The MLA Black Book is a quarterly detailed overview of the pre-sale real estate marketplace spanning the Greater Vancouver and Fraser Valley regions. This market intel is brought to you by MLA Advisory and covers pre-sale sales results, including active sub-markets, development and rezoning application activity, project launches, and upcoming releases to look out for in the next quarter.

MLA Advisory's Market Update

As we continue into the Fall season here in Vancouver, the colours of the leaves have changed, but it seems that the mood in the market has not. While schools re-open and residents return from what was, for many, their first summer vacations in two years, the Canadian housing market and the overall economy continue to grapple with inflation and its costly associated interest rate hikes. The most recent CPI print recorded a 6.9% increase in October which, although down from the 8.1% peak in June, remains high. The Bank of Canada moved forward with a 50-basis point increase at the end of October. The resultant dampening effects on the housing market have been apparent with limited demand and softened prices. Housing resale activity was 33.3% below the 10-year October average in Greater Vancouver, while composite benchmark prices have declined 8.6% since their peak in April of this year.

Yet despite a perfect storm of international economic woes, tight domestic monetary policy, and an uncertain near-term outlook, homeowners in Metro Vancouver have yet to capitulate. Whether fueled by long-term confidence in the market or plain refusal to sell for less than what they bought, buyers have mostly resisted the call to list their properties for sale. As a result, contrary to expectations in a down market, new listings in Metro Vancouver were down 10.0% relative to the 10-year average for this time of year.

Several factors have made this possible. Among them, an extremely resilient labour market has meant the average homeowners are fiscally more sound and capable of meeting mortgage payments than in a typical recessionary period. Additionally, while interest rates have increased to historically elevated levels, the stress test has “pre-vetted” homeowners for this situation. Finally, fixed-rate mortgages have long been a preference for Canadian homeowners, representing 77% of all residential loans – a pool that will only be affected by rising rates at their mortgage renewal.

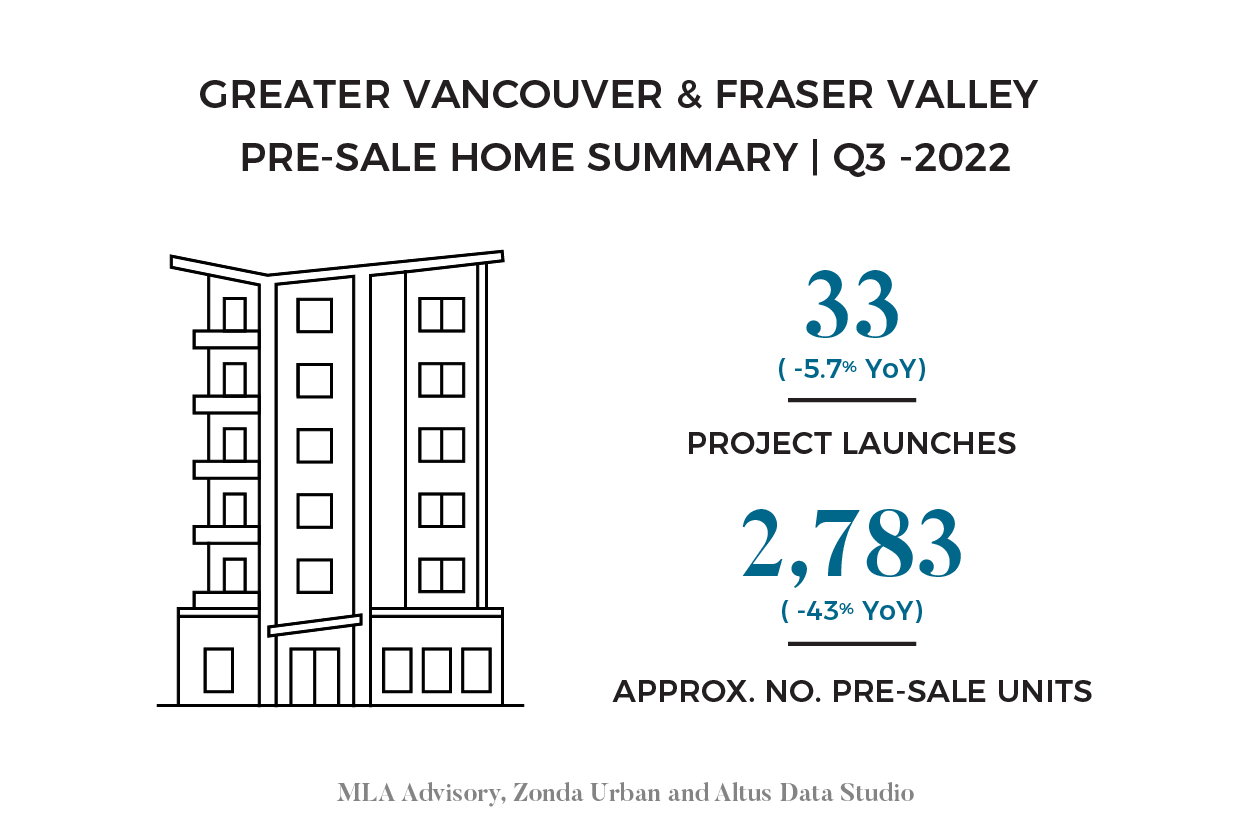

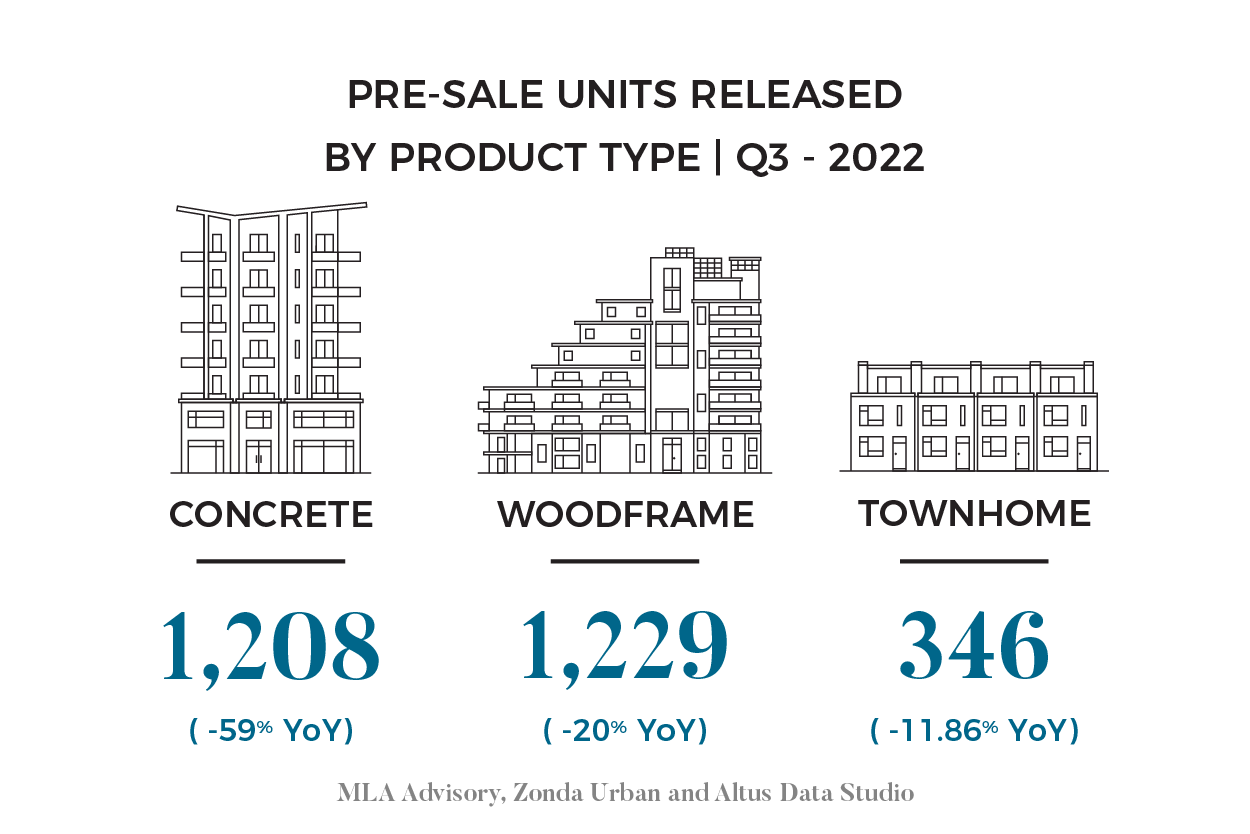

In the presale market, 43% (1,204) of products released in Q3 were absorbed into the market over the quarter. The absorption rate is slightly elevated from the previous quarter and highlights that even as our market slows, several successful launches have supported overall market activity. Developers launching in today’s market recognize the need for a deep pool of potential buyers to meet absorption requirements leading many developers to test the waters and engage realtors to understand the depth of the market and whether they should launch or wait for improved market conditions. As a result, MLA Advisory estimates that 60%+ of branded presale programs that could have launched in today’s market are holding out for improved conditions in Spring or Fall 2023.

There is a reason for both optimism and pessimism as we look forward. On the one hand, core inflation is beginning to moderate. While still far from BoC targets, both the headline print and the composition of the inflation give a cautionary reason for hope. On the other hand – as a small, open economy – it is not enough to contend with domestic inflation. The Federal Reserve in the U.S. is poised to proceed with rate hikes on its schedule, sure to send shockwaves into the Canadian economy. And elsewhere, the shadows of the Ukraine war, continued supply chain issues, and China’s recently re-affirmed zero-covid policy loom overhead. All things considered, we expect the remainder of the year to be a continuation of the trends we have seen surface in the latter half of 2022 – a time of pause, careful consideration, and reassessment.

For information on active sub-markets, development and rezoning application activity, project launches, and upcoming releases to look out for in the next quarter download the report.