March Real Estate Market Data & Insights

"Many concrete projects were paused back in 2019 and 2020. With strong market demand from both investors and end users we are seeing strong sales numbers across the board and developers racing to get into the market. ” Suzana Goncalves EVP, SALES AND MARKETING; PARTNER, MLA CANADA.

HIGHEST NEW PROJECT ABSORPTION SINCE 2018

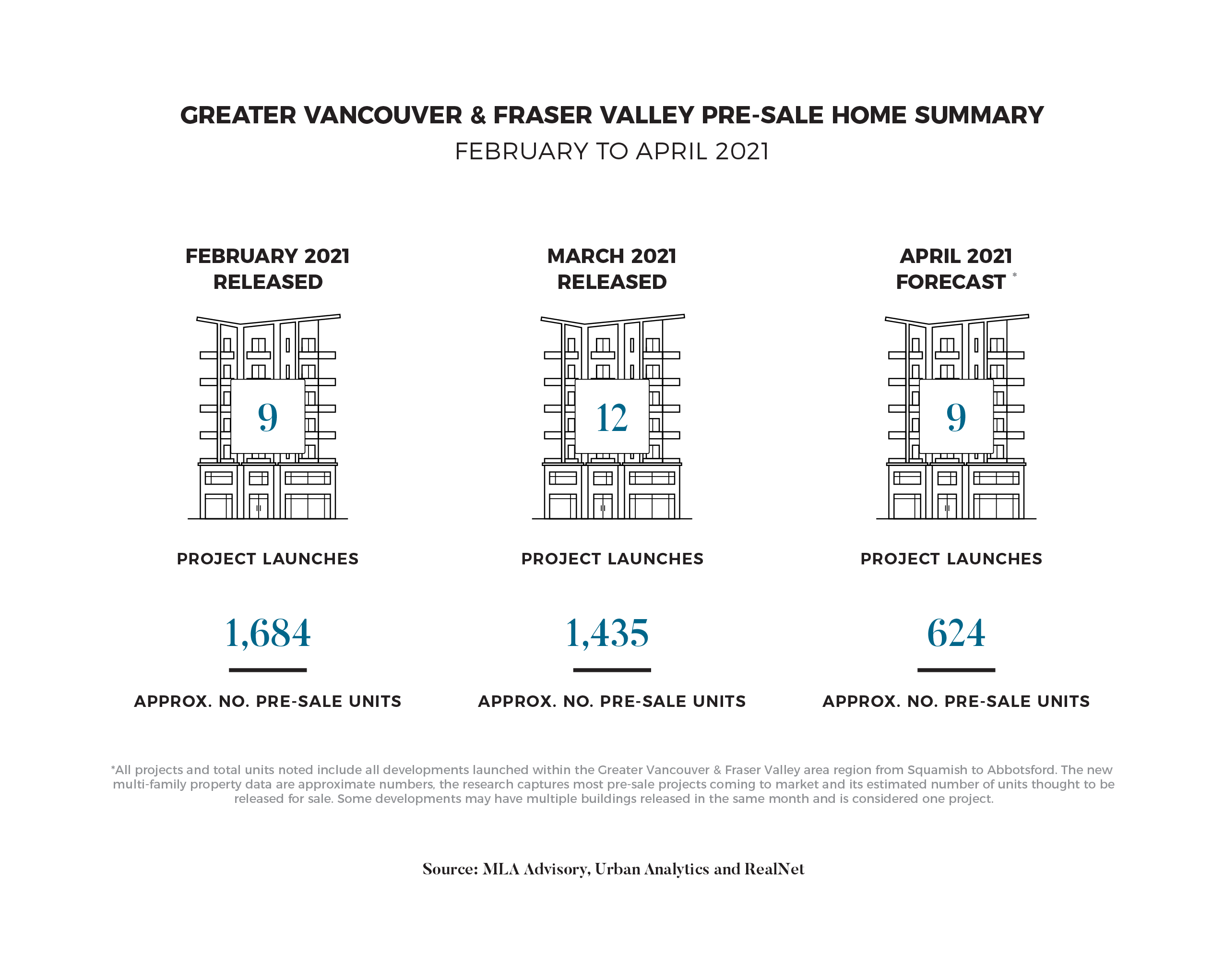

In March, 12 presale projects launched sales and released approximately 1,435 condominium and townhome units to market. The majority of newly released units (74%) are in concrete condominium developments; there were three new concrete towers that began sales in March. These projects are Central Park House by Bosa Properties and Concord Metrotown by Concord Pacific located in Metrotown, as well as Belvedere by Square Nine Developments in Surrey, which notably sold out in three weeks of sales. Of the total newly released inventory in March, 845 units were absorbed, indicating a 59% same-month sales rate. This is the highest same-month sales rate for newly released projects since early 2018. As 2021 has progressed, developers have flooded into the market and are looking to capitalize on current market demand that is partially fuelled by low interest rates and some speculate, a “FOMO” effect of not wanting to miss out on rapidly escalating prices.

RECORD BREAKING RESALE MARKET ACTIVITY

There was record-breaking resale market activity in March across the Lower Mainland as a total of 9,037 sales occurred across Greater Vancouver (5,708 sales) and the Fraser Valley (3,329 sales). Absorptions were extremely elevated in March across all product types - the sales-to-listings ratio was above 60% in both markets, indicating that for every ten homes on market, at least six sold. Moreover, sales of detached homes and condominiums in the Fraser Valley were both up 145% from March 2020, indicating robust demand for homes of all sizes and price-points. This elevated demand has resulted in month-to-month benchmark price increases of 3.6% and 4.9% in Greater Vancouver and the Fraser Valley, respectively. Market momentum observed in the resale market is positively influencing the presale market as developers are feeling confident that they will achieve presale financing; similarly, investors have notably increased their buying power over the past six months, which is a key indicator of presale project success.

DEVELOPERS RAMANTLY PREPARING FOR THE SPRING MARKET

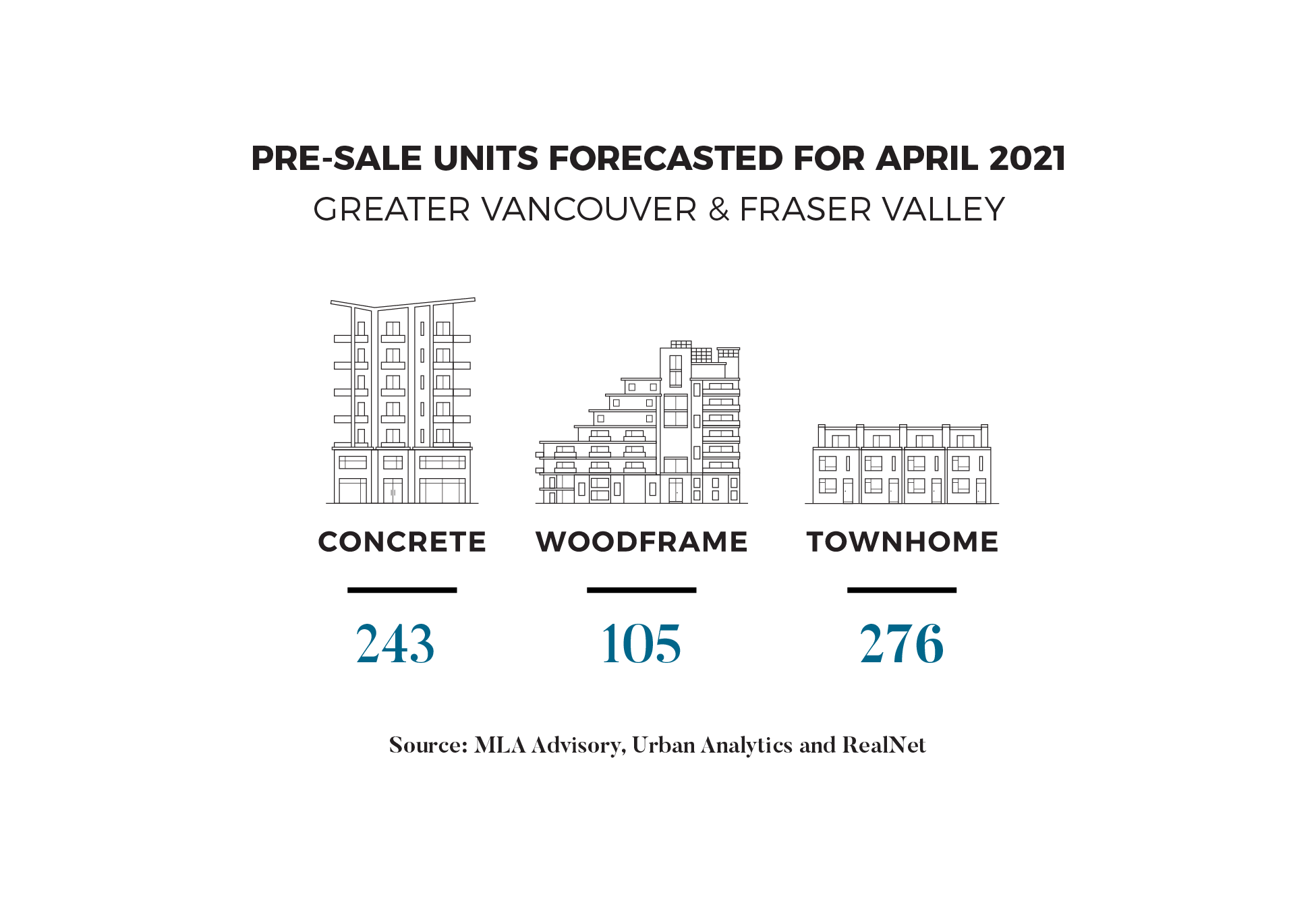

Both presale and resale markets are moving at lightning speed in the Lower Mainland. Many developers want a piece of the action and are quickly preparing to launch new projects during the Spring, which is typically the busiest time of the yearly real estate cycle. Looking ahead to April, MLA Advisory forecasts that there will be nine new presale projects that will launch sales; these projects are mostly small format and will release approximately 645 condominium and townhome units to market. Unlike six months ago, there has been a noticeable increase in demand for premium product in relatively expensive markets such as Vancouver West and Vancouver East. In particular, six of the nine upcoming presale launches for April are in these two submarkets with an additional four projects slated for launch in May. During the initial months of the pandemic, demand shifted East to peripheral regions as purchasers sought affordability, however, given price increases across all product types, relative values are more aligned between East and West and demand has rebounded back to urban cores.