May Real Estate Market Data & Insights

THIS EPISODE IS NOW AVAILABLE IN AUDIO ONLY

Listen on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio

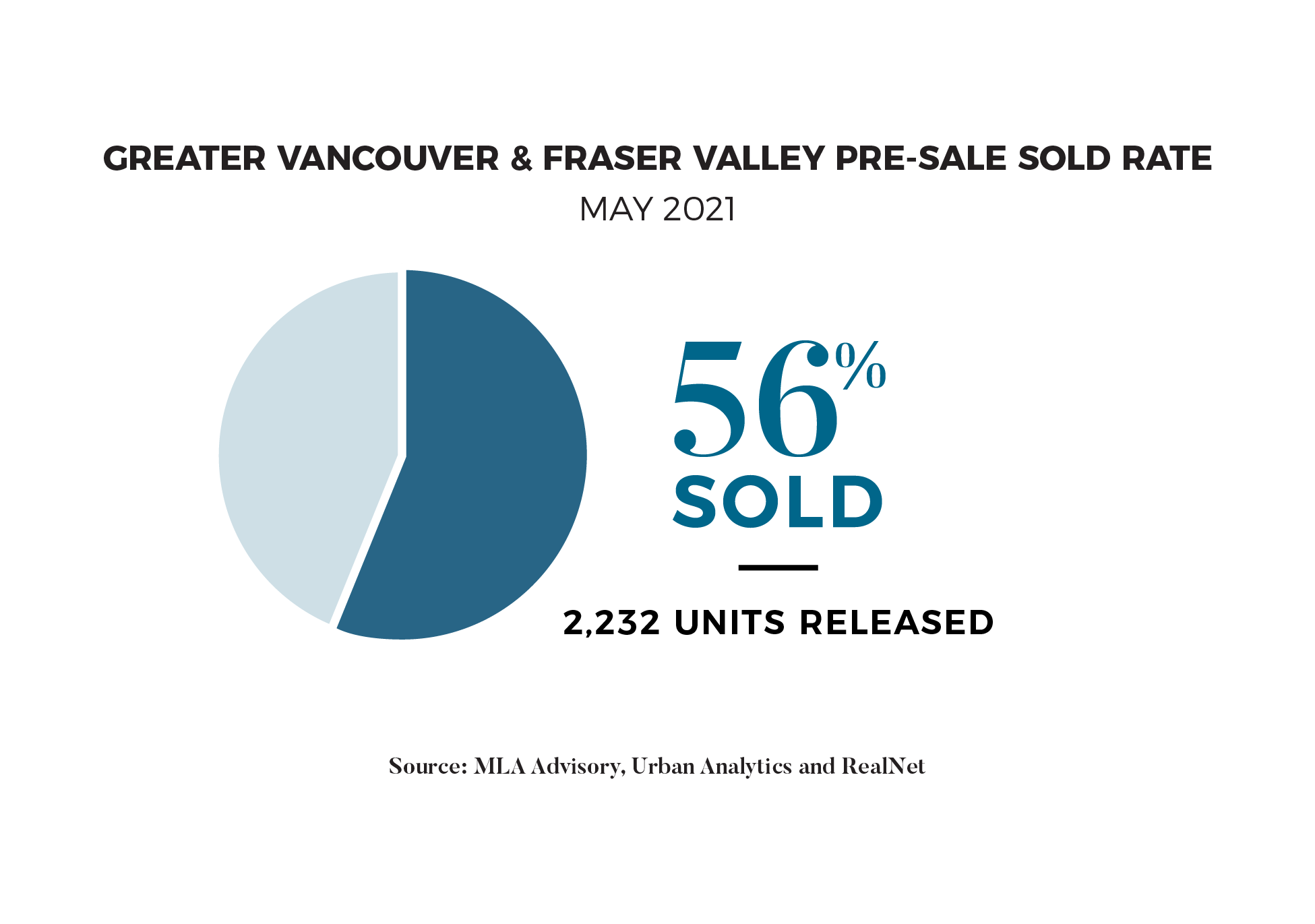

"May marked the largest monthly inventory release we have seen in the market in several years and a 56% first month absorption rate proves strong demand. This market activity is also being seen across all product types and in all markets still supported by the resale market and fueling developer confidence. Therefore, we are expecting a very busy June even with Covid restrictions easing and buyers reassessing future plans. ” Suzana Goncalves EVP, SALES AND MARKETING; PARTNER, MLA CANADA.

PRESALE OFFERINGS ABSORBING WELL AT LAUNCH

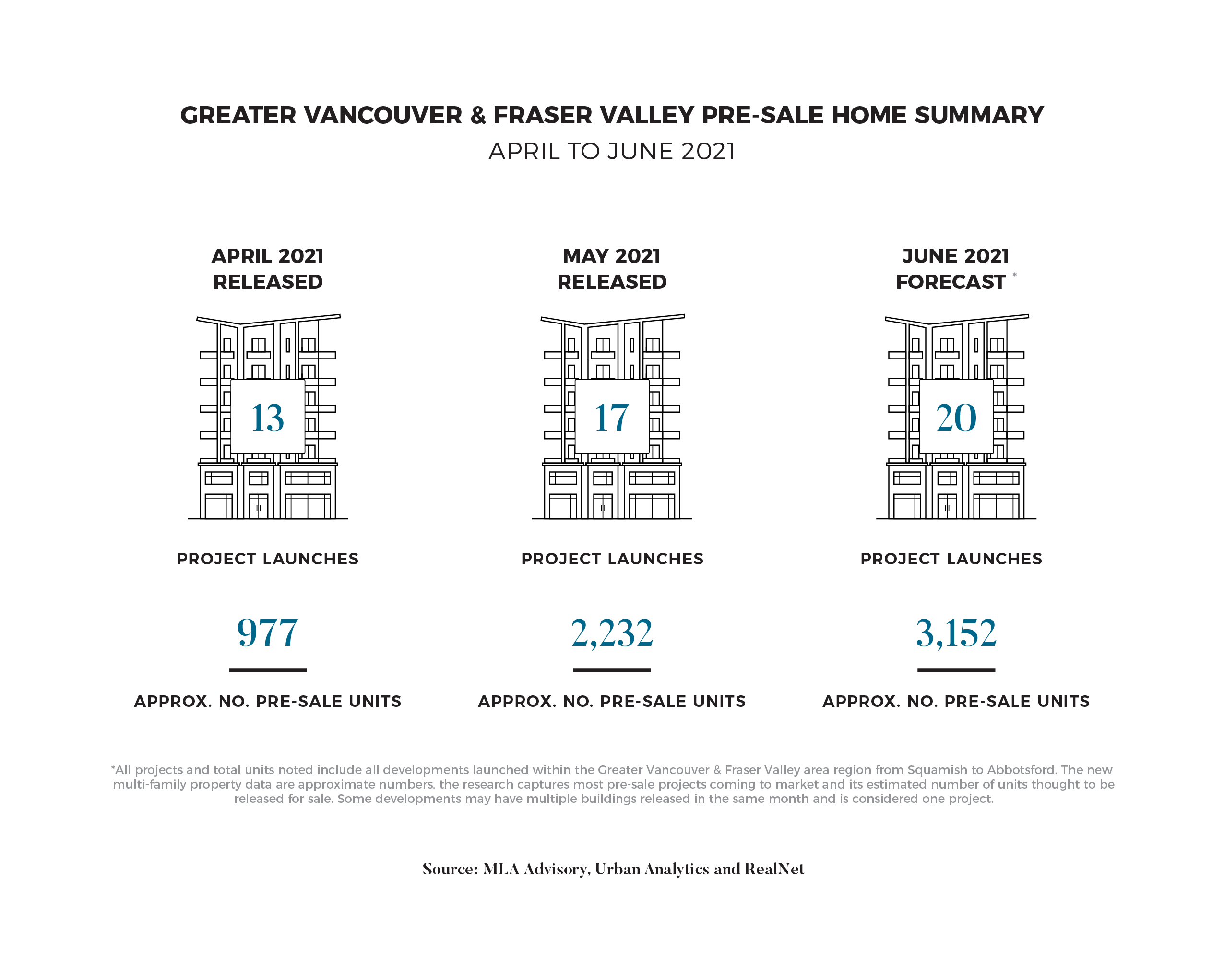

Despite a slight reduction in resale market activity over the past two months, the presale market has shown no signs of slowing. In May, there were 17 new presale projects that began selling, releasing 2,232 condominium and townhome units to market. Of the newly released units, 56% sold in May, marking the third consecutive month of 50%+ presale absorptions. Broken down by product type, there were three townhome, eight wood frame condominium, and six concrete condominium projects that launched sales campaigns in May. There was concentrated market activity along the Cambie Corridor, where three projects began sales – Ava by ThinkHome, Revive by Belford Properties, and Autograph by Pennyfarthing Homes. Presale project success along Cambie, one of the most discussed areas in the bull-run of 2016 and 2017, indicates greater market strength and adequate developer confidence in absorbing premium product. Overall, the most presale market activity occurred in Langley and Surrey, where seven projects sold 820 of the 1,270 newly released units, marking a 65% same-month sales rate in these two cities.

AMENDED STRESS TEST WILL HAVE LITTLE IMPACT ON PRESALE

The Office of the Superintendent of Financial Institutions (OSFI) has followed through on a promise to revisit and alter the minimum qualifying rate for uninsured mortgages in Canada. An uninsured mortgage is one in which a homebuyer places a down payment of at least 20% of the purchase price. In essence, the change raises the minimum qualifying rate by 0.46% to 5.25%, which results in 4%-5% less borrowing power for prospective homeowners. Additionally, the federal government has said that this change will also apply to insured mortgages (mortgages with down payment less than 20%). In the short term, some buyers will have to temper their expectations or look for more affordable homes to enter the market, but in the long term, these slight changes to an existing policy will have very little effect on demand.

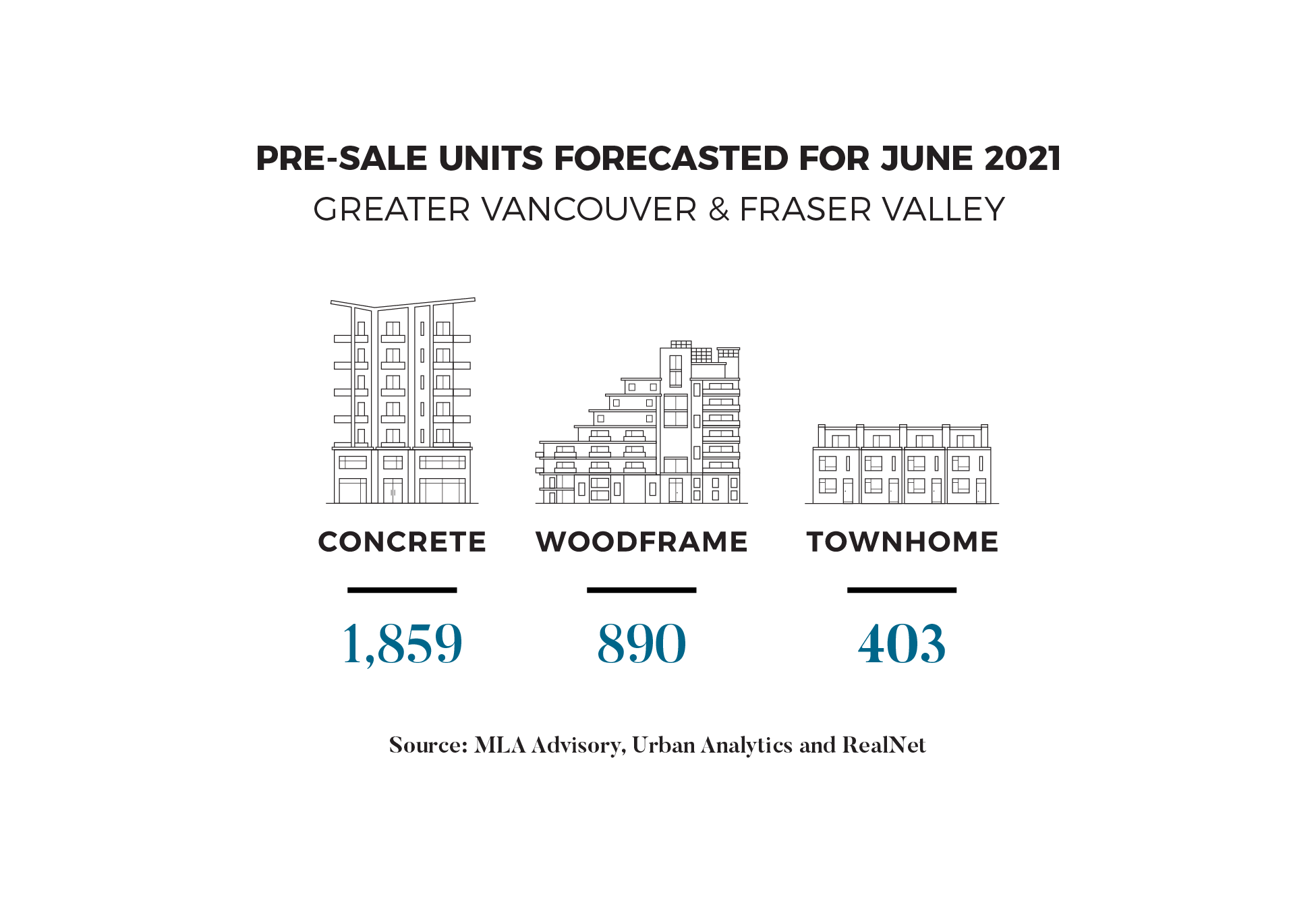

NO PRESALE SLOWDOWN IN SIGHT

Consecutive months of strong presale project absorptions has renewed developer confidence in bringing new developments to market. Proven demand, combined with more optimal showing conditions in the spring and summer, is resulting in a wave of new projects in every submarket from Squamish to Chilliwack. As a result, MLA Advisory anticipates 18 project launches in June that will release approximately 3,077 new condominium and townhomes units to market. Interesting projects to watch include The Saint George by Reliance Properties, which offers efficient, functional homes near the future Mt Pleasant Canada Line Station, Archer Green by Polygon Homes, which is the beginning of a master plan concept in Mission’s Silverdale neighborhood, and Pine & Glen by Onni, which will be the first new presale release in Coquitlam Centre since November 2018.