May 2022 Pre-Sale Real Estate Market Insights

THIS EPISODE IS NOW AVAILABLE IN AUDIO

Listen on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio

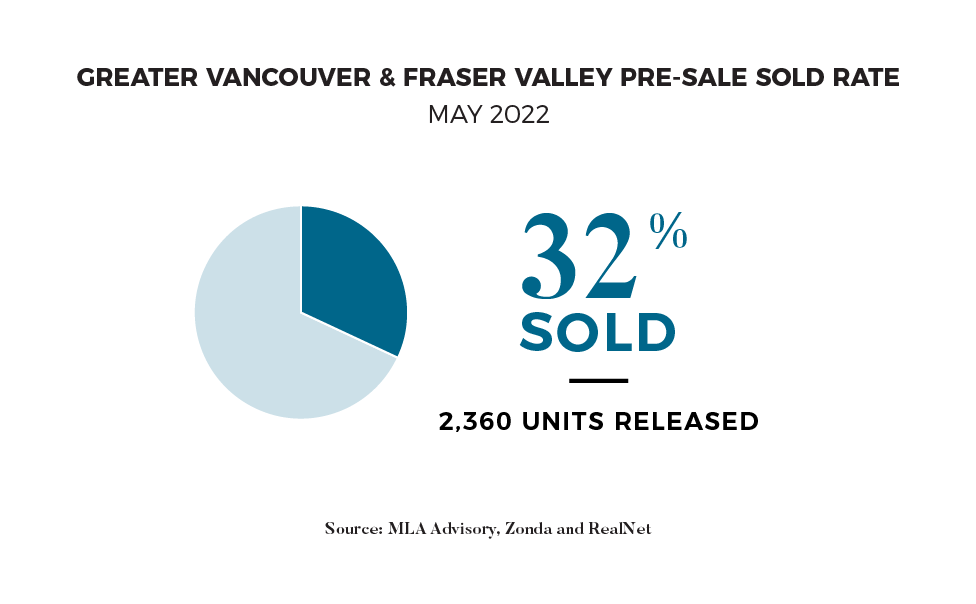

"Presale activity stabilized across Metro Vancouver in May, achieving 32% same-month absorptions - matching the sales activity we saw in April. Developers acted swiftly to respond to changing market demand by offering attractive incentive programs and increasing marketing efforts generally, leading to several successful launches in May. This, in turn, is signalling developers with upcoming programs to move forward with the launch of their presale programs in the early-Summer and late-Fall.”

– Suzana Goncalves, EVP, Sales and Marketing; Partner, MLA Canada

PRESALE MARKET SEES STABLE AND ROBUST ACTIVITY

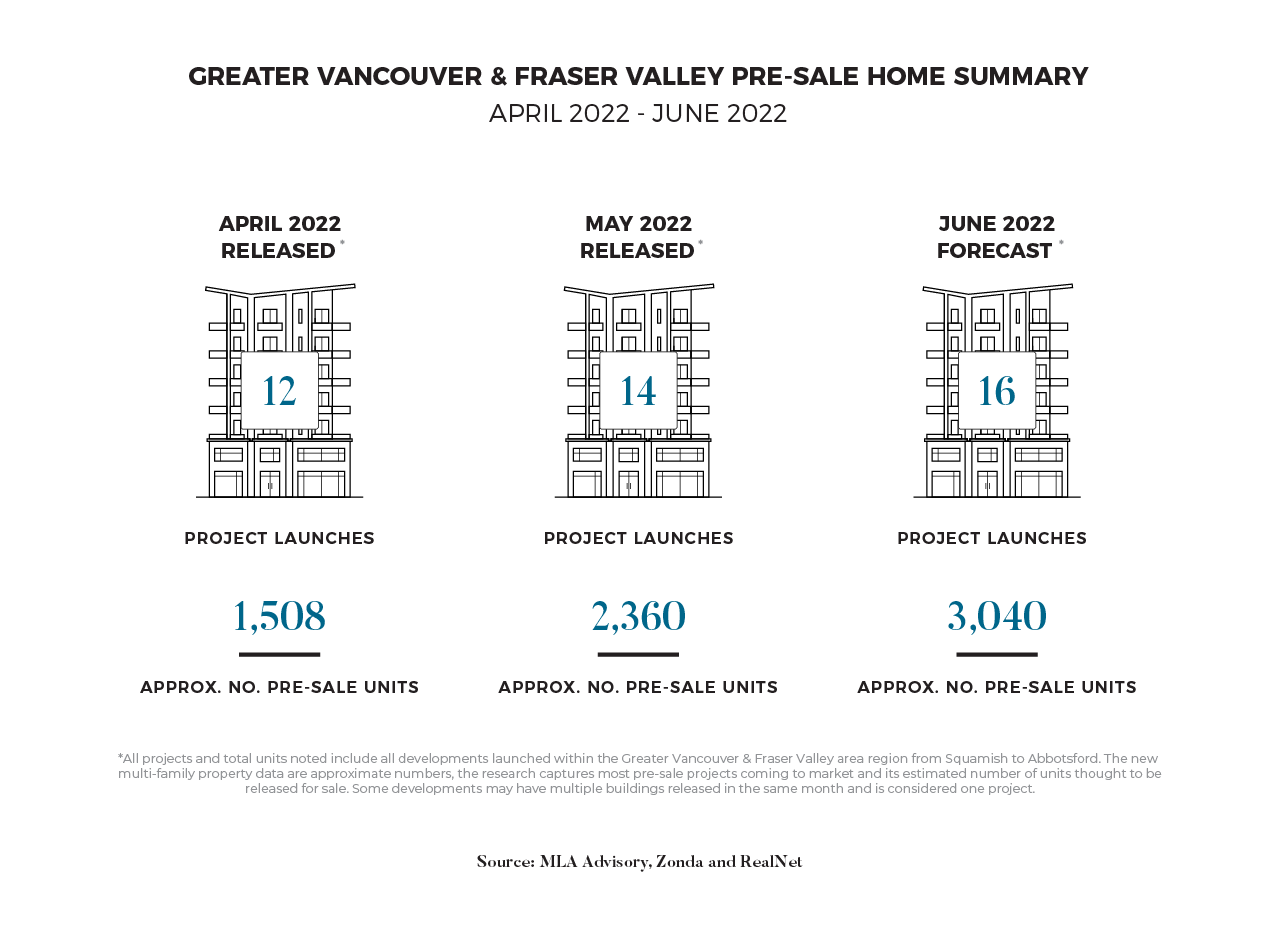

After a precipitous drop in activity in April, May saw steadied pre-sale activity as buyers and developers found their bearings in our changing market environment. In total, 2,360 homes were released in May, achieving a same-month absorption of 32% (758). These results are in-line with the pre-sales activity we saw in April and, while early, suggest a new normal for absorption targets for pre-sale launches. While increasing variable and fixed-rate mortgages will continue to impact sales volume and prices in the medium- and long-term, developers are finding new and innovative ways to build buyer interest and achieve necessary pre-sale absorptions.

Construction Costs to Affect Presale Supply

Construction costs in BC are soaring, constraining activity in new housing starts and development in a region already facing significant supply challenges. Broken supply chains, rising municipal fees, and rising building material costs have created the perfect storm of growing construction costs. Average construction costs in Vancouver rose 4.3% in Q1 2022 and have averaged yearly increases of approximately 15% year-over-year since January 2020. The Canadian labour market is also reaching historically low levels of unemployment – with many employers reporting difficulty in attracting or retaining new talent.

These challenges mean developers are working in an increasingly risky and complex market to launch developments. For many developers, profits on typical products are often very narrow, and these rising input costs will create hesitancy to move forward with projects that no longer have the revenue to justify the risks. As a result, projects that do not have the revenue to justify the launch will be held back, and the immediate impact will be to create an additional strain on a market that faces existing supply needs.

The Metro Vancouver area experienced depressed activity and its subsequent impact on the market in the past. As the typical build cycle of development ranges from 2-3 years from start to finish, the inventory impact is typically experienced 24-36 months after a period of constrained activity. Metro Vancouver market reached record-breaking levels of low inventory in 2021, partly attributed to the depressed new housing and construction activity levels in 2018-2019. As we are now seeing a repeat of those trends, tracking these continually rising costs and their impact on supply will be critical to understanding market metrics in Metro Vancouver in the coming years.

MARKET TIMING FOR PRESALE LAUNCHES

As our market continues to reposition itself against rising interest rates and increasing costs, developers are now making critical decisions about whether to launch their product in the Summer, late Fall, or Spring of 2023. Critical considerations as part of that decision include when they bought the land, what stage of the development process the project is in, and whether they’ve been able to budget construction costs within their pro forma. Well-capitalized firms with in-house or strong relationships with their general contractor are best positioned to ride the wave of uncertainties that many other, smaller developers will be challenged with over the near term.

With that in mind, MLA Advisory forecasts robust pre-sale launch activity in June, with 16 programs releasing 3,040 units into the market. Several interesting launches to note are Elmwood by Marcon, Alina by Strand, Walker House by BMG, and Form by Anthem properties.

We want to hear from you! If you have a real estate question that you'd like us to talk about in our next Pre-sale Pulse, submit your questions to us.