June 2022 Pre-Sale Real Estate Market Insights

THIS EPISODE IS NOW AVAILABLE IN AUDIO

Listen on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio

"We have seen another significant release of inventory in presale last month and very stable absorption at 32%. Presale becomes one of the best asset classes to purchase in to lock in today’s price with rising construction costs, long-term price escalation and beliefs around declining interest rates when completion occurs in 2-4 years depending on the project. Having said that, travel and summer will likely see a decline given other distractions before the market picks up in the Fall."

– Suzana Goncalves, EVP, Sales and Marketing; Partner, MLA Canada

CONSISTENCY REIGNS SUPREME WITHIN THE METRO VANCOUVER MARKET

While rising interest rates and broader economic uncertainty have led many potential buyers to wait and see what direction the resale market takes, recently launched presale programs continue to see steady demand. Same-month absorptions were 32% (642) in June, achieving the same level of absorptions observed in May. For the third month in a row, presale absorptions were within 1-2% of each other. Investors remain optimistic about the overall health of Metro Vancouver’s market and continue to capitalize on the unique opportunities available by purchasing presale products. Given the nature of buying a presale home, purchasers tend to have more time to accrue/obtain financing, uniquely benefiting presale buyers when the debt cost is rising. There is also a recognition that submarkets with strong fundamentals that include such value-adds as access to a nearby Skytrain station are better positioned to retain their value in a slowing market. A testament to this includes recently launched programs such as Alina by Strand in West Coquitlam, which sold 132 (54%) of its inventory within its first two weeks of starting sales in July.

BANK OF CANADA RAISES INTEREST RATES 100 BASIS POINTS

During the most recent rate announcement on July 13th, the Bank of Canada announced that it would raise its key interest rate to 2.5%, a 100 basis points increase from the previous rate announcement in June. While a rate increase was anticipated, the amount came as a surprise to many. A 100 basis points increase is the largest single rate increase since 1998 and outpaces the 75 basis point increase most recently triggered by the US Federal Reserve. The Bank of Canada sites excess demand and persistent inflation as the leading reason for wanting to front-load further rate increases. Looking ahead, the Bank of Canada has adjusted its outlook on inflation from previous rate announcements to take a longer-term view. They expect inflation to ease to around 3% at the end of 2023 before returning to the 2% target in 2024.

PRESALE ACTIVITY TO REMAIN HIGH THROUGH SUMMER

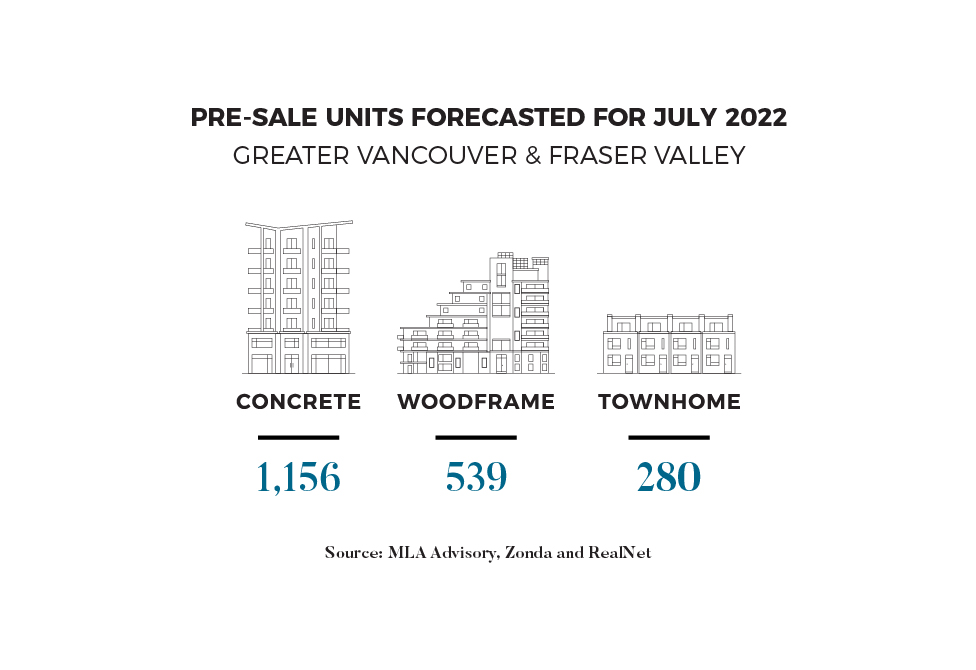

The late-Summer market is generally characterized by decreased presale activity as potential purchasers move their attention away from real estate and towards recreation and warmer weather. However, launching a project in the fall could provide a unique opportunity to capitalize on an existing pool of potential buyers. MLA Advisory forecasts twelve project launches in August, releasing 1,975 units to market across Metro Vancouver. Several significant concrete launches are expected to make up 58% (1,156) of the product. Significant launches thus far include Hue by Marcon in Port Moody. The project is targeting $930 PPSF and has sold approximately 50% of its inventory since launching.

We want to hear from you! If you have a real estate question that you'd like us to talk about in our next Pre-sale Pulse, submit your questions to us.