Shopping for a new home is a big investment both in time and money. As homebuyers, we know we need to spend time researching different locations, comparing quality and features, assessing various neighbourhoods — all to ensure we are getting good value for our money. But don’t forget to also do your research to get the “best value” out of your mortgage. As the Bank of Montreal eloquently states in their home financing brochure: “There is more to a mortgage than an interest rate.”

You can knock years off your mortgage and save thousands of dollars in interest costs with the right payment structure. But becoming mortgage-free as soon as possible will require some planning and strategy:

- Increase the frequency of your payments from monthly to bi-weekly or weekly. The more frequent your payments, the faster you’ll pay down your mortgage.

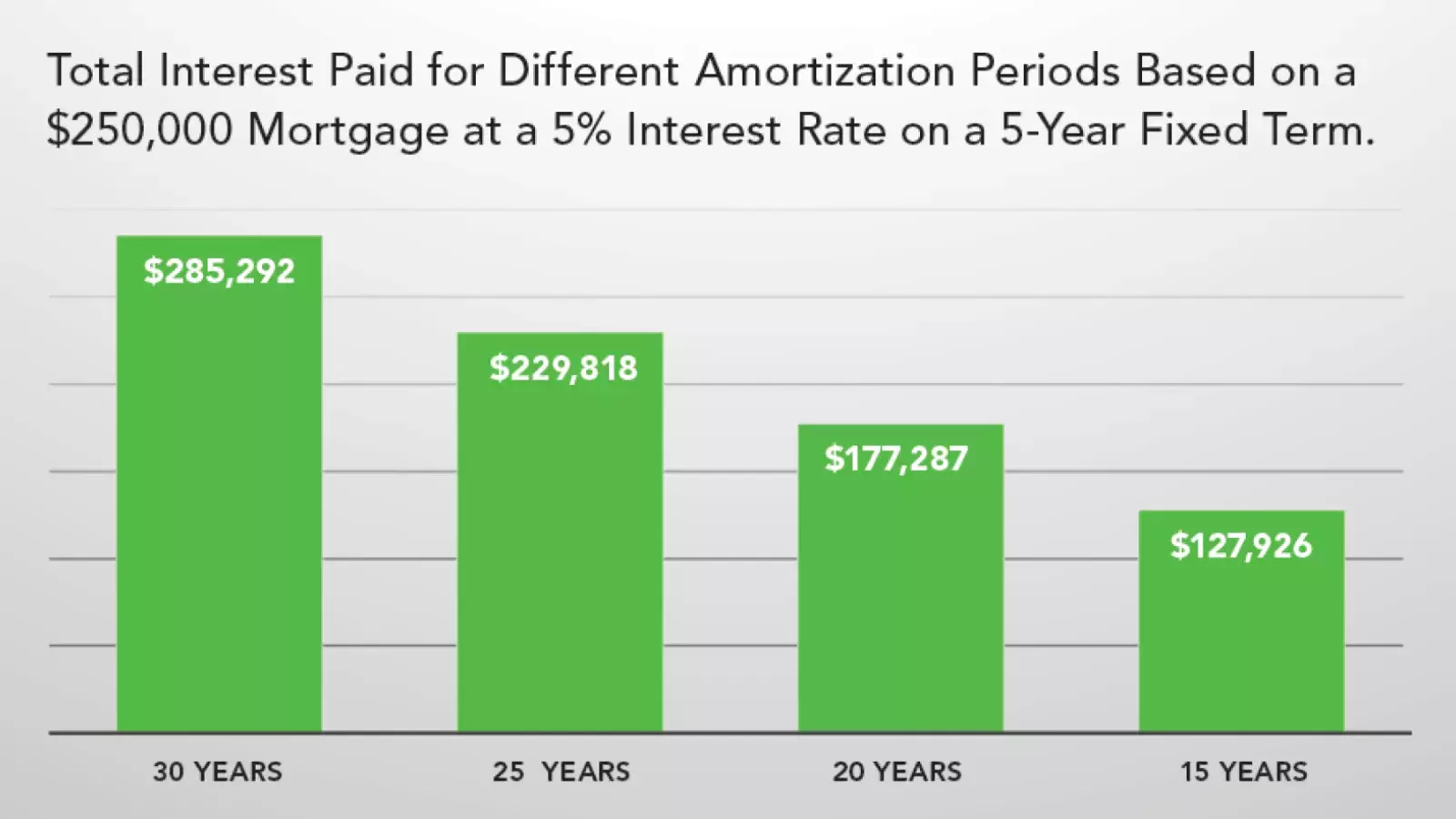

- Reduce your amortization period by 5 or 10 years. Your monthly payments will be higher but you will have saved a large amount in interest costs by the end of your mortgage.

- Take advantage of your bank’s option to increase your mortgage payment either monthly or as an annual lump sum.

You’ll want to speak to your bank about your options. Most banks offer additional features if you choose to pay down your mortgage faster such as a building up a “Mortgage Cash Account” at BMO where you can re-borrow prepaid funds at any time starting from $2,500 without charge. This allows for flexibility, as your financial needs change over the years or in case of an emergency.

Be sure to get pre-approved before you begin your home search. Your local bank can hold a pre-approved interest rate for you up to 3 months. However, when looking to purchase a pre-sale home (which likely will take more than 3 months to complete), speak with the sales team at any presentation center and they will be able to provide you with a broker such as a TD Mobile Mortgage Specialist who can hold interest rates up to 24 or 36 months. Having a solid understanding of what you can afford and how you can pay your mortgage down faster will ease and guide your home search. BMO Mortgage Development Manager, April Jang-Lee advises “Plan early and be realistic. Remember that the first home you buy will likely not be the only or last home you purchase.”

At the end of the day, plan for your mortgage just as much as you plan to find your dream home. It’s a hand-in-hand process where your mortgage broker, Realtor, and sales representative work together to assist you with the exciting journey of home ownership.