"With swirling uncertainty related to the threat of tariffs and a new regime in the USA, January was one of the quietest months on record for presale activity. Overall, prospects active in the market are exhibiting patience and a lack of urgency as they get a grip on the current state of affairs. Despite a slow January, we anticipate a return to normal levels of presale launch volume in February as Lunar New Year campaigns take full effect.” - Garde MacDonald, Director of Advisory

MARKET FREEZE, SIGNS OF THAWING AHEAD

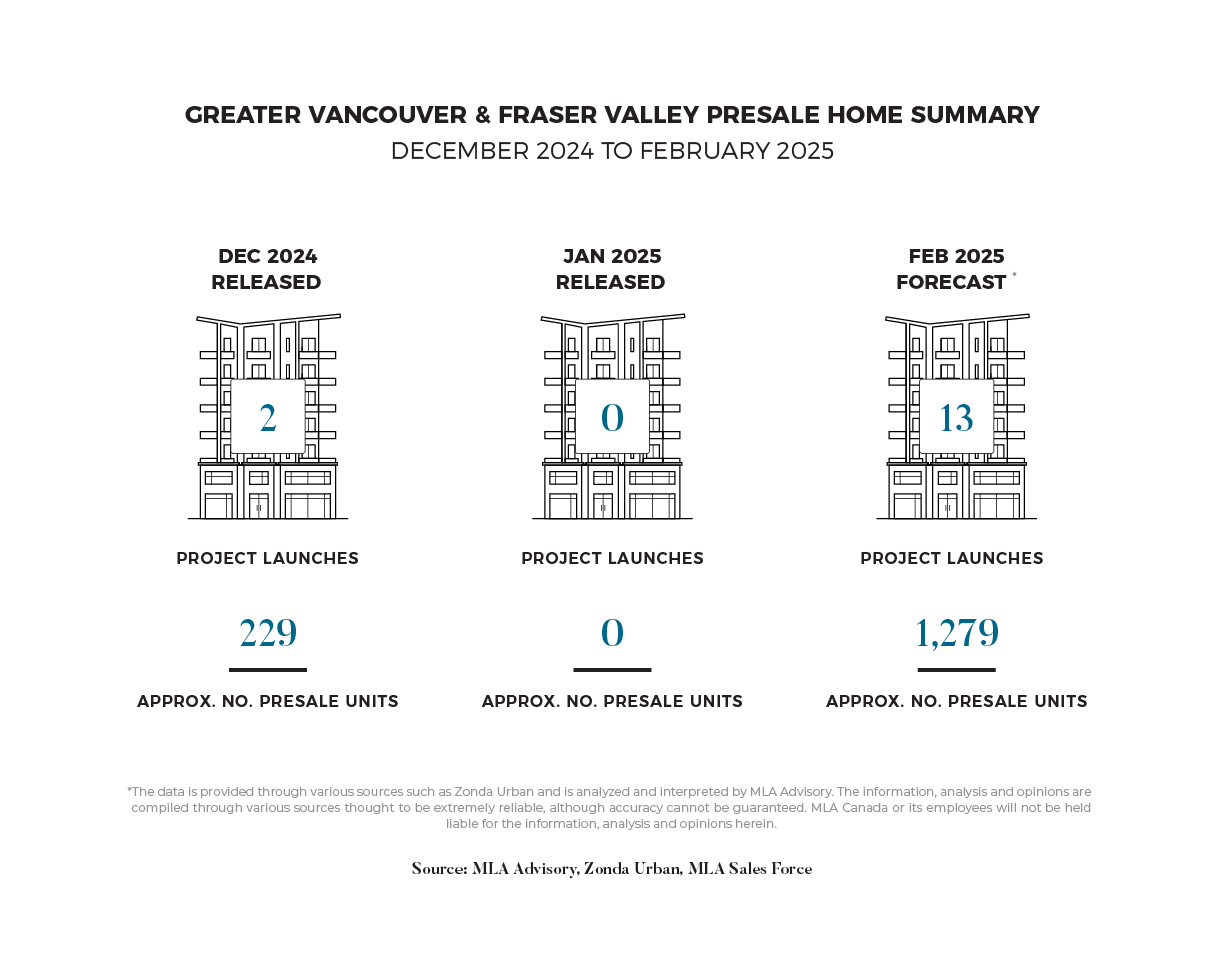

The holiday slowdown extended into the New Year, making January particularly quiet for market activity and new project launches. For the first time in four years of MLA tracking, no new projects or units were released over the month, reflecting the continued buyer hesitation and post-holiday fatigue. However, interest began to build in the latter half of the month, with increased traffic in sales galleries.

With Lunar New Year falling in late January, the market saw a surge in incentives and bonuses aimed at both realtors and buyers in the final weeks of the month. A series of industry events—including Lunar New Year celebrations, realtor previews, and market seminars—helped generate buzz and drive traffic back into sales galleries. Developers with upcoming projects are closely watching market activity to gauge demand and the success of incentives before refining their strategies and launching new product in the coming months.

THE TARIFF TRAP

Last month, the threat of new tariffs sparked widespread uncertainty, as fears grew about the U.S. imposing a 25% tariff on Canadian goods. On February 1st, President Donald Trump followed through, imposing a 25% tariff on almost all goods from Canada. In turn, Prime Minister Justin Trudeau responded with 25% tariffs on $155 billion worth of U.S. goods. With the tariffs set to take effect on February 4th, Trudeau stepped in on February 3rd, announcing that Trump would delay the tariffs for at least 30 days after Canada made commitments to enhance border security.

With 75% of Canadian exports going to the U.S., a 25% tariff could prompt American buyers to look for cheaper alternatives, reducing demand for Canadian goods. This drop in demand could lower revenues for businesses, trigger layoffs, and potentially lead to an economic slowdown. Analysts caution that extended tariffs could trigger a recession, with projections indicating that such tariffs could stunt Canadian growth for three years, significantly reduce GDP, and push unemployment to 8%. Coupled with a slowdown from reduced immigration, the outlook could worsen. Additionally, if U.S. tariffs move forward and Canada retaliates, price hikes would likely hit consumers, leading to slow growth and inflation, which would put the Bank of Canada in a challenging position to maintain economic stability.

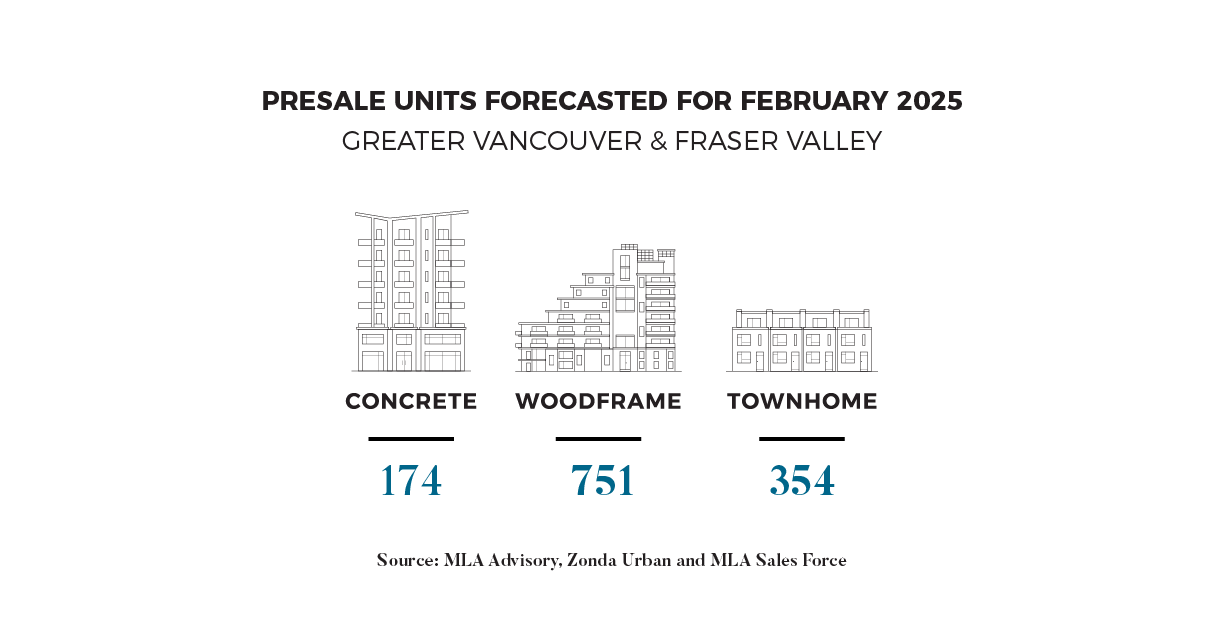

A WAVE OF WOOD FRAME

Looking ahead to February, an uptick of new product is anticipated to enter the market, with 13 projects slated for launch and over 1,300 units to be released across Greater Vancouver. A key trend among these upcoming developments is the focus on wood frame and townhome projects, with the majority concentrated in the Fraser Valley. This shift is largely due to the continued low investor interest, prompting developers to prioritize end-user-focused homes that cater to the demand for more affordable housing. However, despite these smaller-scale projects being easier to bring to market, the ongoing delays in launches highlight the challenges developers are still facing.

January saw a decline in resale activity compared to December, with sales remaining below the 10-year seasonal average. As demand continues to dip and inventory rises, buyers have a broader range of options to choose from. Buyer caution, heightened by the looming threat of tariffs, has further contributed to the increase in available listings. With economic uncertainty ahead, further rate cuts are likely and may keep buyers on the sidelines. Despite increasing inventory and weak demand, prices have remained relatively stable, though potential disruptions to the economy, such as tariffs, could shift the market outlook.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, presale, and resale market video report, Presale Pulse.

Subscribe to the MLA Canada YouTube Channel or find the Pre-Sale Pulse on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio.