"The market showed no signs of slowing down in May and the results do not disappoint. With same-month absorptions at 40%, developers are getting every signal they need that the market is hungry for new supply and is willing to buy even while interest rates remain high” Suzana Goncalves EVP, Sales and Marketing; Partner, MLA Canada

SALES MOMENTUM CONTINUES IN THE METRO VANCOUVER PRESALE MARKET

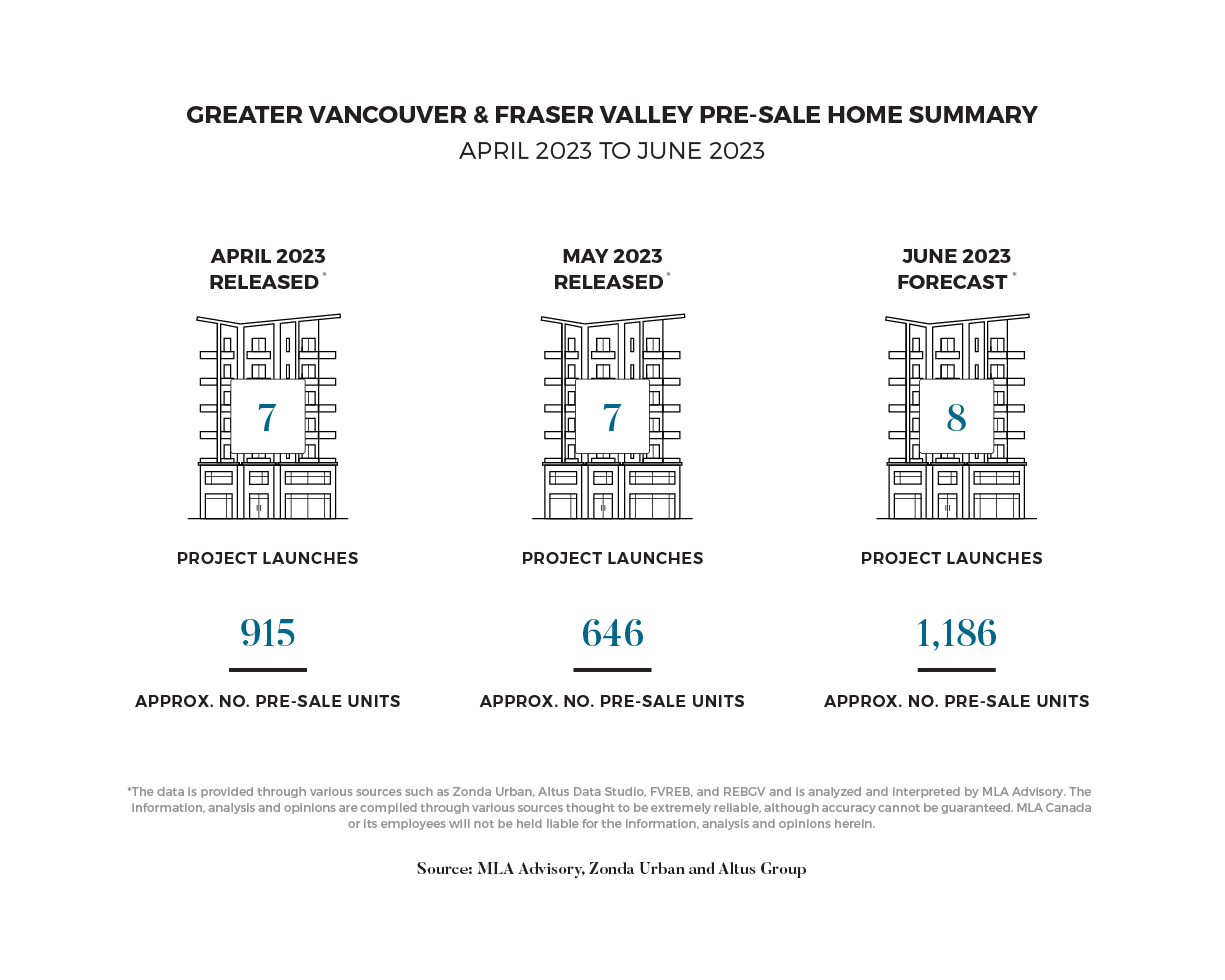

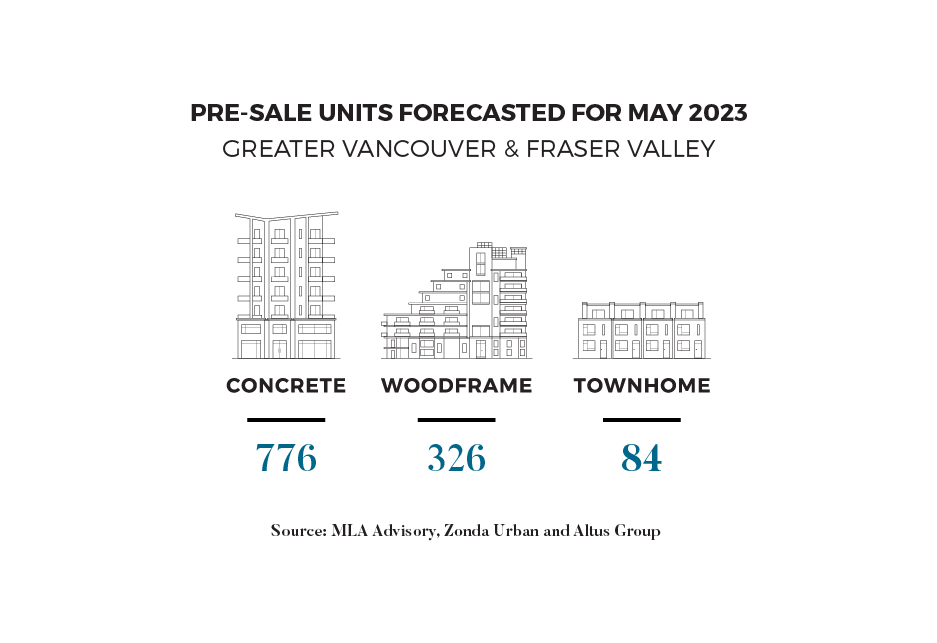

The presale market in Metro Vancouver continues to gain traction as demand remains robust and buyer interest persists. In May 2023, a total of seven projects consisting of 646 units were released across Metro Vancouver.

This year's same-month absorptions witnessed a notable increase, reaching 40% in May, surpassing the 33% recorded in April and the trailing three-month average of 30%. The rising absorptions indicate a healthy level of buyer activity and an overall positive market sentiment.

To offset the sting of higher interest rates, buyers continue to seek more affordable markets within the region. This shift has been especially true in West Coquitlam, where buyers are flocking to capitalize on its comparatively affordable housing options. As a result, several towers are now preparing to launch in West Coquitlam, aiming to meet the overall demand and cater to the needs of these eager buyers.

HOW A TURBULENT COMMERCIAL SECTOR COULD IMPACT RESIDENTIAL DEVELOPMENT

Rising office vacancies and decreasing demand for spaces with central business districts (CBD) are expected to have long-lasting implications for the residential real estate market. As a result, we can anticipate several important outcomes:

Firstly, expect increased capital inflow to the residential sector. As returns on commercial investments decline, institutional investors are likely to seek higher returns in the residential market. This influx of capital could increase competition for existing purpose-built rental properties and developable land. However, while this focus on the residential market may support the housing supply, it is also expected to intensify competition for land suitable for multi-use developments. Consequently, land values may rise, increasing overall development costs for condominium projects.

Secondly, the decline in traditional office and retail spaces will likely drive the continued rise of mixed-use developments. Expect Developers to pivot towards incorporating a combination of residential, commercial, and recreational spaces. This trend is reminiscent of the approach taken by Riocan, which has mandated an increase in apartment rentals to complement its retail holdings. Integrating different functions within a single development could help adapt to the market's changing needs.

Additionally, repurposing commercial spaces for residential use is also expected to become more common. While there are challenges associated with converting office spaces into residential units, the growing demand for housing may incentivize developers to undertake such conversions. This shift in property utilization could help address the surplus of office space while providing additional residential options.

In summary, the decline in office values is poised to impact the residential market in several ways. The residential sector may experience increased capital inflow, a rise in mixed-use developments, and a greater emphasis on repurposing commercial spaces. These changes reflect the evolving dynamics of the real estate market and the need to adapt to shifting demands and preferences.

TIMING IS EVERYTHING

In June, MLA Advisory is forecasting eight presale launches, introducing a total of 1,186 units to the market. These launches are primarily driven by developers aiming to take advantage of the current sales activity and the scarcity of available inventory in the market. For reference, we anticipate at least three tower launches in West Coquitlam and two in Burnaby, bringing just over 1,600 units to the Fall market.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, pre-sale, and resale market video report, Pre-Sale Pulse.

Subscribe to the MLA Canada YouTube Channel or find the Pre-Sale Pulse on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio