“Developers are facing continued challenges in reaching presale construction financing and bringing new housing to market. Market conditions are in Buyer’s Market territory across most asset classes and price discovery is still ongoing. Early September traffic at active MLA sales galleries is providing more confidence leading into the Fall market, however, there is still a long way to go to align with historical sales volumes." - Garde MacDonald, Director of Advisory

SEASONALITY BRINGS MODEST ACTIVITY TO PRESALE MARKET

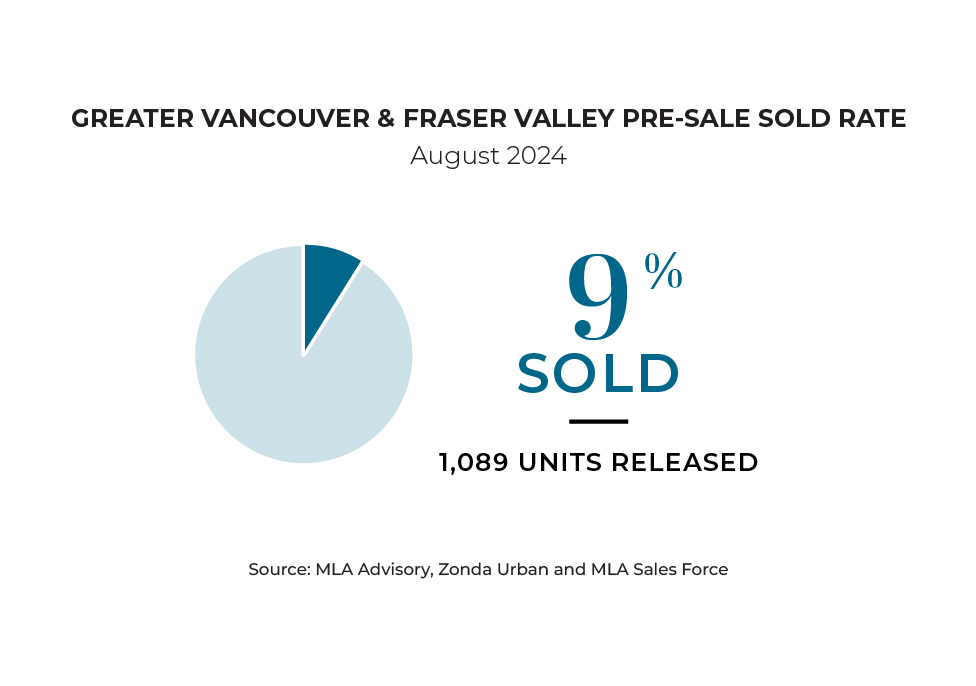

Seasonal shifts in an already compressed market led to decreased same-month sales absorptions for projects launching in August. With approximately 100 units sold, absorptions of launched inventory in August was approximately 9% - the lowest it’s been since Fall of 2020. It should however be noted that many of the projects that launched in August offered a limited release near the end of the month, which would have negatively compressed these numbers.

SEASONALITY BRINGS MODEST ACTIVITY TO PRESALE MARKET

Seasonal shifts in an already compressed market led to decreased same-month sales absorptions for projects launching in August. With approximately 100 units sold, absorptions of launched inventory in August was approximately 9% - the lowest it’s been since Fall of 2020. It should however be noted that many of the projects that launched in August offered a limited release near the end of the month, which would have negatively compressed these numbers.

METRO VANCOUVER’S SUPPLY GAP IS POISED TO WIDEN AS HOUSING STARTS DECLINE

Vancouver's housing market is experiencing a severe slowdown in construction, according to recent data. Housing starts have plummeted, with a 43% year-over-year decrease in the first half of 2024, translating to just 8,500 new units, compared to 15,000 in the same period last year. This decline is driven by rising interest rates, which have increased the cost of borrowing, and escalating construction costs, making projects financially unfeasible for many developers. Additionally, tighter lending conditions have further constrained financing options, exacerbating the situation.

In all likelihood, the full downstream effects of this slowdown won't be felt for another 3-4 years. As projects currently under construction wrap up, the lull in new construction will become more apparent. This gap in the housing pipeline will likely lead to increased competition for the limited supply of new homes, driving prices even higher. The anticipated shortage could exacerbate the existing housing crisis, making it even more challenging for residents to find affordable options in the coming years.

EXPECT TEPID MARKET CONDITIONS TO PERSIST

As the weather cools and everything pumpkin spice returns, the real estate market faces a less promising transition. Increasing inventory in both the presale and resale markets, coupled with low investor sentiment, continue to weigh heavily on the sector. Today's projects are typically either distinguished by a unique location and offering, emphasis on non-luxury end-user product—or are backed by developers with the financial means to weather the slower-paced absorptions currently being experienced in the market.

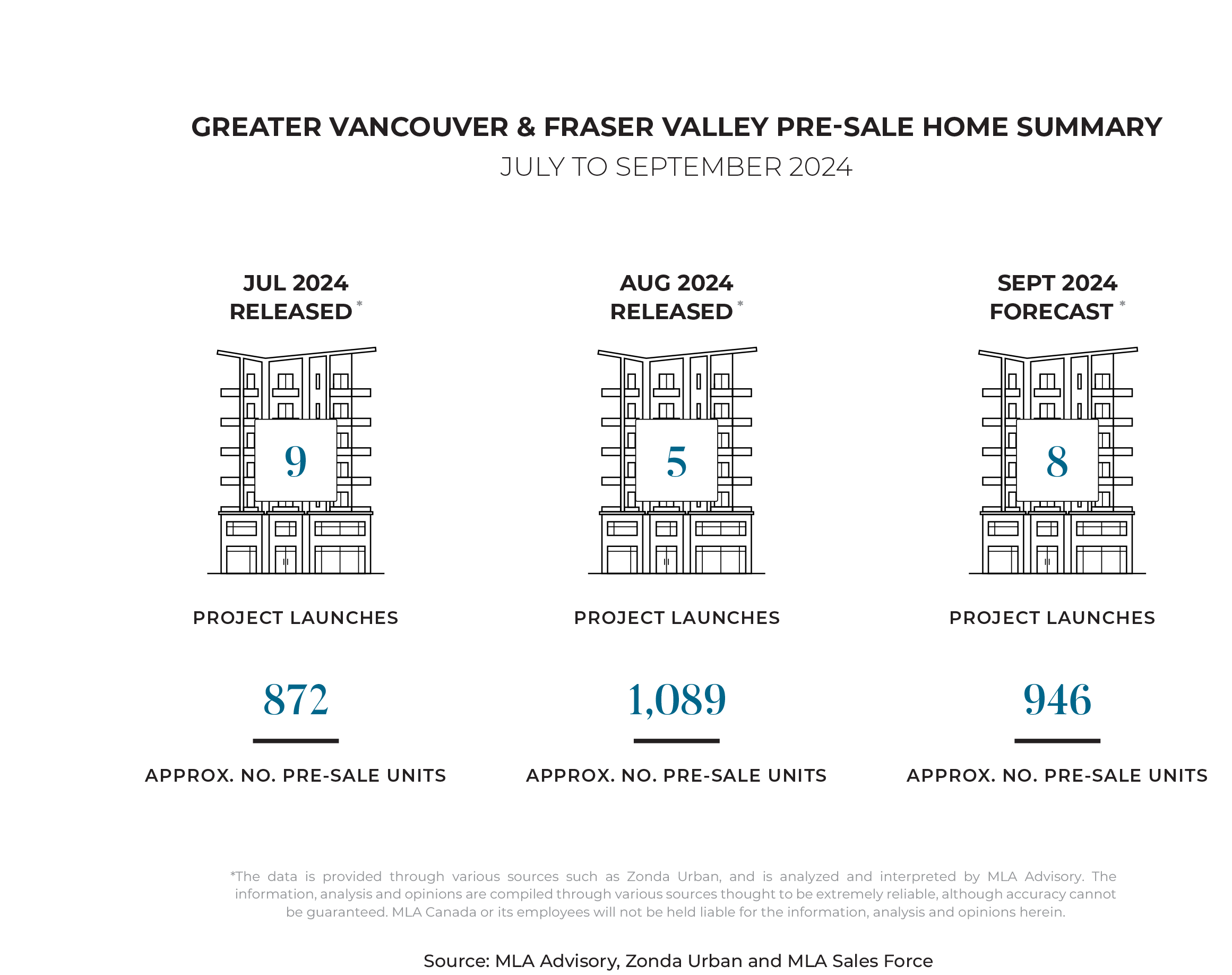

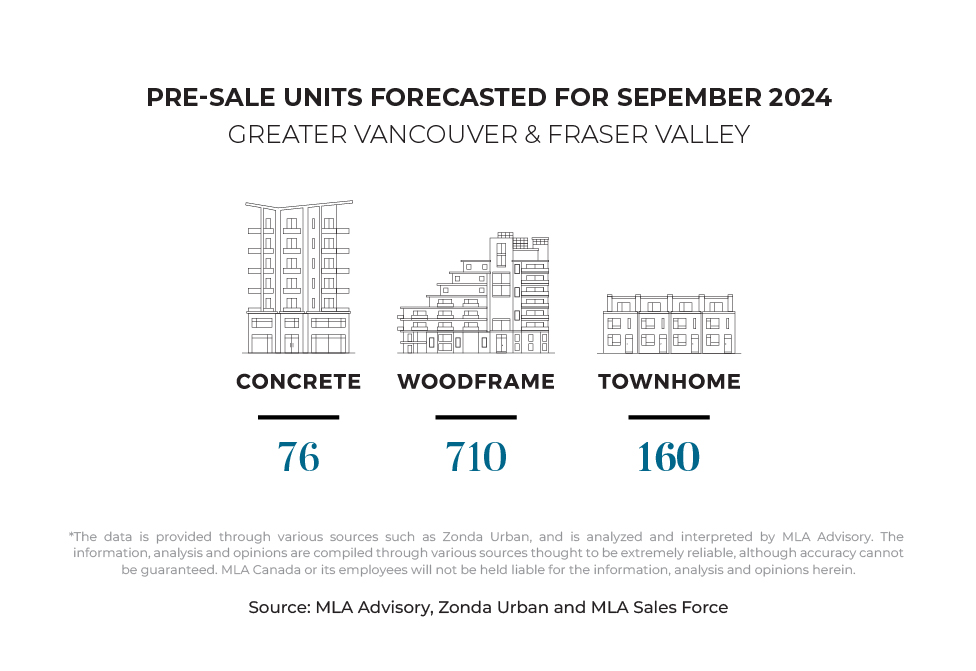

Rather than expecting any major shifts, we should anticipate a gradual return of demand as decreased interest rates slowly work their way through the economy. Given resales influence on overall market sentiment, active resale listings will likely need to be delisted or absorbed before significant momentum returns to presale programs. While eight projects are set to launch in September, introducing just under 950 units to the market, the overall outlook remains cautious. Existing inventory will need to be sufficiently absorbed so we can return to a sales-to-listings ratio at or above 25%, before any substantial resurgence in presale demand can be realized. Until then, the market will remain in a slow transition, much like the gradual change of seasons.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, presale, and resale market video report, Presale Pulse.

Subscribe to the MLA Canada YouTube Channel or find the Pre-Sale Pulse on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio.