“Even with the Canadian election resolved, the real estate market continues to be uncertain and exhibit weak metrics. Compared to historical norms, we are seeing about half as many new projects come online every month. Furthermore, the approximately 1,500 total presales in Q1 signal a deflated market that is well below typical unit absorption. Our outlook for 2025 remains centered around a soft sales environment, high volume of project completions, and steep purchase incentives to drive end-user sales.” - Garde MacDonald, Director of Advisory

PRESALE PAUSED FOR POLITICS

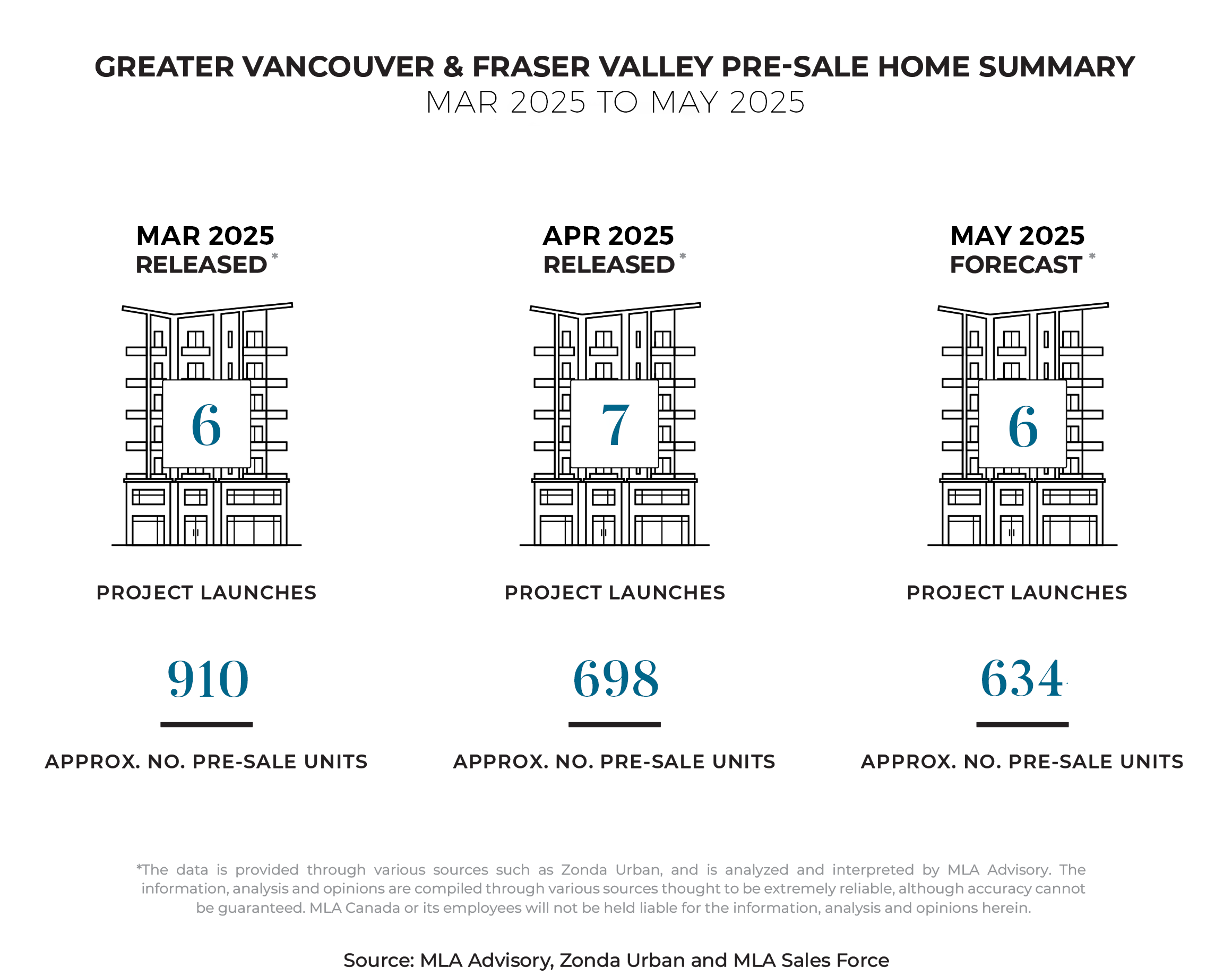

The spring market continued at a subdued pace and fell short of the typical activity expected during this time of year. In April, seven projects launched across Metro Vancouver and the Fraser Valley, bringing nearly 700 units to market. This aligns with the consistent but modest pace of launch volume throughout 2025, averaging six to eight projects per month. However, it marks the lowest launch volume for the month of April since 2020. Historically, April tends to deliver double-digit launches. Last April saw 17 project launches, marking this year’s total a decrease of 70% in comparison.

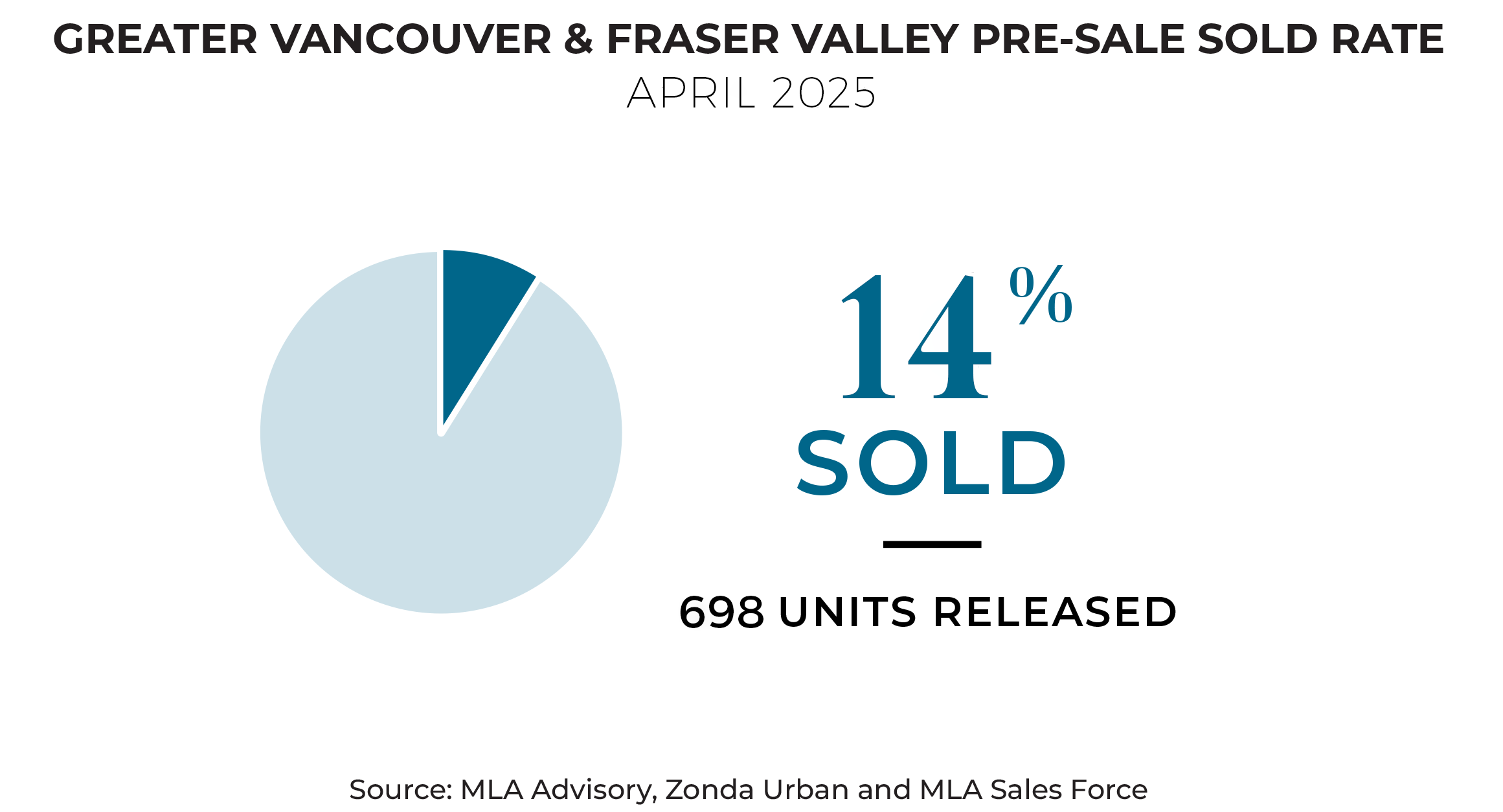

With the provincial election on the horizon at the end of April, both buyers and developers approached the month with caution, holding off on major decisions while awaiting clarity on future leadership. In this context, the tempered demand seen in April is not unexpected. Fewer than 100 homes were sold, resulting in an absorption rate of 14%. For comparison, this figure falls below the five-year average for April, which sits just above 30%.

CLARITY IN LEADERSHIP, SAME ECONOMIC UNCERTAINTY

For Canadians, the federal election was top of mind in the macro landscape last month, with the Liberals returning under a minority government. Two housing proposals stand out from their campaign that could make an impact on the presale market: a reduction in the development charges for multi-residential projects and a GST exemption on new homes under $1 million for first-time buyers. While neither is a silver bullet, they could help improve project feasibility for developers and provide enough incentive to prompt action from some buyers on the sidelines.

In parallel with political developments, Canada’s economic data is showing signs of strain. February saw the weakest monthly GDP in over two years, down 0.2%, adding pressure on the Bank of Canada to consider future rate cuts. While March is expected to post a slight rebound of 0.1%, these figures don’t yet capture the impact of newly introduced tariffs. Many experts anticipate negative GDP growth in Q2 once those effects are fully reflected.

PRESALE LAUNCHES SLOW, RESALE STOCK GROWS

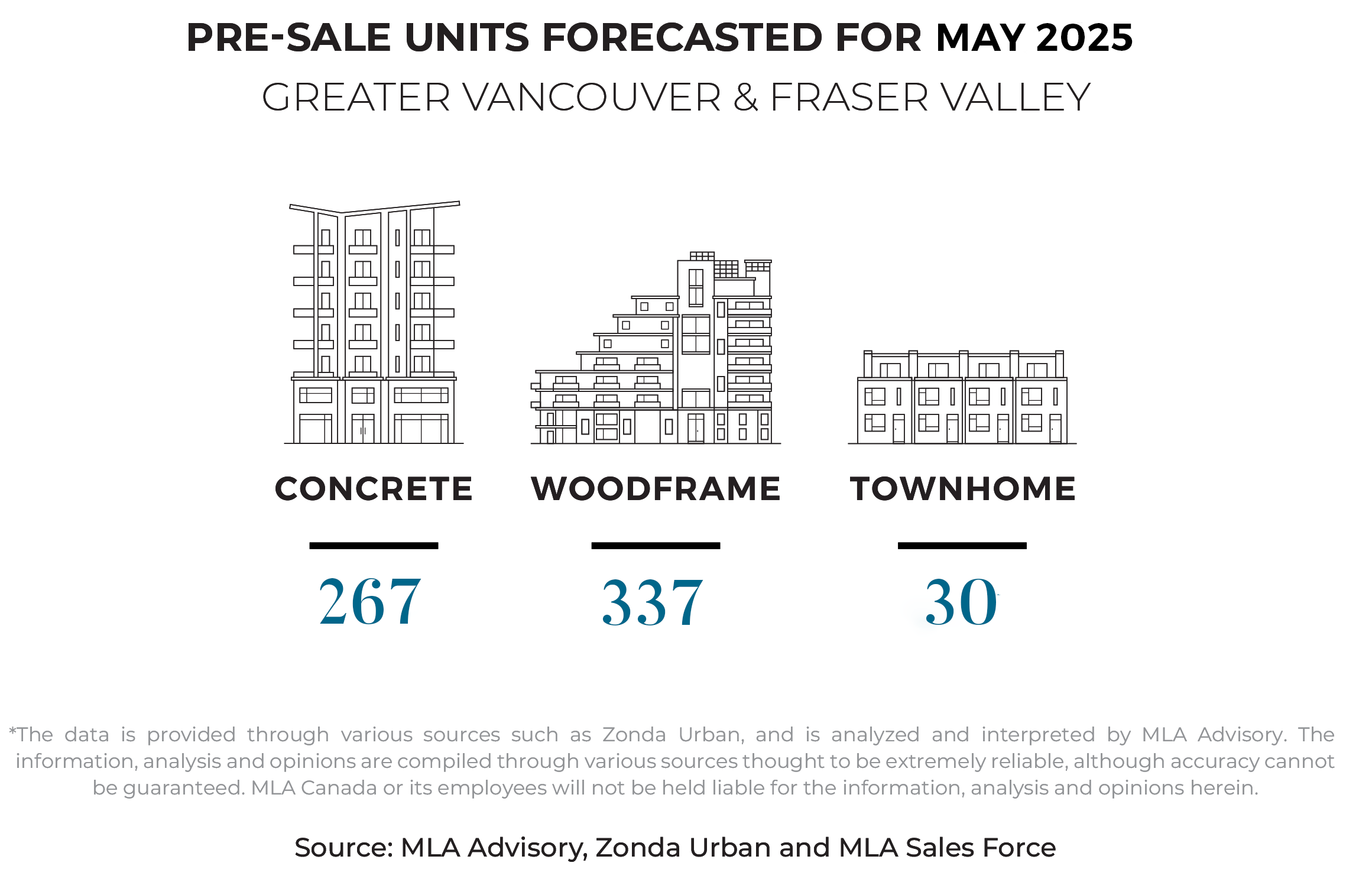

May is expected to follow the launch pace we've seen in 2025, with six projects set to hit the market, adding just over 630 units. The majority of these are low-rise wood-frame developments, with all but one located in the Fraser Valley. About half of these projects are reintroducing themselves with fresh "coming soon" messaging, building on previous rollouts from earlier months.

Resale activity is slowly improving month over month, though it's still below typical spring averages. Greater Vancouver recorded just over 2,100 sales, while the Fraser Valley saw just over 1,000, both down more than 20% compared to last year. With the election behind us, there's hope that the clarity in leadership can stimulate market activity. Inventory remains high, with both regions seeing about a 10% month-over-month increase, pushing Greater Vancouver to over 16,000 active listings and the Fraser Valley to around 10,000. While monthly price declines have been minimal, year-over-year, Greater Vancouver has seen prices drop by nearly 2%, and the Fraser Valley by about 3.5%.

Stay tuned for the upcoming release of Presale Pulse—your all-in-one video briefing on the latest in macroeconomics, presale launches, and resale performance.

Subscribe to the MLA Canada YouTube Channel or find the Pre-Sale Pulse on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio.