The MLA Black Book is a quarterly detailed overview of the pre-sale real estate marketplace spanning the Greater Vancouver and Fraser Valley regions. This market intelligence is brought to you by MLA Advisory and covers pre-sale sales results, including active sub-markets, development and rezoning application activity, project launches, and upcoming releases to look out for in the next quarter.

MLA Advisory's Market Update

Over the past two years, the tortoise and the hare tale has found a modern-day parallel in Metro Vancouver's real estate market. As we reflect on 2022, it's clear that it was the year of the hare, marked by a swift and robust start, only to lose momentum and "nap" for the rest of the year. In contrast, 2023 is characterized by slower absorption figures but at a steady and consistent pace. Just like the classic fable, the market dynamics have played out in a way that emphasizes the value of stable and consistent progress rather than relying solely on short-term bursts of speed. While we don't expect the tortoise (2023) to win the race and achieve higher aggregate sales than the hare (2022), it will provide greater certainty for those participating in the market and position our market for greater success in 2024.

The Bank of Canada's recent decision to pause rate hikes has bolstered the sentiment that market activity will remain stable for the rest of the year. In addition, the central bank's announcement that inflation is expected to reach 3% by the end of 2023 has led many to believe that interest rates will decrease in the next twelve months. As we have witnessed in the past year, the expectation of future rate changes can impact market activity as much as current rates. This news is particularly significant in the presale market, where long-term outlooks, market stability, and anticipated future demand play a crucial role in potential buyers' decisions. All else being equal, the prospect of lower interest rates will likely bring buyers who were on the sidelines over the last year to enter the fray.

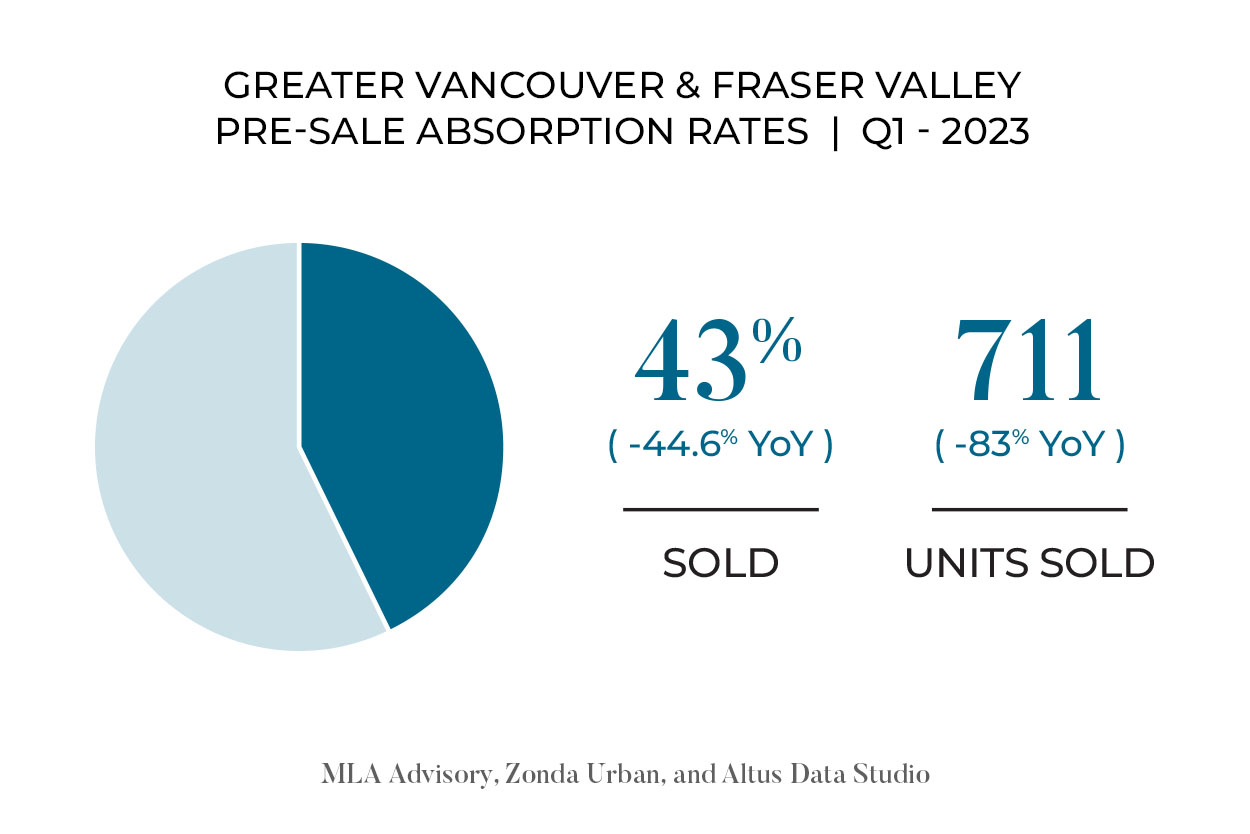

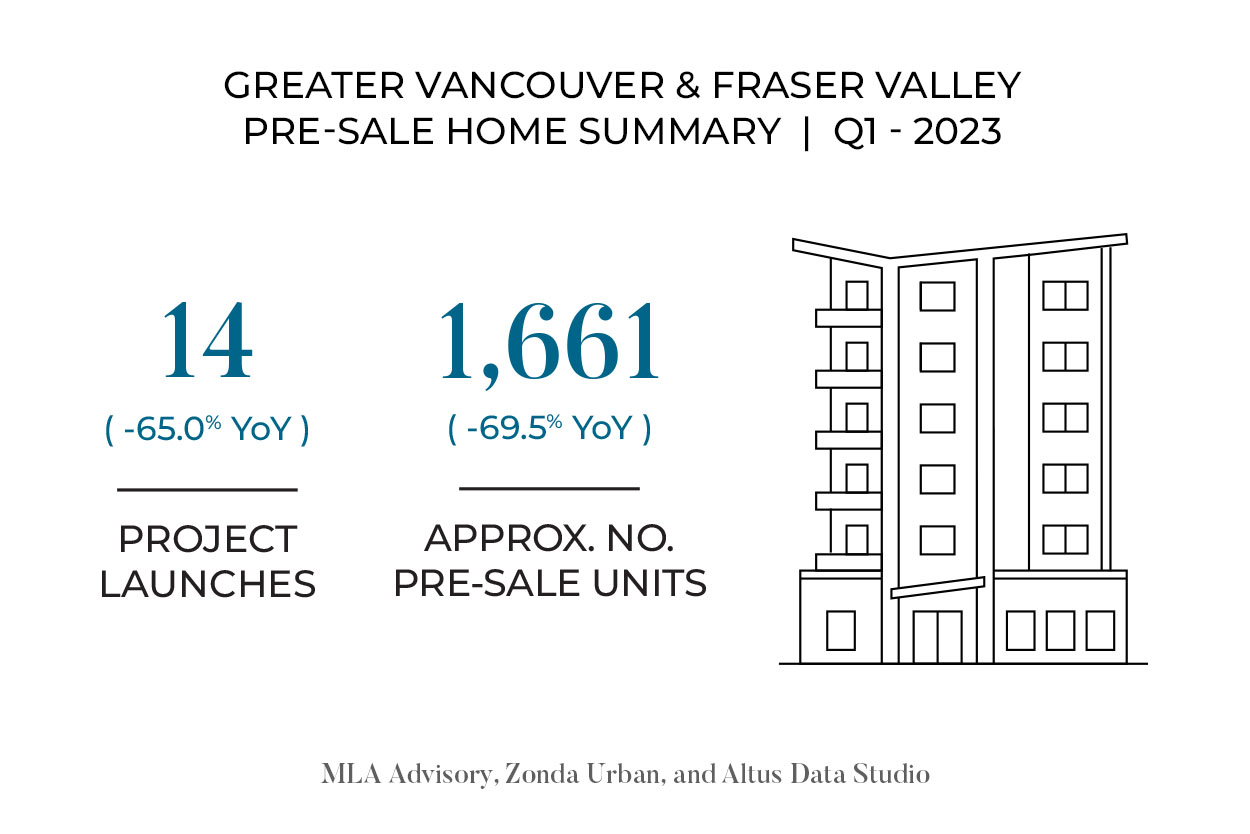

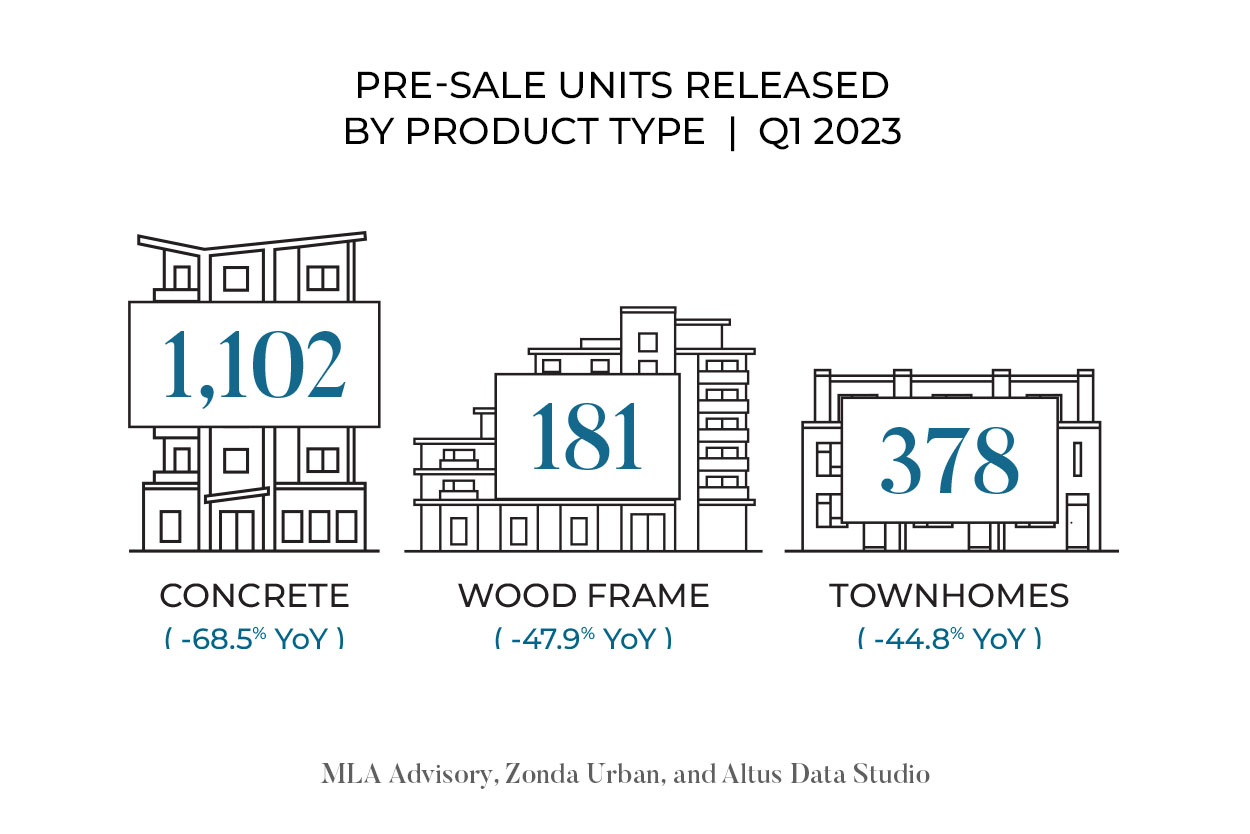

In Q1 2023, a total of 14 presale programs were launched, releasing 1,661 units to the market. The project launches were evenly split between the Greater Vancouver and Fraser Valley markets, with 52% (916) of the inventory released in the former and 48% (745) released in the latter. However, the same-quarter sales absorptions for these programs were only 43% (711), which is notably below the 74% experienced over the same period last year. Therefore, we should refrain from normalizing the deviance when comparing the two periods. As mentioned, market activity at the start of last year was like a flash in the pan and was driven primarily by buyers wanting to lock in historically low-interest rates.

Burnaby was the most active submarket by released inventory, launching two prominent presale programs - Perla by Polygon and South Yards by Anthem. These programs stood out with same-quarter sales absorptions higher than the market average, reaching 58%. The early sales momentum of these programs exemplifies the robust market activity witnessed in the Burnaby market. This trend also extended to West Coquitlam, where we saw higher-than-expected traffic to our sales floors.

Critically low supply remains a primary concern within Metro Vancouver's real estate market. While demand has fallen to levels not seen since 2009, actively listed resales at the end of March were the lowest in over 20 years. As a result, low inventory have helped buoy prices and kept purchasing conditions in favour of sellers. Consequently, as lending conditions improve, supply will overtake rates as the major hurdle for those wishing to enter the market.

The current market conditions suggest a window of opportunity for developers who are seeking to launch their product in the Fall. Given the low launch activity and stable sales absorptions that we've experienced so far this year, we recommend that developers proactively plan early sales strategies within the next few weeks to prepare for opportunities that arise in the coming months. This is especially true for developers with upcoming products in Burnaby, West Coquitlam, and Surrey.

For information on active sub-markets, development and rezoning application activity, project launches, and upcoming releases to look out for in the next quarter download the report.