Article by Nicholas Frappell, Advisory Associate at MLA Canada

Just as warm weather has attracted sun-seekers to our beaches, the real estate market is experiencing a surge in activity, with buyers and sellers drawn in by the allure of improving lending conditions and appreciating values. However, just as the waves ebb and flow, so too does the market. While the currents may be favourable, it's essential we navigate with caution, recognizing the potential of hidden riptides beneath the water’s surface.

Key Insights into Metro Vancouver's Housing Market Surge

The Canadian housing market has shown remarkable resilience as of late. In May alone, Metro Vancouver recorded over 5,000 resale transactions, a level not seen since March 2022. This defies the typical seasonal slowdown associated with this time of year. However, it's crucial to examine the underlying factors driving activity before jumping to conclusions. In this post, I will delve into the data, explore two informative graphs, and discuss the potential conflicts and challenges facing our market in the years ahead.

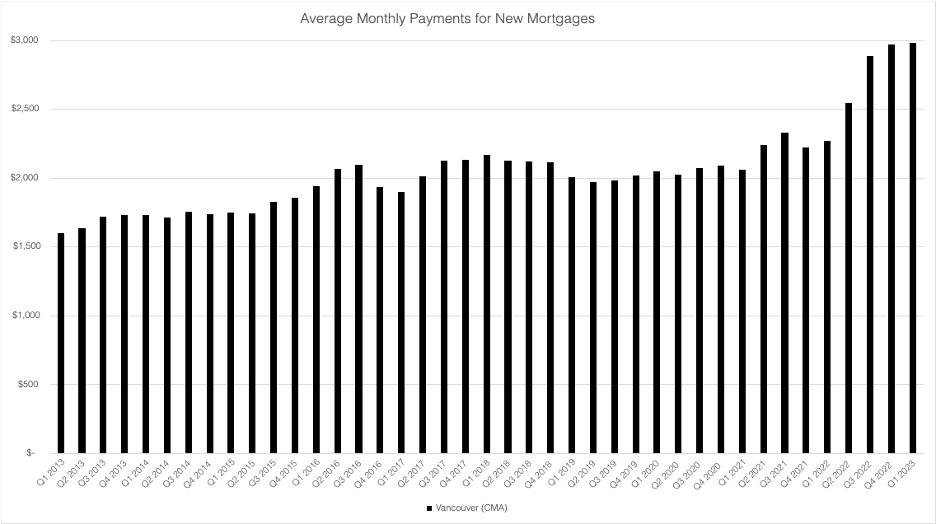

The first graph showcases the average monthly payment of new mortgages in Vancouver CMA (including refinancing). This graph reveals that the average payment for new mortgages has surged at its fastest pace in over a decade. In Q1 2023 alone, average mortgage payments for new loans witnessed a staggering 31% increase YoY.

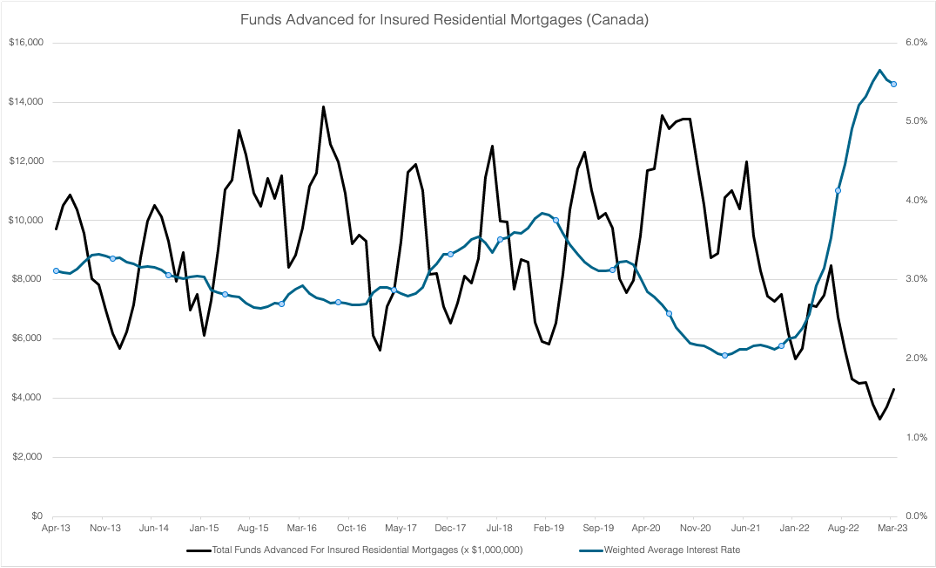

Meanwhile, the second graph illustrates the volume of funds newly advanced for residential mortgages in Canada, along with their average interest rates. These figures reveal the sheer volume of residential loan issuances that occurred in 2020 and 2021 across Canada, driven primarily by historically low-interest rates and FOMO within the market. A primary concern for me is the wave of refinancing that will occur in 2025 and 2026. This will likely increase the financial strain for already financially constrained borrowers. When you consider reports, such as from CIBC, which have indicated that a significant portion (1 in 5) of homebuyers struggle to make interest payments, the picture painting our market becomes even less clear.

In conclusion, the recent surge in real estate activity and the resilience of the market are undoubtedly positive signs for our industry. However, it is essential to consider the potential challenges and conflicts that may arise in the coming years. The wave of loan refinancing, coupled with reports of borrowers struggling to make interest payments, highlights the need for caution and a comprehensive analysis of the market's underlying health. By maintaining a balanced perspective, industry professionals and stakeholders can make informed decisions and navigate the open seas with greater confidence.

Advisory Associate, MLA Canada

LinkedIn | MLA Advisory