DECEMBER PRE-SALE MARKET CLOSES OUT THE YEAR STRONG

As expected, December inventory levels were down allowing for a strong same month sales absorption. All eyes will be on Lunar New Year Incentives as programs aim to hit presale requirements and new programs test market depth on larger scale projects. These incentives started in December and will likely run until mid February allowing programs to maximize effectiveness and results. - Suzana Goncalves, Executive Vice President, Sales and Marketing

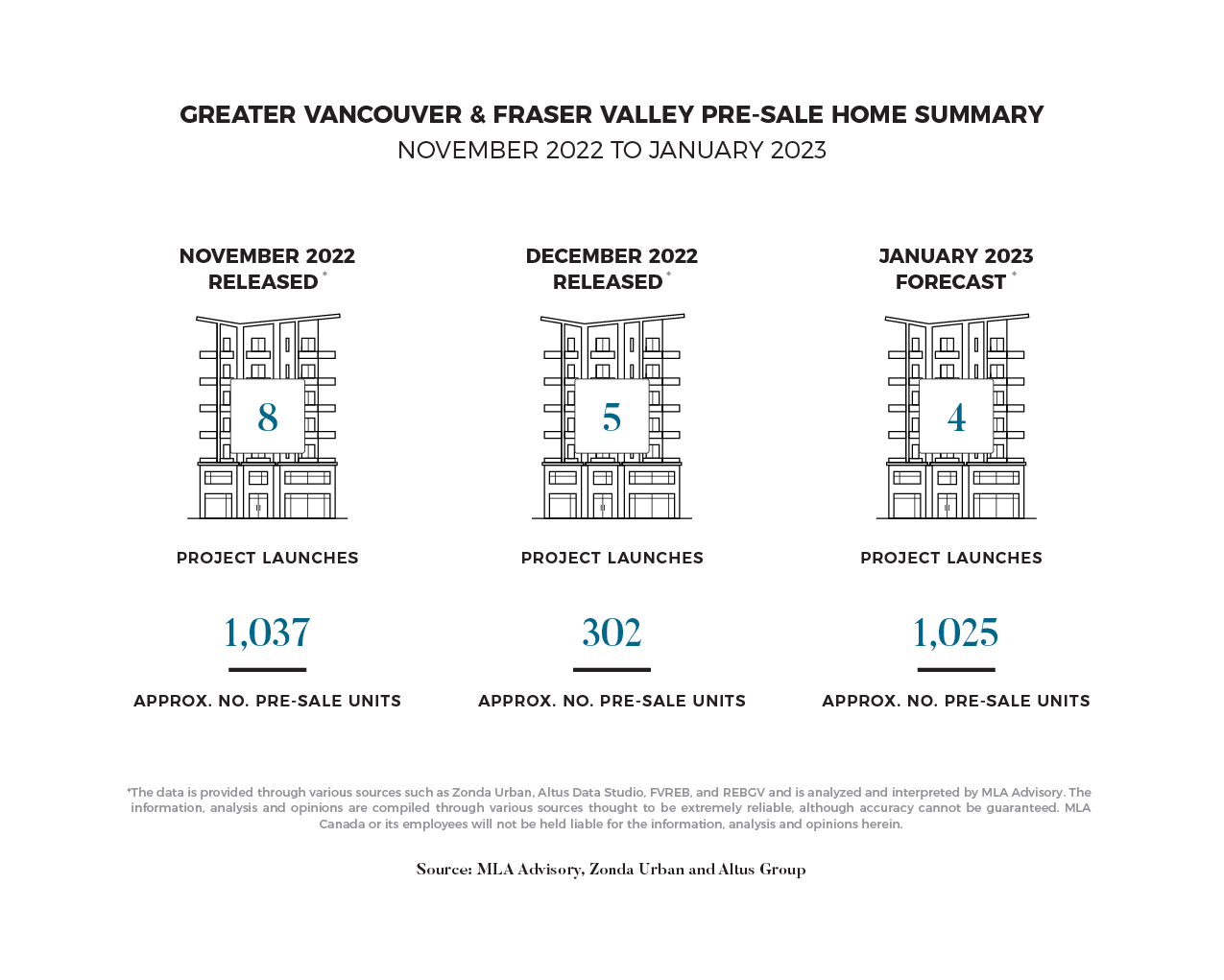

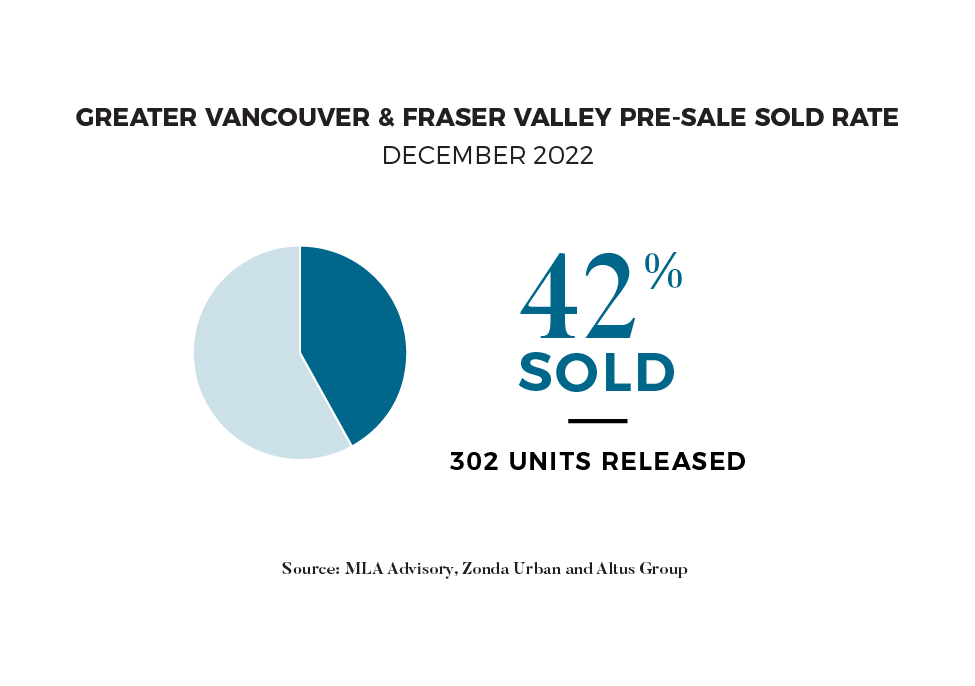

Presale launch activity in December was limited, in line with the seasonal cycle, which typically sees the holiday season as the slowest period of the year. Five presale programs launched in December – largely townhome and wood frame products as concrete developments took a backseat. These projects brought a total of 302 units to market. While a modest amount, same-month absorptions were robust at approximately 42% of released inventory sold. Sitka House drove much of the success, which advertised 80% of the product absorbed following its launch in December. In recent months, we have seen smaller product forms benefit from their lower-end prices, given rising interest costs and increasing challenges to qualify for a mortgage.

MORTGAGE RATES, AFFORDABILITY, & YOU

There’s been much ado about the Bank of Canada’s record seven interest rates – in headlines, economic analyses, and watercooler conversations. But, while a 400 basis point increase on paper is a sizeable increase, what has been the true impact on affordability for the average buyer in Metro Vancouver?

To answer this question, we conducted a case study on an average household buying in today’s market and back in March of 2022, when rates were at historical lows. The household we examined had a combined yearly income of $175,000 and is looking for a mortgage with 20% down on a 25-year amortization.

We found that such a family could have purchased a $900,000 home at today’s rates versus a $1,060,000 home back in March 2022, which indicates that the impact on affordability due to interest rate hikes has been approximately 15%. Though substantial, this is significantly lower than the increased rates, primarily due to the government stress test, which effectively set a lower bound of the qualifying rate at 5.25%.

We can see the effects of this affordability gap play out in the numbers. Over the last year, benchmark pricing for detached homes, the most expensive product form and therefore most impacted by affordability, dropped by 5.1% across Metro Vancouver. In comparison, condominium products remained +1.7% up on the year. In addition, sales activity across the market dropped as buyers struggled to meet higher financing requirements forcing them to either exit the market or lower their target home price. As rates continue to rise and likely remain elevated throughout 2023, these trends on the impact on affordability will only increase.

A BRIGHT, LUNAR START TO A NEW YEAR

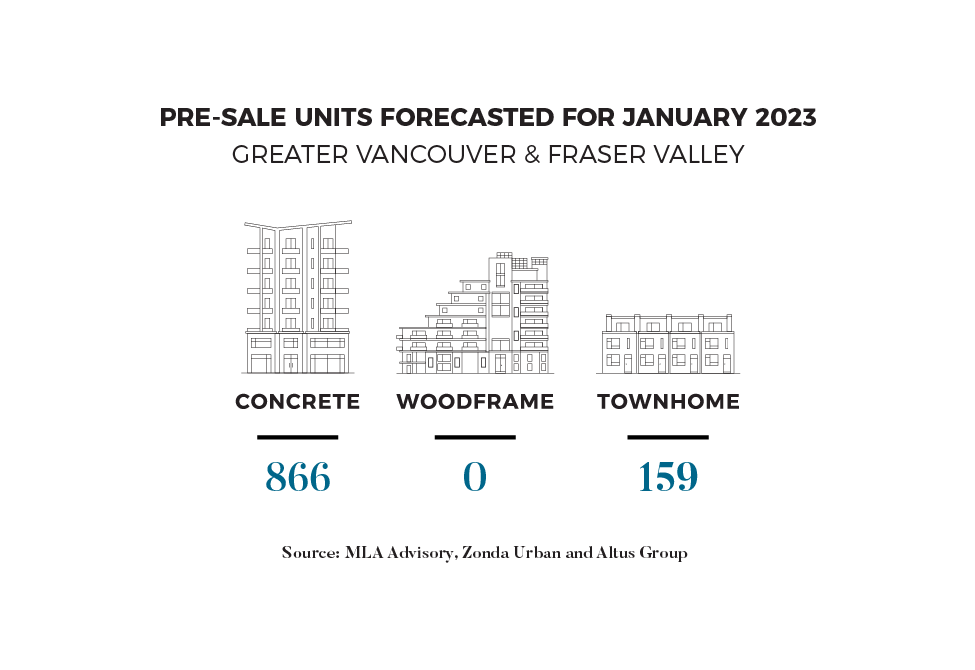

As schools and markets re-open after a restful holiday break, many in the real estate industry will watch for a solid start to the new year. Developers are in full swing as the Lunar New Year, which falls on the 22nd of January this year, fast approaches. Programs are privately beginning preview events for high-volume realtors, and marketing campaigns offering new incentives are in full force. Developers hope to capitalize on the segment of buyers who delayed their purchasing decision in 2022 amid uncertainty and may now be reconsidering. A successful start to the year will signal other developers to proceed with their campaigns, having increased confidence in latent demand in the market. MLA Advisory forecasts four presale launches bringing approximately 1,025 units to market. These programs include Lucent by Landa Global, which is currently conducting VIP realtor previews ahead of a launch later in the month.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, pre-sale, and resale market video report, Pre-Sale Pulse.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, pre-sale, and resale market video report, Pre-Sale Pulse.

Subscribe to the MLA Canada YouTube Channel or find the Pre-Sale Pulse on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio