“This Spring presale market was the slowest in recent memory outside of May 2020 during the Covid lockdown. The limited number of projects that launched are ground-oriented and lowrise developments, predominantly in price sensitive markets south of the Fraser. Overall, the current presale environment continues to be marked by limited presentation centre traffic, slow absorption, and a noisy incentive market.” - Garde MacDonald, Director of Advisory

MAY, THE MONTH OF MAYBES

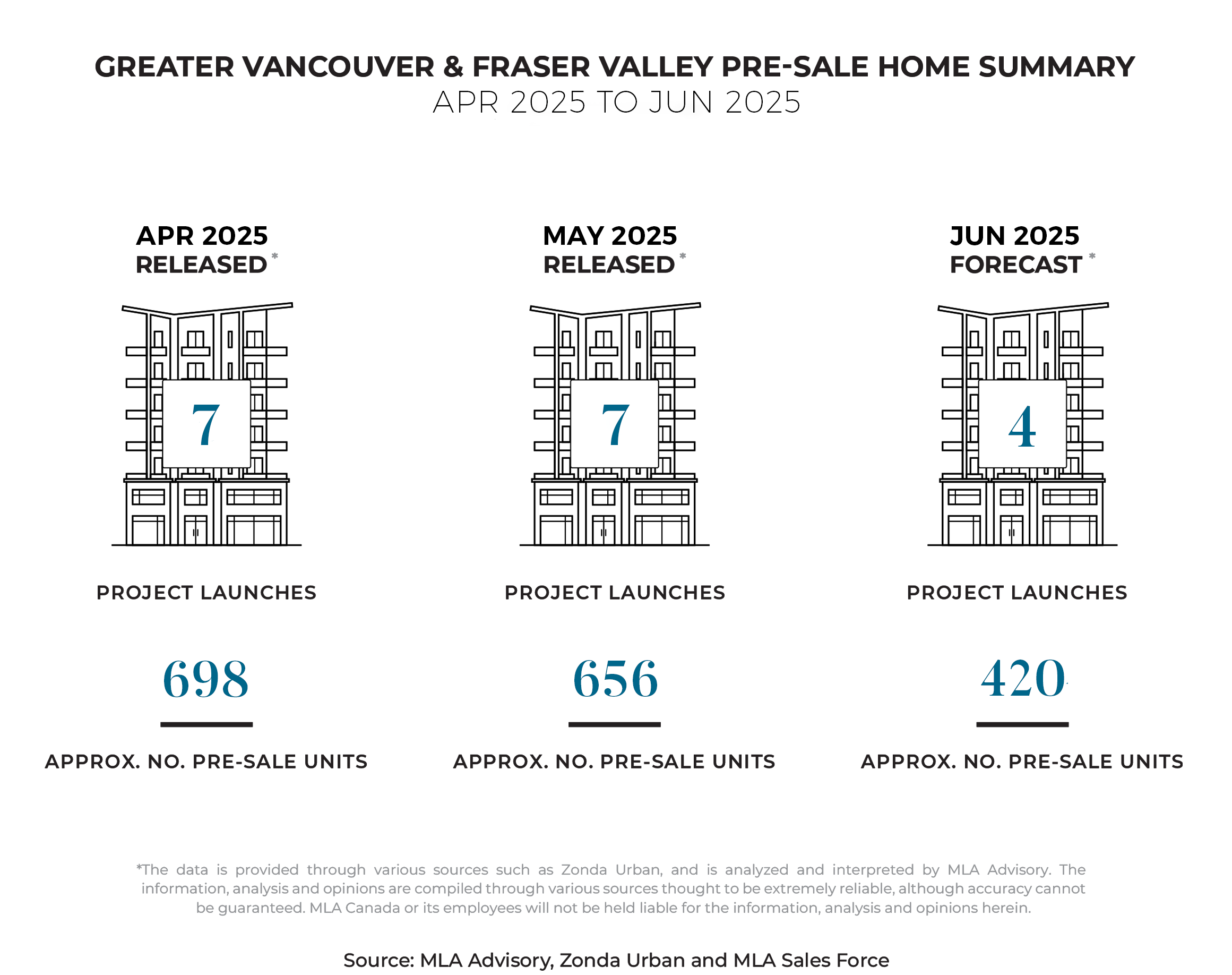

The trend of subdued presale launch activity continued into the month of May, with just seven projects launching and a total of 656 units brought to market. That’s a significant drop compared to the same time last year, when 19 projects were released, bringing over 3,000 units to market. It is worth noting that there was one concrete launch in May 2025 and this accounted for just over 40% of the total released inventory. Many developers are still weighing the timing of the market, with many opting to hold off on their launches for a later date.

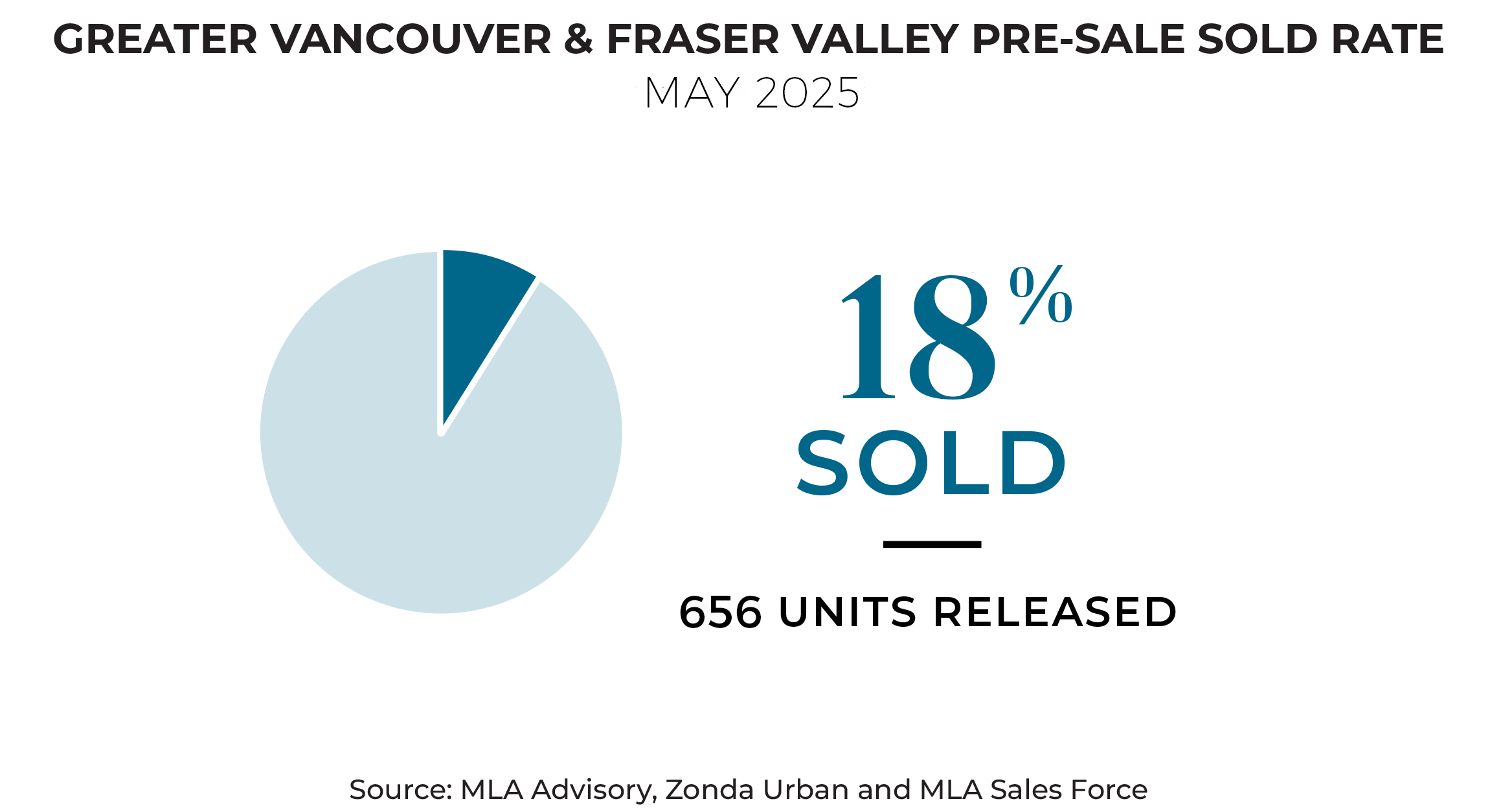

Over the month, nearly 120 units sold, resulting in a same-month absorption rate of 18%. Although these figures are modest and not as high as typically expected for this time of year, they mark the highest absorption rate recorded so far in 2025. The recently announced GST rebate, introduced at the end of May, likely hasn’t had an impact on these numbers just yet. As awareness builds, it may support absorption over time, though the market remains price-sensitive and cautious, with buyers continuing to weigh their options carefully.

GST REBATE: HOPE OR HYPE?

Starting May 27, the federal government will remove GST for first-time homebuyers on newly built homes up to $1 million, with a reduced GST for homes priced between $1 million and $1.5 million. This means first-time buyers could save up to $50,000 on a new home. Overall, this is a positive move for the real estate industry. While it’s unlikely to attract many buyers who weren’t already considering a purchase, it could encourage those actively searching by making presales more competitive and reducing the premium compared to resale homes. Many buyers have been waiting for this policy, so increased interest and traffic may follow.

Another key issue is how the rebate applies to assignments – or rather, how it doesn’t. First-time buyers purchasing assignments after May 27 don’t qualify if the original contract was signed earlier. There are many assignments that are listed below original prices due to failed completions, and they pose an opportunity for buyers seeking shorter timelines. However, the lack of rebate eligibility may discourage some purchases. There is hope that future changes or clarifications will address these concerns.

OPPORTUNITY TO DIVE INTO THE SUMMER DIP

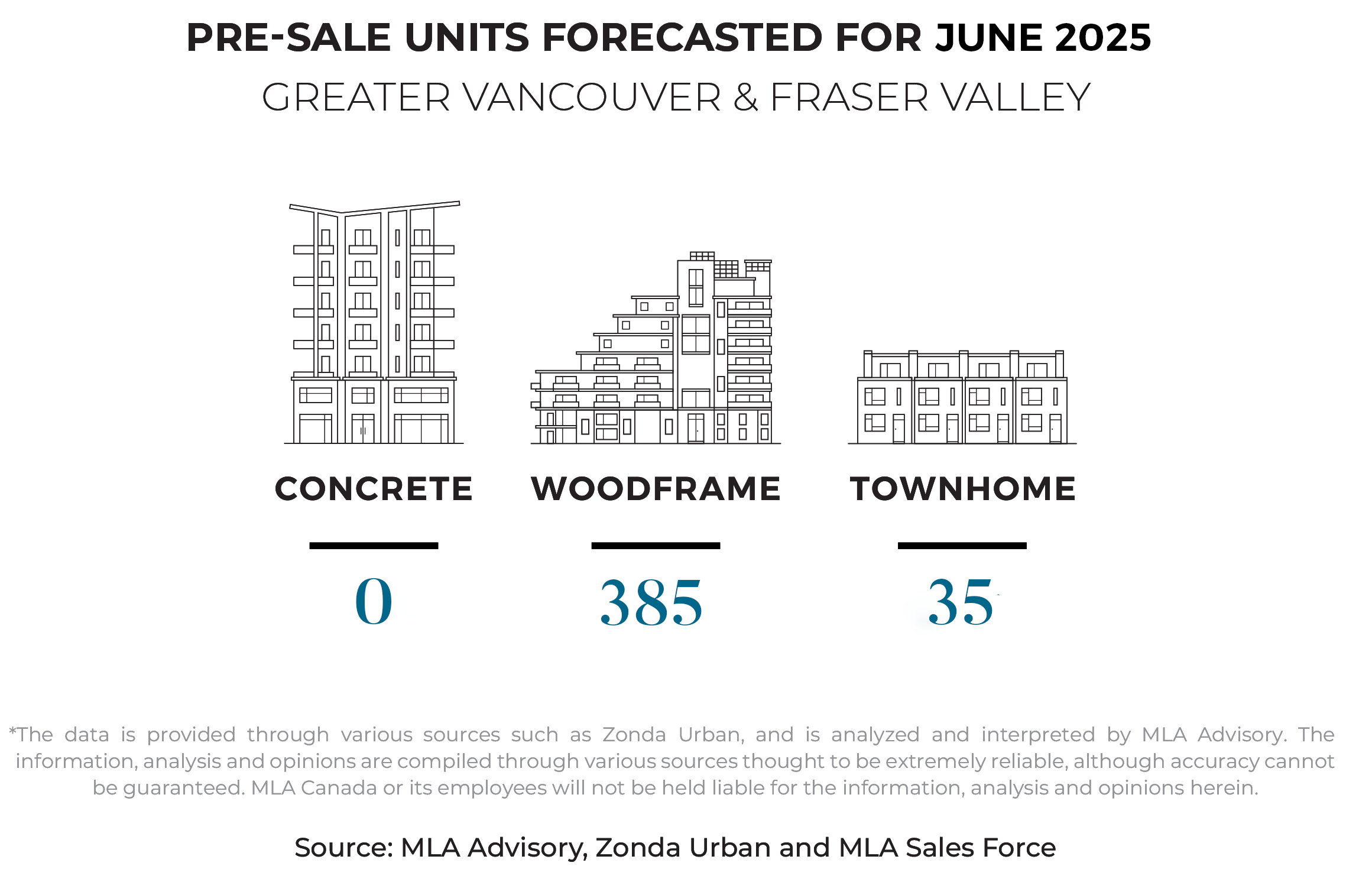

June is expected to see an even slower pace of launch activity, with just four projects bringing 420 units to market. For comparison, the 5 year average for June is around 13 project launches and over 1,550 units released, putting this month at just over a quarter of typical levels. June is usually the final active stretch for presale launches before the summer slowdown sets in, lasting through mid to late September. What comes next for the summer market remains difficult to predict.

Resale activity continues to be sluggish, with modest month-over-month gains, sales rose 13% in the Fraser Valley and 3% in Greater Vancouver. However, both regions sit over 30% below the 10-year seasonal average for May. Inventory continues to climb, with Fraser Valley at par and Greater Vancouver nearing peak levels from 2008, totaling over 17,000 active listings in Greater Vancouver and nearly 11,000 in the Fraser Valley. Prices are down year-over-year by over 4% in the Fraser Valley and nearly 3% in Greater Vancouver. If elevated inventory and slow sales persist, further price softening is likely, though any declines may be minimal as many sellers appear willing to wait. For buyers on the sidelines, this summer could offer the right window to step in.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, presale, and resale market video report, Presale Pulse.

Subscribe to the MLA Canada YouTube Channel or find the Pre-Sale Pulse on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio.