"Other than the Spring, September and October are traditionally the second busiest months of the year for presale. This year is no different, however, activity is largely on the developer side as buyers continue to be patient and chase value, leading to lower sales volumes during launch period compared to long-term averages. This is resulting in an accumulation of active supply in the presale market.” - Garde MacDonald, Director of Advisory

A WINDOW OF OPPORTUNITY FOR BUYERS

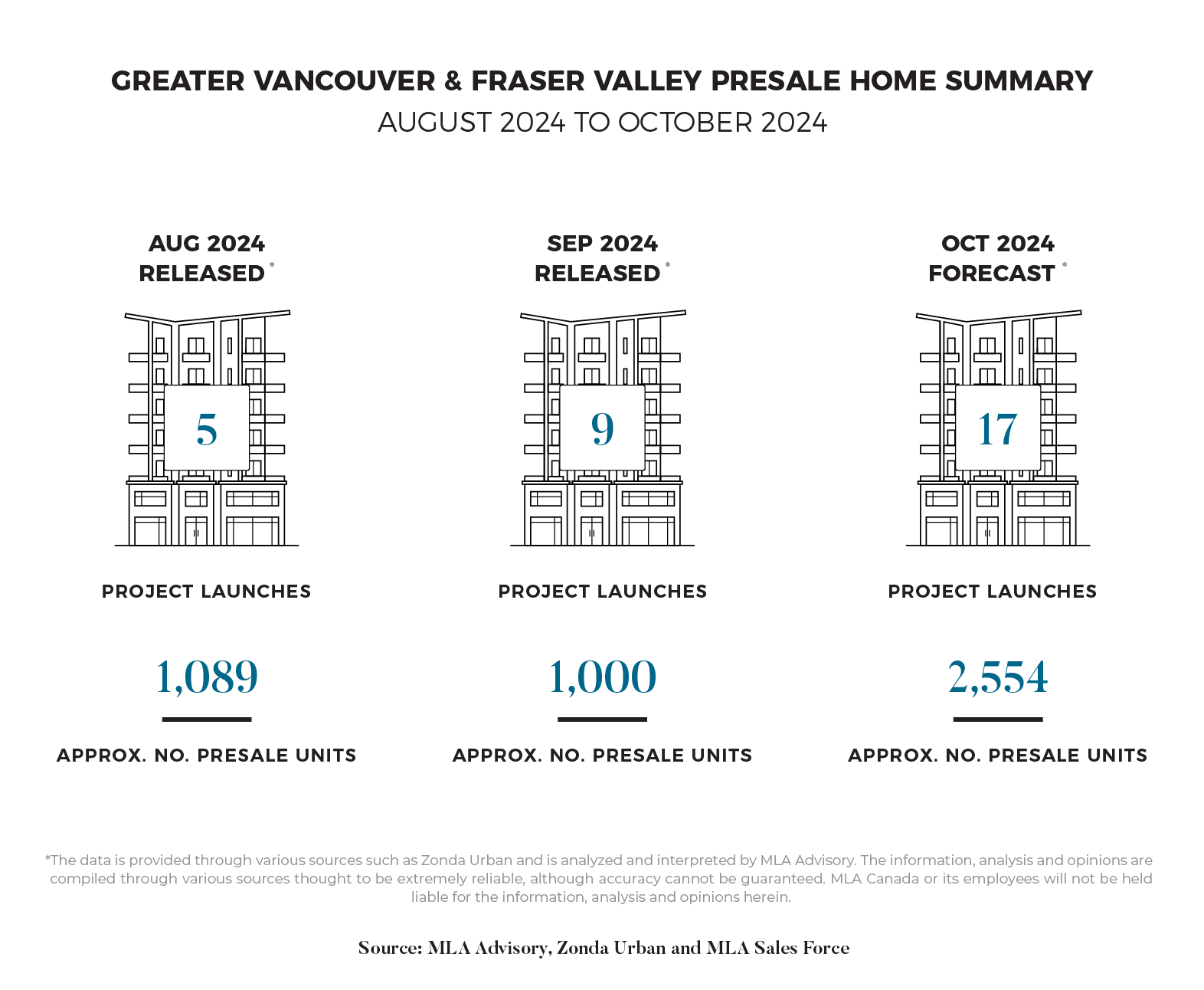

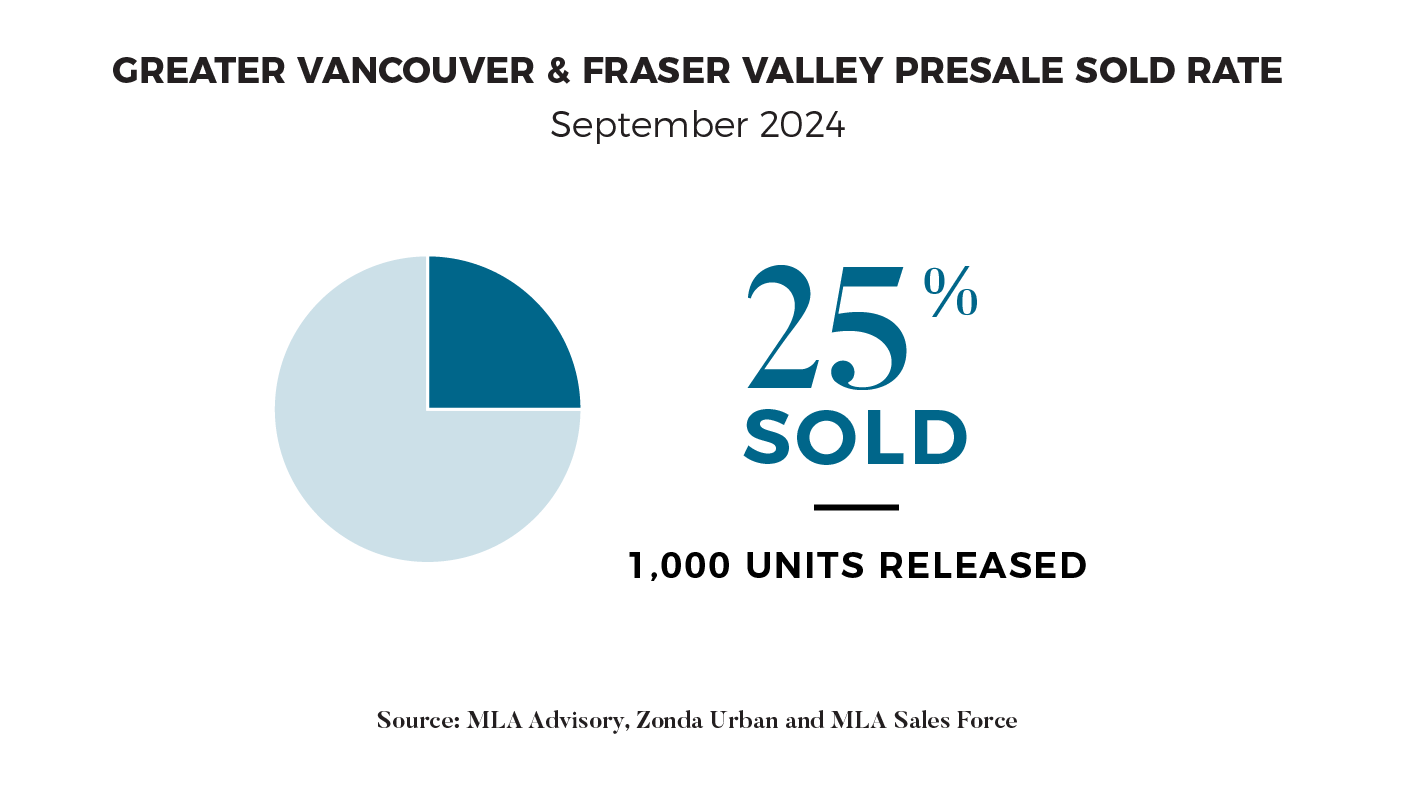

Presale activity began to show slight improvement in September compared to August. As we moved into the fall, 9 projects launched during the month, adding a total of 1,000 units to the market. Same-month absorption for these projects reached 25%, an improvement from last month’s 11% absorption rate, despite a similar number of units being introduced to the market. This creates a strong opportunity for buyers, as the current market offers attractive incentives and flexible deposit structures, making it more favourable for those looking to purchase.

ATTAINABLE HOUSING INITIATIVE: HEATHER LANDS PROJECT

In mid-September, the Government of British Columbia, in partnership with the MST Nations—xʷməθkʷəy̓əm (Musqueam), Sḵwx̱wú7mesh (Squamish), and səlilwətaɬ (Tsleil-Waututh)—launched the Attainable Housing Initiative (AHI) aimed at enhancing housing affordability. The initiative prioritizes first-time home buyers to purchase homes at an initial price that is 40% below market value.

Presale buyers at the Heather Lands project, covering 21 acres and featuring 2,600 homes, will finance only 60% of the purchase price, with the Province covering the remaining 40% in partnership with the landowner and developer. Repayment of the Province's contribution is required after 25 years, upon selling the home, or if the property is no longer the buyer's primary residence—whichever comes first. The AHI and the 60/40 financing model are applicable only to the initial purchase and do not extend to secondary sales that follow.

Additionally, buyers will benefit from a reduced 5% deposit based on the 60% they are financing. This initiative aims to provide a diverse range of housing options, including studio, one-, two-, and three-bedroom homes, making them accessible to middle-income earners at below-market prices through the 60/40 financing model. The AHI units will be sold as 99-year strata leaseholds on land owned by the MST Nations.

COMPLEX MARKET DYNAMICS PERSIST

Vancouver's housing market is experiencing a severe slowdown in construction, according to recent data. Housing starts have plummeted, with a 43% year-over-year decrease in the first half of 2024, translating to just 8,500 new units, compared to 15,000 in the same period last year. This decline is driven by rising interest rates, which have increased the cost of borrowing, and escalating construction costs, making projects financially unfeasible for many developers. Additionally, tighter lending conditions have further constrained financing options, exacerbating the situation.

In all likelihood, the full downstream effects of this slowdown won't be felt for another 3-4 years. As projects currently under construction wrap up, the lull in new construction will become more apparent. This gap in the housing pipeline will likely lead to increased competition for the limited supply of new homes, driving prices even higher. The anticipated shortage could exacerbate the existing housing crisis, making it even more challenging for residents to find affordable options in the coming years.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, presale, and resale market video report, Presale Pulse.

Subscribe to the MLA Canada YouTube Channel or find the Pre-Sale Pulse on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio.