April Real Estate Market Data & Insights

"We continue to see a very busy spring market with a solid absorption rate in all product types. We expect there to be an increase in project launches and units released over the next two months as developers try to hit the market before the summer. ” Suzana Goncalves EVP, SALES AND MARKETING; PARTNER, MLA CANADA.

CONSECUTIVE MONTHS OF STRONG NEW PROJECT ABSORPTION

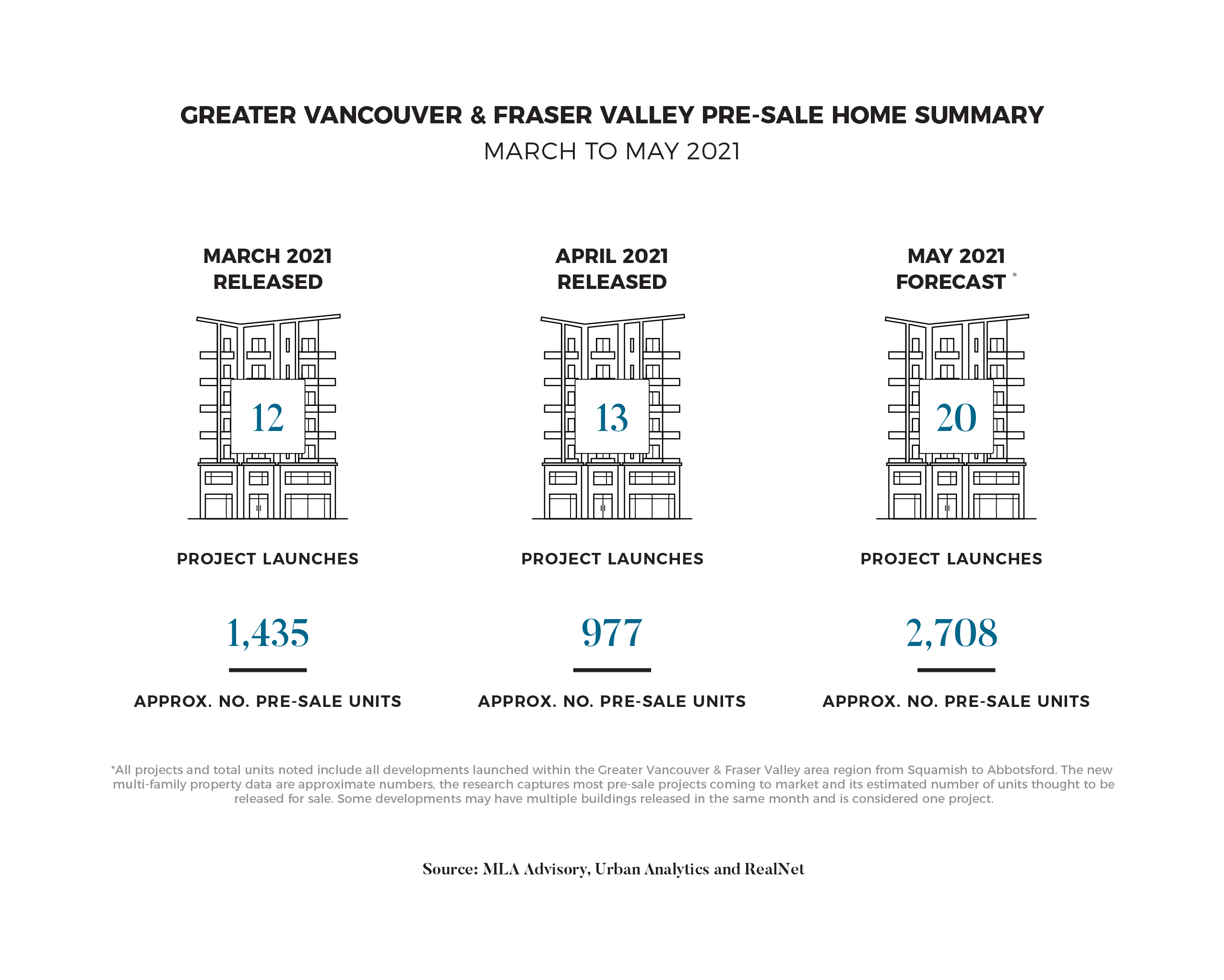

Following a very busy March, there were 13 new presale projects that launched sales in April. These projects released approximately 977 condominium and townhome units to market. Additionally, existing projects released new phases in April that generated a renewed presence in market and capitalized on robust market demand across all product types. Overall, there were six new townhome and seven new condominium project launches across six different submarkets in the Lower Mainland. The same-month sales rate for these newly released projects was 56% (544 units), which is slightly less than the 59% same-month sales rate observed in March. Notably, there were six presale project launches in Vancouver West and Vancouver East; these projects contain 416 units and account for 43% of April’s newly released units. Increased presale activity in these submarkets is a positive indicator as all these projects are in the premium segment of the market and are priced over $1,000 PPSF. This is a stark contrast to where market activity was concentrated six to ten months ago – primarily detached homes and townhomes in more affordable submarkets to the east.

EARLY MARKETING PERIOD PERMANENTLY EXTENDED

As previously recorded, the Superintendent of Real Estate had extended the early marketing period last spring in response to the pandemic. Since then, there have been ongoing discussions about permanently extending the early marketing period due to the size and scale of current development sites. The Superintendent acknowledged that these more complex developments take longer to obtain building permits as well as financing with increased requirements from lenders and has now confirmed the policy has officially changed to a 12-month period up from a 9-month period. With this change, developers will now have more time to hit presale targets which, during slower markets, will help maintain some supply versus the near full stop of concrete supply we saw in 2019. This should also encourage more design diversity in home sizes and utility. For example, larger suites predominantly take longer to sell, so this additional time will give comfort to developers to include more of this kind of product in their developments.

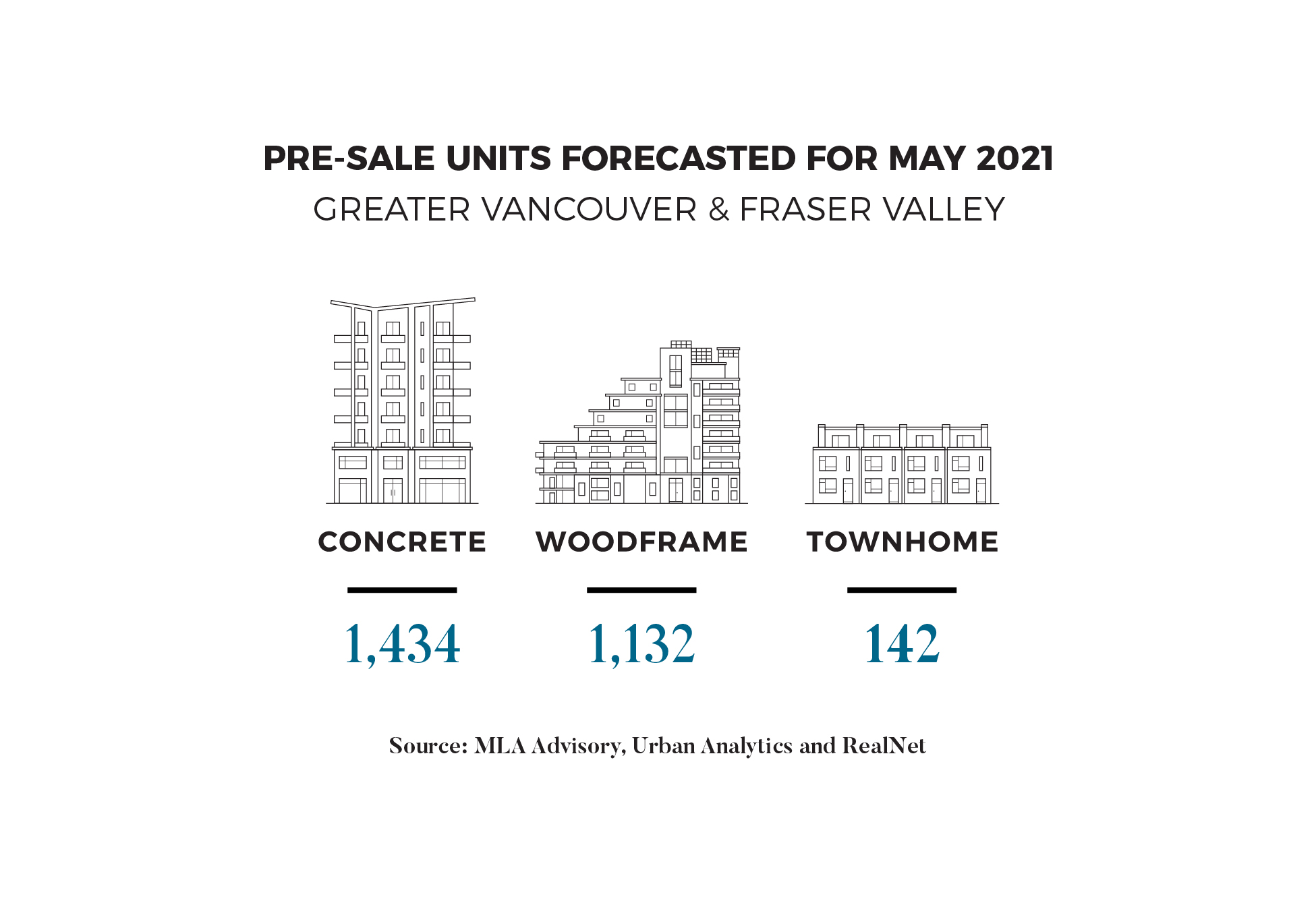

SPRING PRESALE MARKET WILL NOT DISAPPOINT

Record-setting market activity seen in the resale market is positively influencing the presale market as 20 new projects are set to begin sales in May. 75% of these upcoming projects are condominium developments (15 out of 20); specific submarkets with the most upcoming activity are Langley, Surrey, and Vancouver. In total, these new project launches will release approximately 2,708 units to market in May. Interesting projects to be aware of include Azure at Southgate City by Ledingham McAllister, which is the first release at a 60-acre master planned community in Edmonds, Burnaby, as well as Redbridge by Kingswood Properties in Squamish, which has received overwhelming interest and released its first phase on May 1. Furthermore, there are multiple upcoming projects along Cambie Corridor that will redefine values along one of Vancouver’s most discussed and expensive subareas. Of note is Autograph by Pennyfarthing homes, a collection of 65 wood frame condominiums that marks the developers fifth building in their Cambie Collection.