"Developers spent February monitoring the market and making “go or no go” decisions on new projects. With prospects exhibiting continued patience and extreme price sensitivity, the presale market remains stagnant. We anticipate a quiet Spring presale market as overarching uncertainty persists with tariffs and equity markets that are now in technical corrections.” - Garde MacDonald, Director of Advisory

RELEASING, REVISING, AND REASSESSING

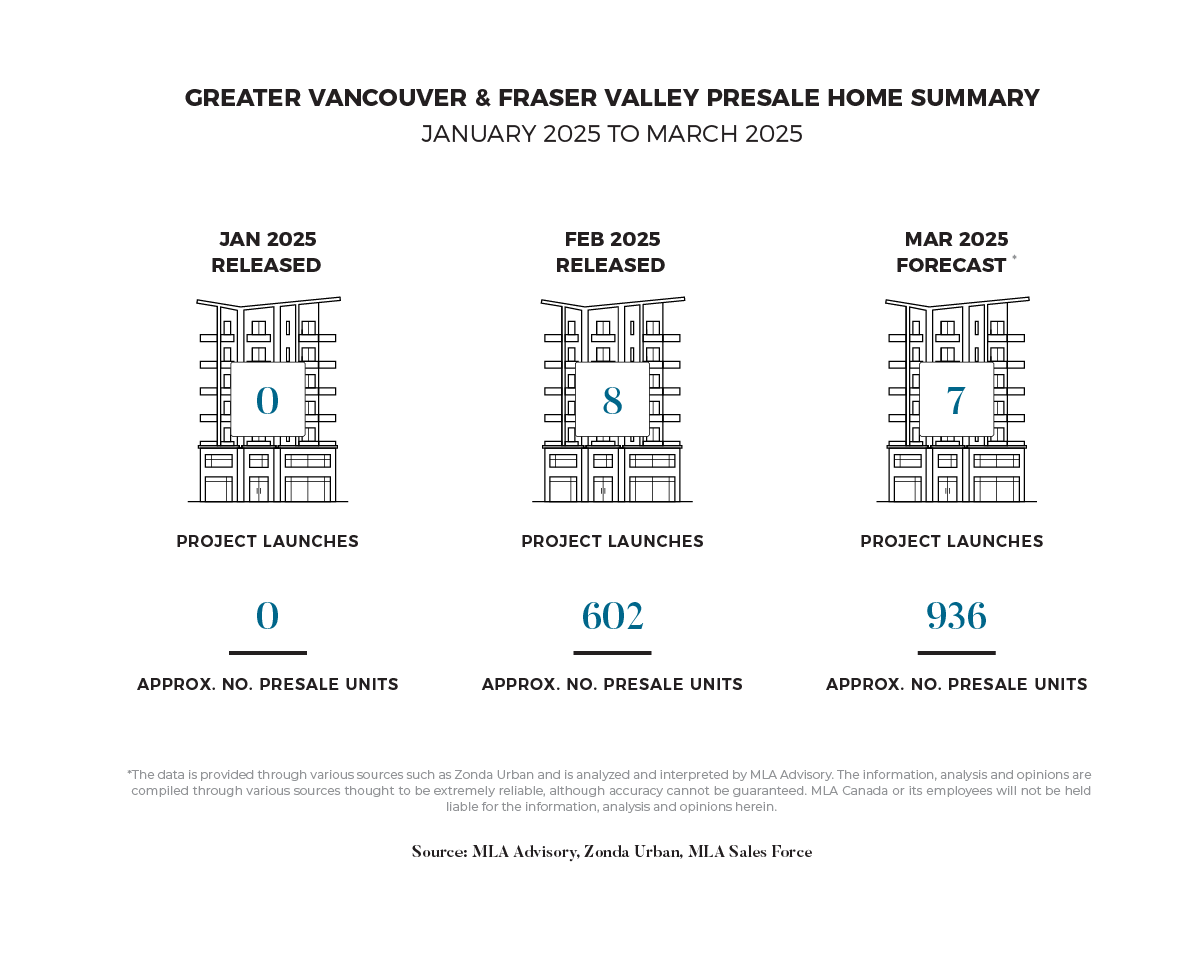

After a silent January with zero launches, February finally saw some project launches in the presale market—though uncertainty still lingers. Just over half of the projects MLA anticipated came to market, with eight developments releasing 602 units. Many developers are testing the waters with early incentives and preliminary pricing, keeping the option open to scale back if demand falls short. Several planned launches have now been pushed to later in the year or even next spring.

Of the 602 units released in February, just over 90 sold, resulting in a 15% absorption rate—well below the levels seen last year when a higher volume of units launched with a 50% absorption rate. This slower pace reflects the broader uncertainty in the market, as buyers take their time evaluating options and comparing offerings across multiple projects before making a decision. Many are also looking beyond a single market, searching across different regions to maximize value, which further delays early sales activity and adds to the challenges developers face in generating momentum.

TARIFF THREATS TRIGGER RATE REDUCTIONS

Inflation edged up slightly in January to 1.9% from 1.8% in December, a figure that, while technically within the Bank of Canada’s 2% target, was lowered by the temporary GST break. Without this tax relief, inflation would have been well above 2%, highlighting persistent cost pressures. Notably, shelter inflation—the largest contributor to CPI—has been trending downward, yet overall inflation remains elevated when the tax break is excluded. This dynamic influences both consumer confidence and the housing market, where buyers are weighing affordability concerns against shifting financial conditions.

Despite inflation staying near the Bank of Canada’s target, the central bank lowered the overnight lending rate to 2.75% in March, mainly in response to ongoing tariffs and the looming threat of a trade war. This rate cut was aimed at alleviating potential inflationary pressures from these trade disruptions. While tariffs on most Canadian goods are currently paused, there are expectations that tensions will continue to rise, putting further strain on the Canadian economy and adding to the overall economic uncertainty.

BUYERS IN THE DRIVER’S SEAT

The momentum from February's project launches is expected to carry into March, with seven projects set to release a total of 936 units to the market. The Fraser Valley remains a key focus, with most of the launches concentrated in Surrey, Langley, and Abbotsford. However, Richmond is a notable exception, with two projects set to launch—an increase for the market, which saw only two releases in all of 2024.

Resales in Greater Vancouver and the Fraser Valley increased by over 10% month-over-month. While February typically sees a sales boost from January, overall sales are still below historical averages, reflecting ongoing market challenges. Inventory levels remain high, with the Fraser Valley seeing over 8,000 active listings (55% above the 10-year average) and Greater Vancouver nearing 12,750 listings (36% above the historical average). Despite these conditions, pricing has remained relatively stable, down just over 1% year-over-year. With more inventory, competitive pricing may become more common. Looking ahead, the market continues to favor buyers, influenced by broader economic factors, decreasing interest rates, and high inventory levels.

Coming soon! Stay tuned for our fully comprehensive overview of the macroeconomics, presale, and resale market video report, Presale Pulse.

Subscribe to the MLA Canada YouTube Channel or find the Pre-Sale Pulse on your favourite audio streaming platform: Apple, Spotify, Amazon Music, iHeart Radio.