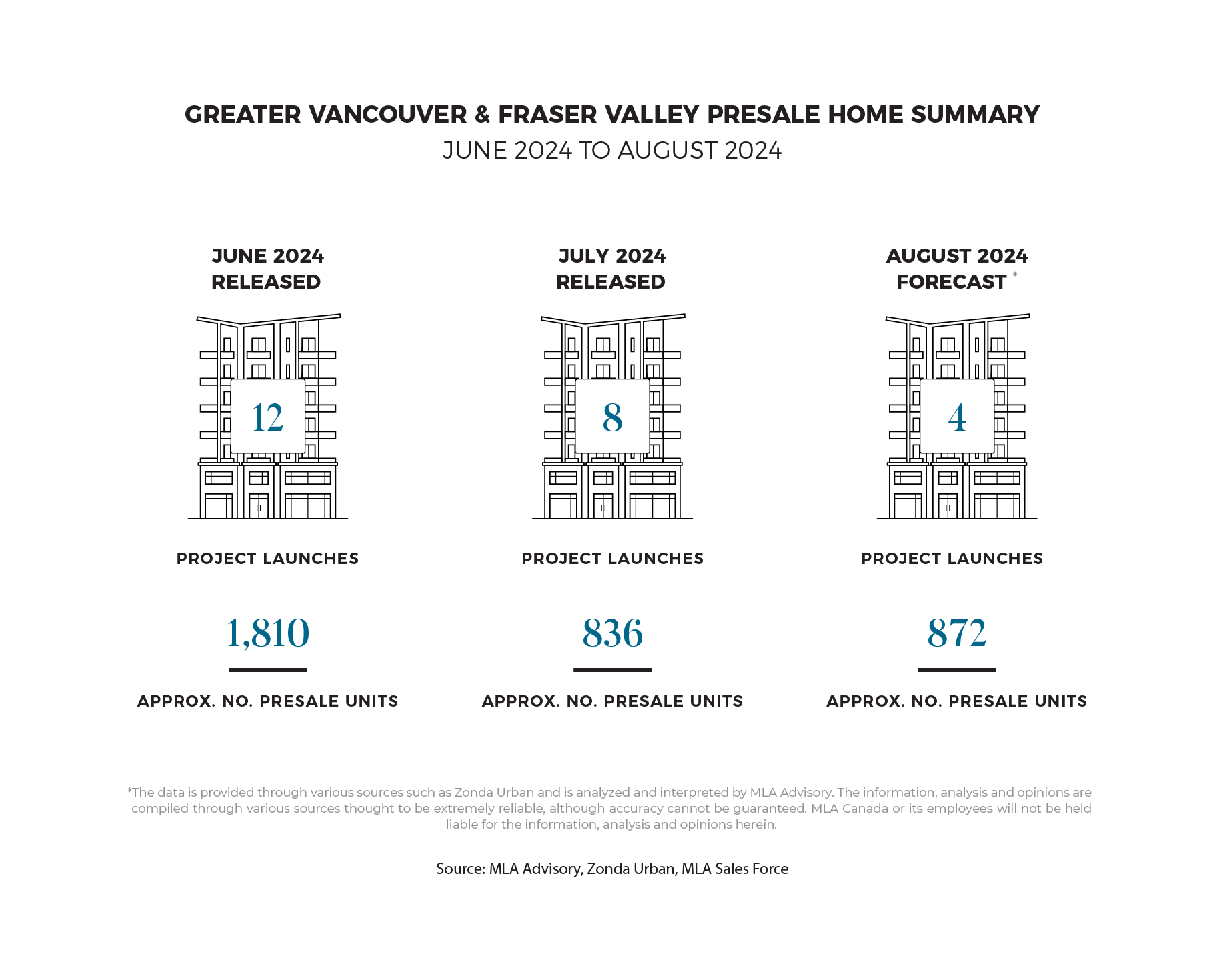

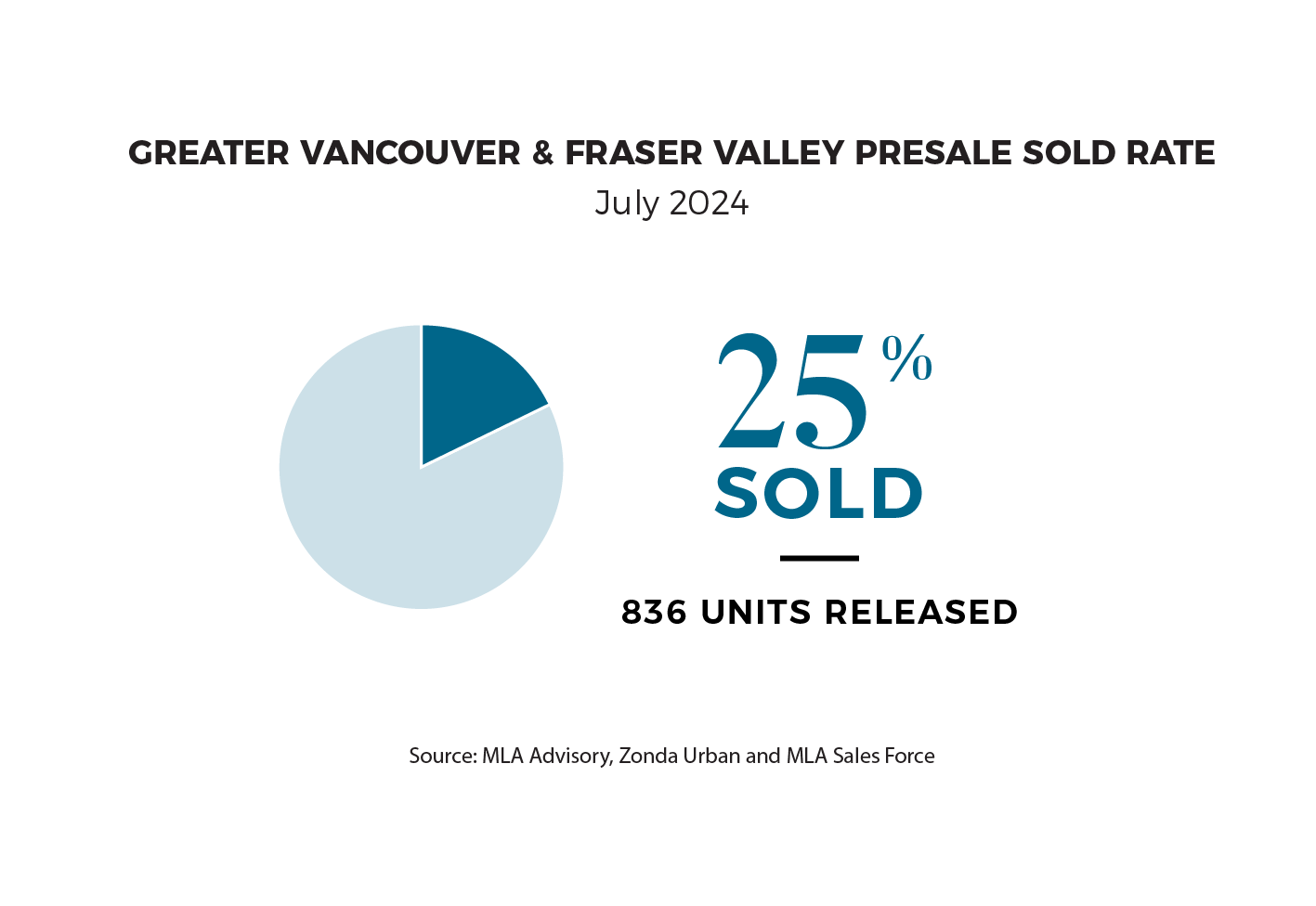

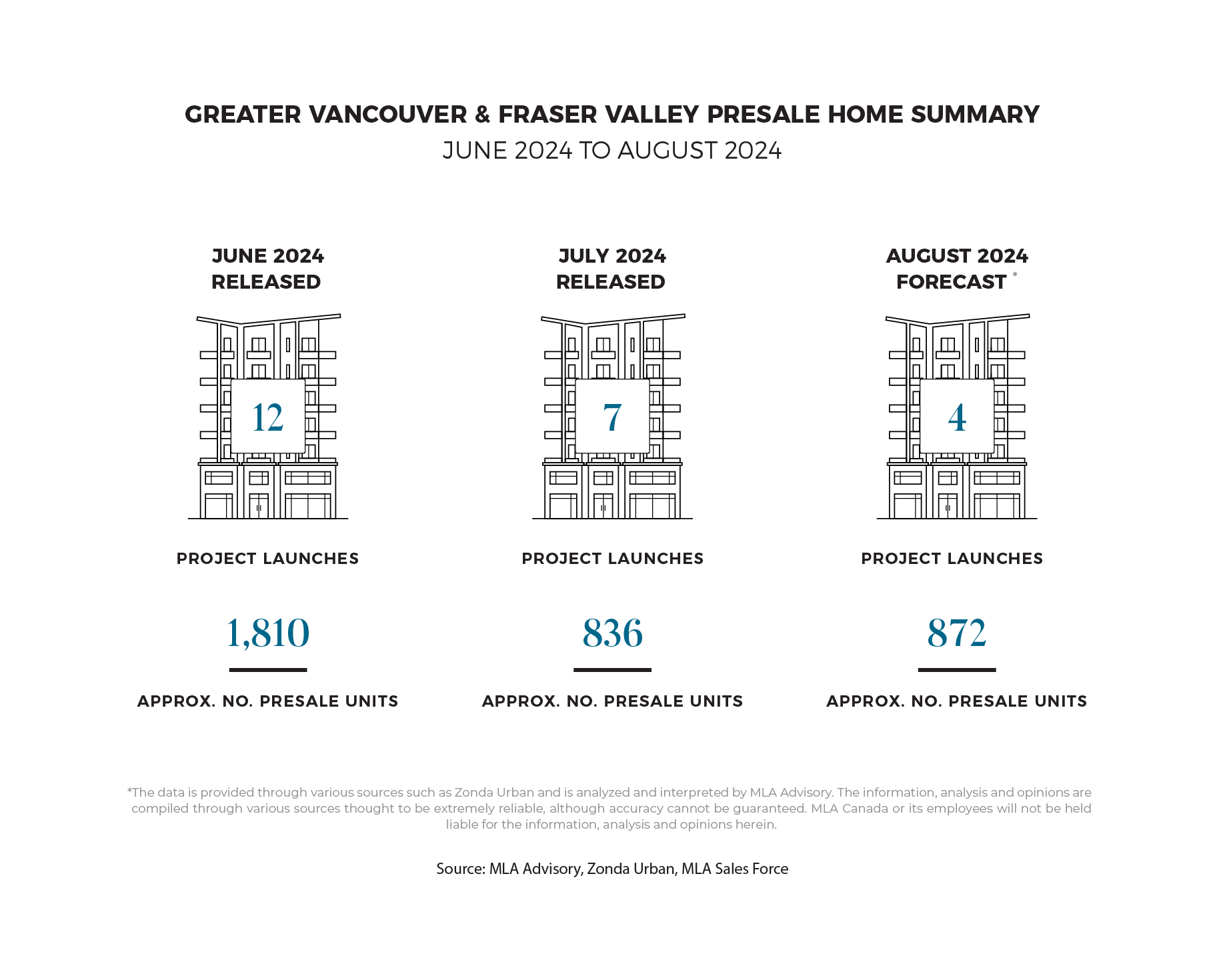

Despite the launched inventory in July being less than half of June's (836 vs. 1,810), sales saw a relative increase, with same-month absorptions rising from 16% to 25%. This increase was primarily driven by Elijah by Whitetail Homes in Langley, which sold 45 (25%) of its 180 homes, and Level by Jayen Properties in West Coquitlam, which sold approximately 100 (56%) of its 178 homes.

Many of the same challenges that persisted in the early-Spring market continue today. The next opportunity for developers to launch will likely be in October when the market picks up again. As homebuyers find their bearings, recent interest rate cuts are expected to bring renewed interest to the market. Developers will likely start releasing marketing materials in the coming weeks to gauge whether they should launch in late-September or in the new year.

VANCOUVER’S RESALE MARKET: A SHIFT TOWARDS BUYERS

This summer has been notably quiet in the Vancouver real estate market, with the balance of power gradually shifting towards buyers. Recent statistics from July show active supply continuing to outpace demand within the market. This trend is mirrored in actively selling presale projects, where moderate sales and rising competition indicate a shrinking pool of buyers.

The situation is expected to intensify as unlaunched presale projects, planning for Fall releases, begin to advertise and list prices, adding to the already growing supply of active inventory. The Bank of Canada’s recent 0.25% rate cut on July 24, the second of the year, has provided buyers with greater purchasing power and improved mortgage qualification conditions.

For buyers, this is an opportune moment. Prices are stabilizing, sellers are more flexible, and developers are offering significant incentives. While we’re no longer seeing the FOMO that characterized are market in previous years, buyers will have to decide if they want to get ahead of renewed demand that return us to low-supply conditions.

TWO MAJOR CONCRETE LAUNCHES COMING IN AUGUST

New high-rise inventory will make up the majority of the 872 units coming the market in August. Two major projects: Bassano by Boffo Developments and Brentwood Block by Grosvenor, both situated in the rapidly growing Brentwood area, have been actively marketing for several months and are slated to begin sales in August. Together these projects constitute 796 homes – making this the largest release of new concrete inventory in a single month since October of last year.

Aside from these launches, MLA Advisory expects Terra Garden in Surrey and Harlowe House in Vancouver West to also begin sales.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, presale, and resale market video report, Presale Pulse.

Subscribe to the MLA Canada YouTube Channel or find the Pre-Sale Pulse on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio.