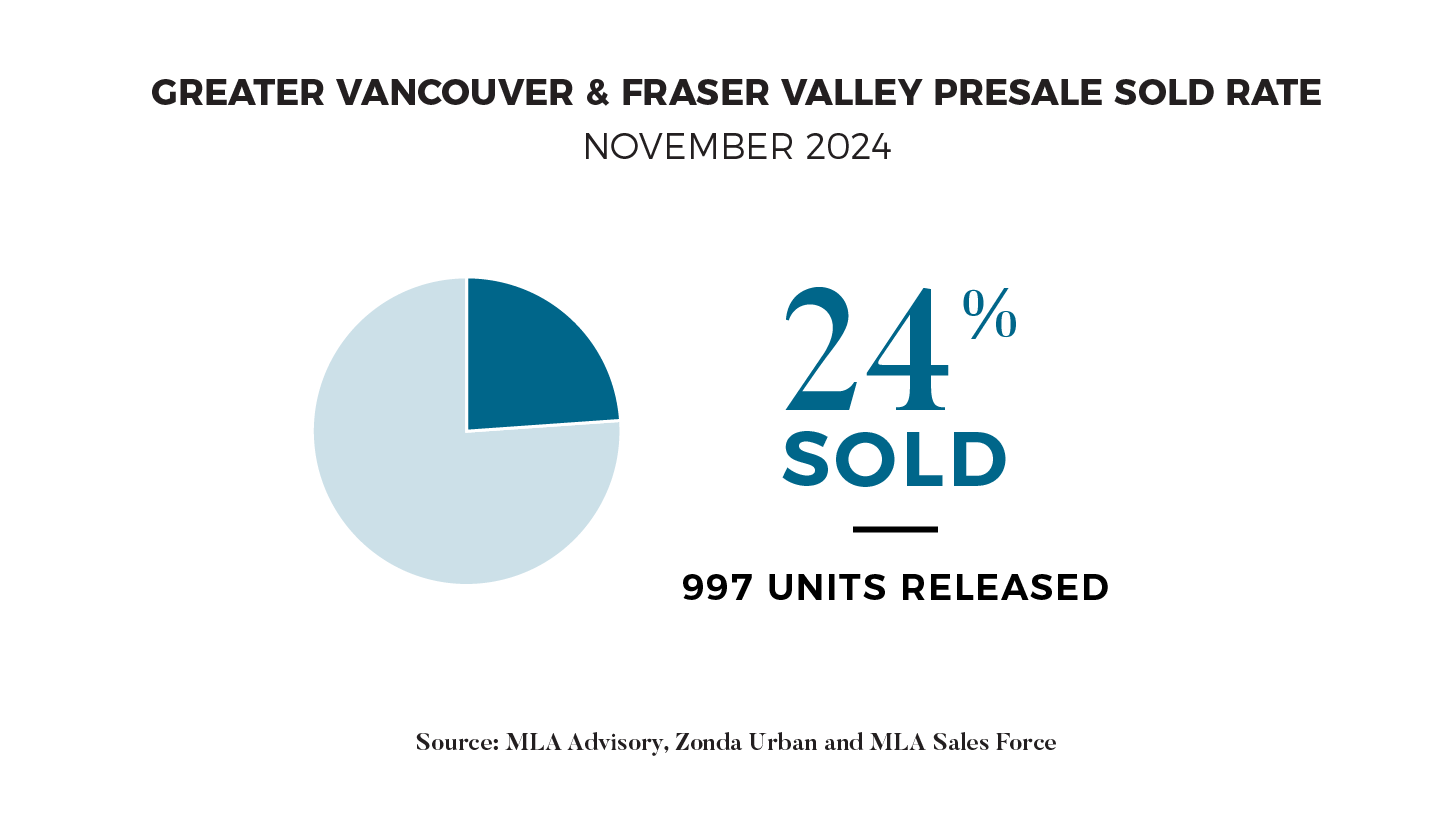

"Many developers who began previews in October have decided to put the brakes on launches due to lack of traffic and buyers. Despite this, the seven projects that launched in November saw reasonable success in context of a slow 2024. Based on our active projects, absorptions in the presale space are steadily improving but numerous hurdles remain for any project coming to market in the next number of months.” - Garde MacDonald, Director of Advisory

'TIS THE SEASON FOR CONSISTENCY

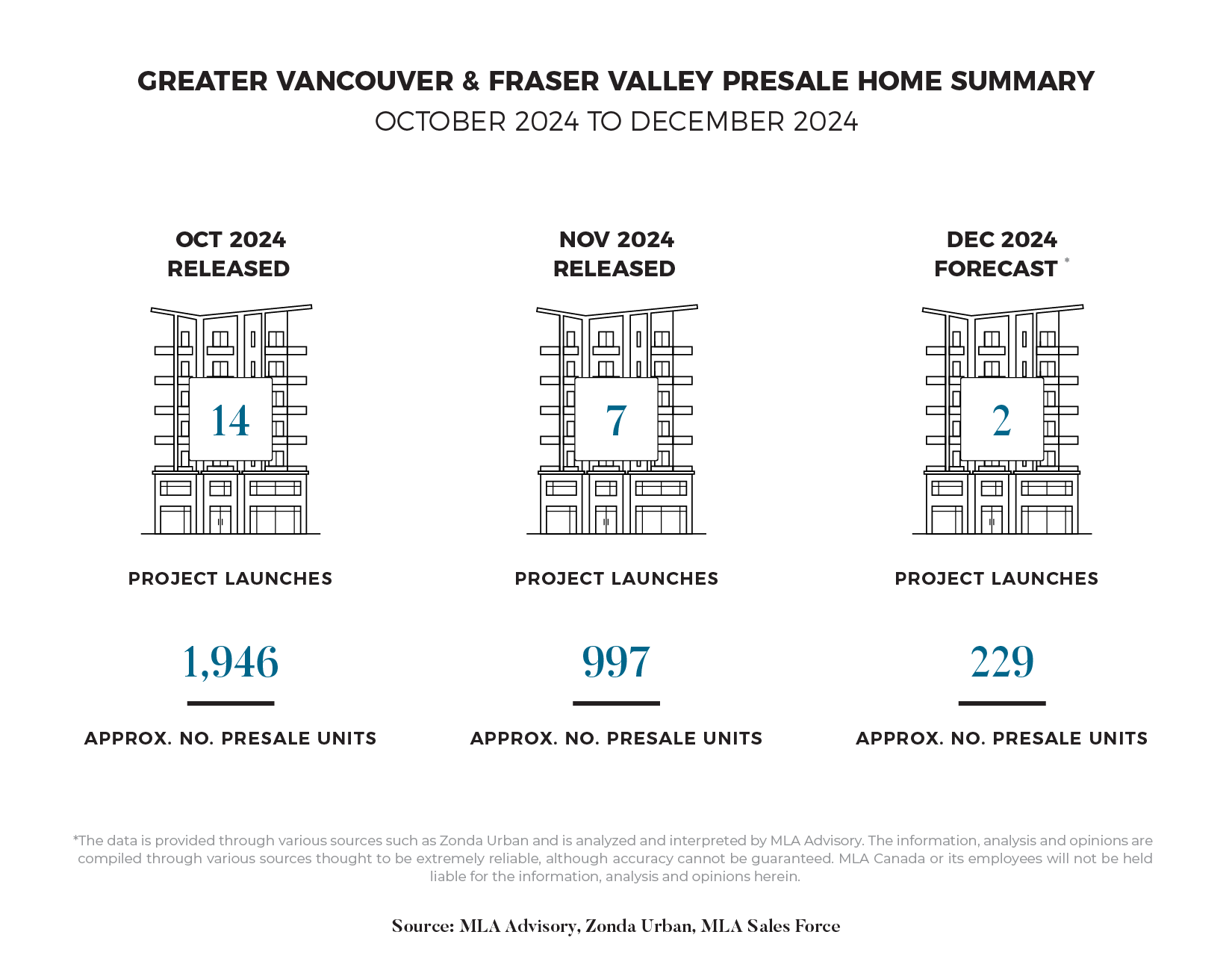

The number of project launches and released units in November was consistent with the trends seen over the past two years. Seven new projects debuted this month, introducing 997 units to the market, with 236 units sold—resulting in an absorption rate of 24%. November typically sees subdued activity as buyers shift focus to holiday preparations and Black Friday shopping. Nonetheless, a few standout projects this month garnered a positive response from buyers.

In 2024, over 115 projects were launched, introducing more than 11,500 units—this activity is below the five-year average of approximately 140 project launches and nearly 14,000 units released. The majority were of wood frame construction, with the Fraser Valley seeing more launches than Greater Vancouver, reflecting strong demand for affordable, end-user-focused housing. Reduced investor interest, driven by policy changes and high interest rates, delayed many concrete launches. Wood frame projects led the market, with around 50 launches and over 5,000 units released.

A HOLIDAY BREAK FROM GST/HST

In November, the federal government introduced a GST/HST break, estimated to cost $1.6 billion, designed to provide relief to Canadians during the holiday season amid ongoing cost-of-living pressures. This measure is set to take effect from December 14, 2024, to February 15, 2025, and will apply to a variety of goods, from food, beverages, children’s toys, to Christmas trees. Alongside this, the government proposed a $250 payment for working Canadians who earned up to $150,000 in 2023, with payments scheduled for Spring 2025. However, the federal NDP withdrew their support due to concerns about the program's inclusivity, and revisions to expand the plan are being considered.

The GST and HST tax cuts, set to take effect in mid-December, are expected to delay holiday shopping as consumers wait for lower prices. While these reductions are likely to ease inflation in the short term, they could provide a boost to growth in the first half of next year. Inflation rose from 1.6% to 2% in October, weakening the case for a 50-basis point rate cut by the Bank of Canada in December. The new tax breaks are likely to put pressure on the central bank to maintain a 25-basis point reduction in December, rather than a larger decrease, as they aim to manage inflation and economic stability.

WINTER COOLDOWN

As we approach the colder winter months, the typical holiday slowdown is expected to take hold in December, with only two projects slated to launch before the end of 2024. Common for this time of the year, a few projects that were initially planned for a November debut delayed their launch timing to the New Year. In total, just 229 units across two low-rise wood frame buildings are anticipated to be released before the year ends, signalling a quieter close to 2024.

On the resale side, after a boost in buyer interest in October, November’s stats suggest that this activity has continued, albeit with a decline in sales from the previous month. This dip is typical for this time of year as many buyers turn their attention toward holiday shopping and family gatherings, which often leads to a decrease in market activity. However, despite the seasonal slowdown, November’s sales figures still exceeded those of the previous two years in Greater Vancouver and the Fraser Valley. With fewer new listings coming to market, this slight uptick in sales over the past two months has helped chip away at the overall buildup of available inventory.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, presale, and resale market video report, Presale Pulse.

Subscribe to the MLA Canada YouTube Channel or find the Pre-Sale Pulse on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio.